What is a CIM?

What is a CIM and how is it used in the Mergers and Acquisitions (M&A) Process?

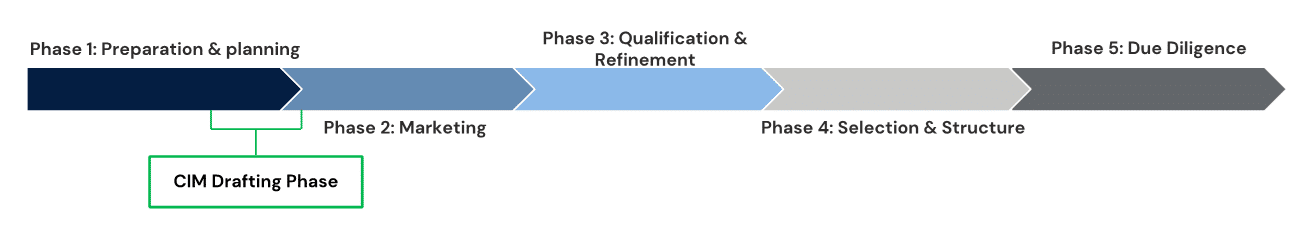

If you’re considering a sale of your business, it’s helpful to first understand the merger and acquisition (M&A) process and how an investment bank can help you navigate through the complicated buyer universe. One essential document in this process is the Confidential Information Memorandum (CIM) or increasingly a Confidential Information Presentation (CIP). For background on the M&A process and where the CIM falls on the deal timeline, check out this article: Step-by-Step Guide to the M&A Process.

Simply put, a CIM is a comprehensive presentation that serves as a marketing document during an M&A process. It is crafted by your advisor, in close conjunction with you and your management team, and outlines nearly everything a potential buyer would need to know before submitting an initial offer. In summary, the CIM should answer the question: “Why should a buyer be interested in your company?”

CIM Preparation as Part of the M&A Process

Source: Capstone Partners Research

Who Creates the CIM?

Creating a thoughtful, well-organized, and detailed CIM is a critical element of a successful sell-side effort. While time-consuming to create, the CIM engages and educates buyers and limits the need for detailed, individual discussions at the beginning of the process. A trusted M&A advisor with industry experience can be a significant asset and can help streamline the CIM writing process. Part of the investment banker’s role is to be in tune with the unique subsector trends of your business. The deal team can make or break a transaction in many cases, so you’ll want to surround yourself with experts that have a successful track record in your sector.

Part due diligence document, and part marketing collateral, the CIM is central to positioning the client for maximum market receptiveness.

Why are CIM’s Important?

Your advisor will know how to optimally position your company to drive up the valuation through experience and knowledge of the buyer universe. Additionally, a veteran banker has the skills to effectively market your business to their vast network of qualified buyers in the space, further increasing your chances of receiving a competitive offer through a bidding war.

The investment banker prepares the CIM not just to sell, but to maximize value for their client by generating qualified interest from as many potential buyers as possible. An offer is only valuable if it comes from a buyer who truly understands your business and is willing to close on their proposed terms. A comprehensive CIM ensures that the buyer understands everything from the relevant experience of the management team, the company’s business model, the product or service differentiation, and the competitive dynamics of the sector. In addition to the granular detail and financial data that appears in a CIM, it also depicts the growth story of the company. The presentation provides details on the company’s history and ongoing initiatives.

What is Included in a CIM?

Every CIM is uniquely tailored to the unique differentiators that make the company a valuable and attractive asset. The CIM is custom-built to highlight the strengths and growth opportunities for the company. That said, there are a few common elements of a CIM that will help provide an all-encompassing presentation to effectively market your company:

- Executive Summary: Similar to an executive summary in a financial statement, this section provides a high-level sample of what’s to come. The executive summary includes the transaction overview, which showcases the target company’s transaction goals, management’s forward-looking plans, and most importantly the rationale for selling.

- Key Investment Considerations: The key investment considerations outline the unique aspects of a business that a potential buyer would find attractive and how it differentiates from the competition. This section will provide five-to-ten leading characteristics of the target company and will depend solely on the individual company and the industry they operate in. This should be thought of as the positioning portion of the CIM.

- Growth Opportunities: This section communicates major growth opportunities including expanding online presence, geographical expansion, or potential M&A opportunities. These points are derived from management’s input and depend on the individual company’s trajectory and should typically generate the most excitement (and scrutiny) from potential buyers.

- Company Overview: This section provides an opportunity to tell the story of the target company. In addition to the firm’s history, it offers specific details such as the company’s timeline, product differentiation, value-added capabilities, marketing strategy, and an introduction to the management team.

- Industry Overview: The industry overview provides a holistic view of the target company’s industry and highlights the size of the addressable market, industry growth trends, and competitive dynamics. Ideally, this section demonstrates that the industry is profitable and is forecast for substantial growth in the coming years.

- Financial Overview: The final section serves three main purposes:

- To provide the target company’s historical financials which demonstrates the financial health of the company and is presented using Generally Accepted Accounting Principles (GAAP).

- To provide a future forecast, ideally a five-year plan.

- To detail key performance indicators (KPIs) such as an adjusted EBITDA that the business is measured against.

Keep in mind that some sellers will choose to hire an outside financial consultancy firm, such as our Financial Advisory Services (FAS) Group, to make sure all financial statements are in order before they are publicly presented. This is often referred to as a sell-side quality of earnings (QoE) report which can serve as an impactful supplement to a CIM.

Planning Ahead

Although the majority of the workload for a CIM falls on the shoulders of the deal team, it’s important to be ready to fill in the gaps with information specific to your company. Making sure all the information is uploaded to a Data room, a file-sharing software, so that it is readily available for your advisors will save time and headache. Taking these steps earlier rather than later, will not only lead to a more complete CIM, but an expedited M&A process. By combining your personal experience as a business owner with your advisor’s knowledge of the buyer universe, you will be able to create a one-of-a-kind CIM for the buyers and achieve uncommon results.

If you have any questions about a CIM or are interested in launching your M&A process, don’t hesitate to contact us for advice here.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.