M&A Process: A Step-by-Step Guide

Having a thorough M&A Process can help increase your chances of success and elevate shareholder value.

Whether you’re looking to retire or start a new venture, you might be inching closer to selling your company. In theory, it’s simple: find a buyer and complete the deal. Unfortunately, it’s never that straightforward to launch a Mergers and Acquisitions (M&A) process, with numerous factors to consider when deciding to sell your business. Common questions that we’ve received include:

- Is now the right time to sell my business?

- What type of buyer is the best for my company?

- How can we ensure maximum value for our shareholders?

- What does the M&A process even look like?

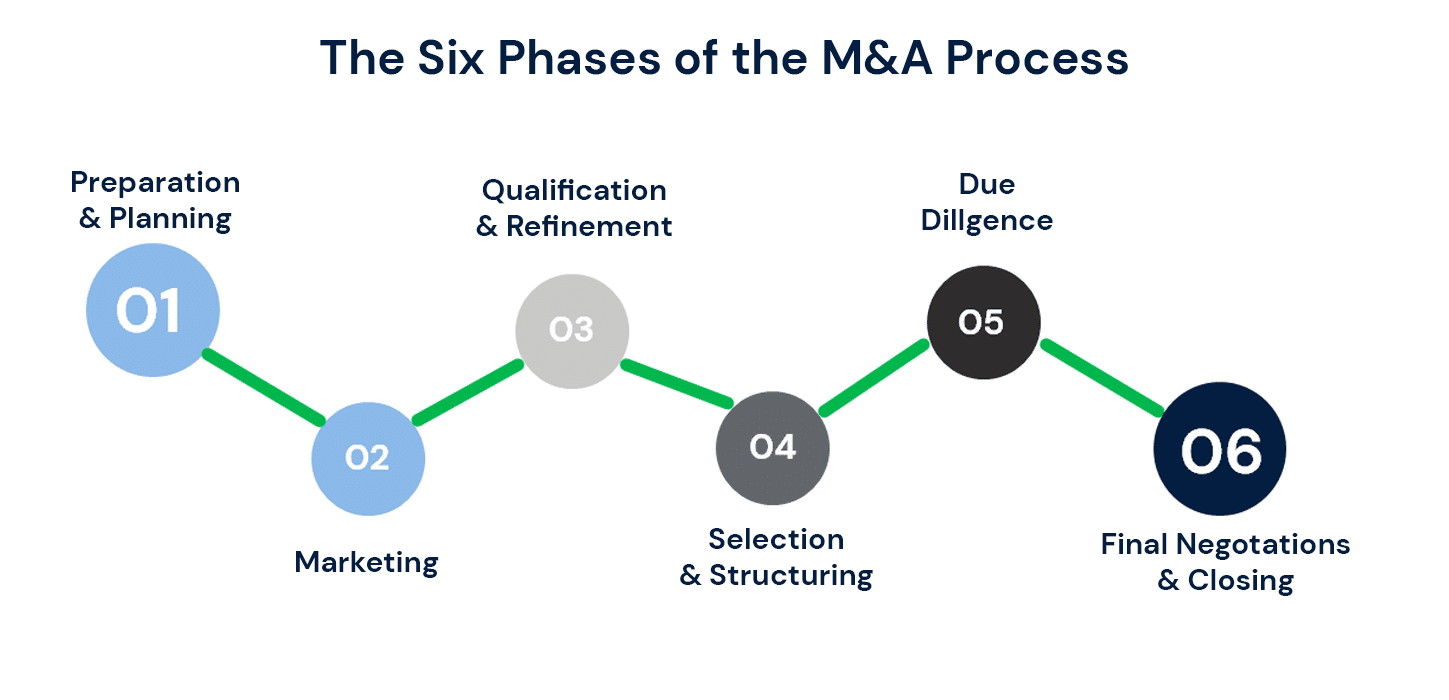

While the first three questions require an in-depth, personal conversation between you and your investment banking advisor, the final question is a bit more straightforward. Below is an outline of the complex 6-9 month M&A process that Capstone Partners Investment Banking Teams use to facilitate transactions and maximize the value of our clients’ companies.

Phase 1: Preparation and Planning

The first step in the M&A process is to gather information on your company so that your advisor can effectively represent you in front of buyers. This information highlights your history, products/services, supply chain and distribution networks, customer base, sales and marketing strategies, growth potential, management structure, competitive landscape, and, last but certainly not least, financial performance. You’ll need to gather information and be readily available to respond to your advisor’s additional requests and inquiries. Expect this stage to be one of the more time intensive for you.

Using the information that you have provided, your advisor drafts the Confidential Information Memorandum (CIM) – an in-depth report detailing precise market positioning, company history and milestones, basic financial information, company structure, products, and more. From the CIM your advisor creates a one-page high-level overview of your company that is used as a Marketing Teaser to generate initial interest in your company while maintaining anonymity. The teaser will be sent to companies that you and your advisor have identified as potential buyers. These target companies are required to sign and return a Non-Disclosure Agreement (NDA) prior to receiving the full CIM (which can easily reach 50 pages in length).

Phase 2: Marketing

During this phase, your advisor contacts buyers and gauges their interest by emailing the teaser and following up with calls and emails to address any questions.

Upon receipt of the NDAs, your advisor distributes the CIM to provide expanded company information and transaction objectives. Generally, expect two weeks for buyers to review the CIM and express interest. In the meantime, your advisor will track the process while answering appropriate questions and responding to supplemental information requests that may arise during review.

Phase 3: Qualification and Refinement

At this stage in the process, your advisor begins to receive preliminary Indications of Interest (IOI) from prospective buyers. An IOI is a potential buyer’s non-binding offer where they provide a valuation range, sources of financing, anticipated timeline for due diligence to be conducted, structure of the transaction, and a plan for post-transaction organizational and operational structure.

The goal is to receive multiple IOIs and establish a competitive landscape that will drive the valuation and terms in your favor. While pricing will be a primary factor when comparing IOIs, it’s also important to consider cultural fit, ability to complete a transaction, buyer reputation and sources of funding.

Taking into consideration all IOIs and potential buyers, you and your advisor review terms together and select a short list of companies to invite to management presentations. Having a targeted, highly manageable short-list is paramount, as it will lead to efficient final stages of the vetting process. Moving forward, your advisor schedules visits, helps create management presentation materials, and coaches you for the meetings themselves.

Phase 4: Selection and Structuring

The selection and structuring phase of the process begins with the management presentations. Most often, Capstone’s clients opt for an off-site location for the meetings to maintain a confidential process. For the first time, you meet with potential buyers to introduce your management team, provide company information, communicate transaction goals, and position your company as a “can’t-miss” investment opportunity. Additionally, the in-person presentations allow both you and the potential buyers to vet each other, professionally and personally.

Upon the completion of management visits, interested buyers submit a Letter of Intent (LOI) which simply sets forth the framework for a deal including a specific purchase price, closing date, sources of funding, length of exclusivity and additional terms that are pertinent to the deal.

Carefully considering all elements of the LOIs, you must select one company to move forward with. Though both sides can still step away from the deal, the signed LOI establishes a period of exclusivity during which neither party can engage with other firms. Agreeing to the period of exclusivity demonstrates a good faith understanding as the buyer will be investing significant resources into due diligence (lawyers, accountants, time, etc.) and wants to be certain that you are not actively shopping the deal to anyone else.

Phase 5: Due Diligence

With the period of exclusivity in effect, both parties conduct their final due diligence efforts. During this phase, you can expect the potential buyer to be far more meticulous in analyzing all aspects of your business including financial records, physical infrastructure, human capital, customer concentration, products and services, growth potential and competitive landscape. Your advisor monitors all progress, addresses any concerns and prepares final ad hoc information as may be requested. Meanwhile, your advisor also conducts due diligence on the buyer to confirm management fit and ability to close the deal. According to a recent Forbes article, “Even a deal that makes strategic sense can come awry if those involved have not done proper due diligence — including the increasingly important assessment of what divestments might need to be made to meet regulatory concerns — or carried out the ground work required to get a deal done.”

Phase 6: Final Negotiations and Closing

Pending a successful due diligence phase, both parties and their respective legal teams resolve all price, structural and technical discrepancies in final negotiations. Concurrently, you and your advisor craft a communications plan to address employees, stakeholders and the outside community. Once all documentation and communications are in order, you and the buyer coordinate the closing and execute the wire transfer. This completes the extensive M&A process.

Pre-planning for the M&A Process: Essential Questions to Answer

Before jumping into the specifics of the M&A process, there is a pre-planning process that needs to occur. This is mission-critical. Questions, such as those that were touched on at the beginning of this article, and those below need to be asked and answered in order to prepare for the M&A process and for what comes after.

- What is the next step in my professional career?

- What are my priorities with the process?

- How will I manage the liquidity that will result from this deal?

An experienced investment banking advisor can help walk you through these questions and more, ensuring you have thoroughly considered all of your options to meet your goals and increase the probability of a sale, your speed to closure, and get you the maximum valuation for your company. If you’re thinking about considering an M&A transaction within the next 24 months and would like some advice on how to start the process feel free to contact us for advice here.

This article was originally published on 4/6/21 and updated on 2/3/22.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.