What is Structured Equity?

Structured Equity as an Alternative to Traditional Growth Equity

In times of market volatility, structured equity can be an effective tool for companies to raise capital that is less dilutive than traditional equity. The approach blends aspects of debt and equity to provide business owners with a flexible capital solution that does not require them to give up control of their company. There are two different types of “structured equity” deals, and in each case, the profile of the company and the type of investor are very different.

#1. Traditional Structured Equity

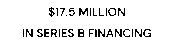

The first type of deal, traditional structured equity, is a hybrid security in which the investor accepts a lower return threshold in exchange for downside protection. It is a lower cost of capital alternative to traditional growth equity and is for companies with strong positive cash flow. Below are key considerations for companies considering a traditional structured equity deal as an alternative to a traditional growth equity raise.

Traditional Structured Equity vs. Traditional Growth Equity

Source: Capstone Partners

For companies with strong positive cash flow (double-digit EBITDA) that are considering raising equity capital, structured equity can be a good alternative to traditional equity given it is much less dilutive. Furthermore, structured equity can be a means of preserving valuation and gives companies more time before conducting their next “priced” round. The most common structure is a redeemable preferred security with warrant coverage that is typically two-thirds less dilutive than a traditional equity deal. The return threshold for these types of structured deals is typically in the mid-teens on an IRR (internal rate of return) basis. The investor base for structured equity deals consists of special situation funds and credit funds.

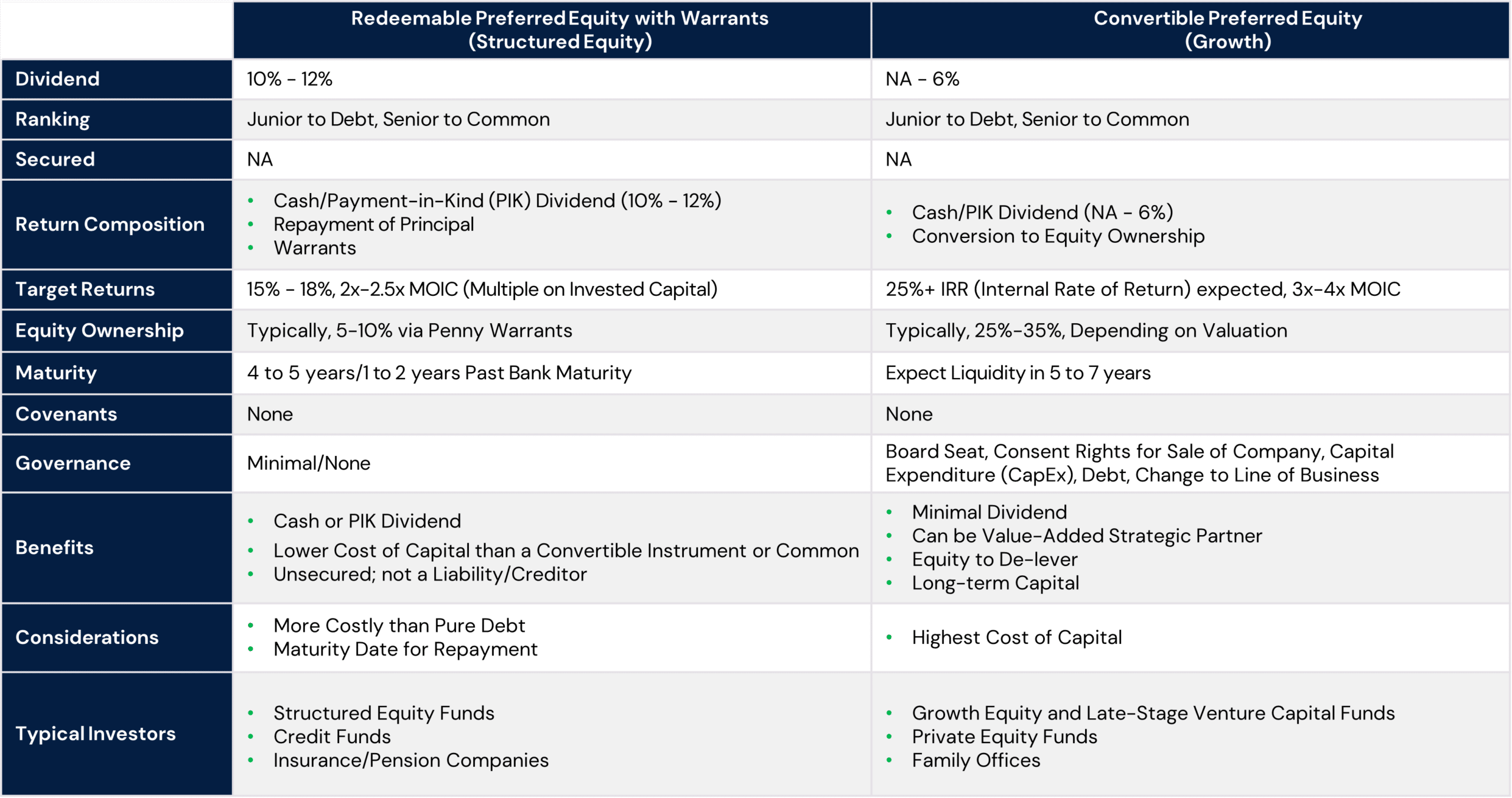

Many larger asset managers, hedge funds and private equity (PE) firms also have separate funds dedicated to structured equity investing. Capstone has intimate knowledge of the structured equity investor universe due to its extensive experience in space.

Structured Equity Investor Universe

Source: Capstone Partners

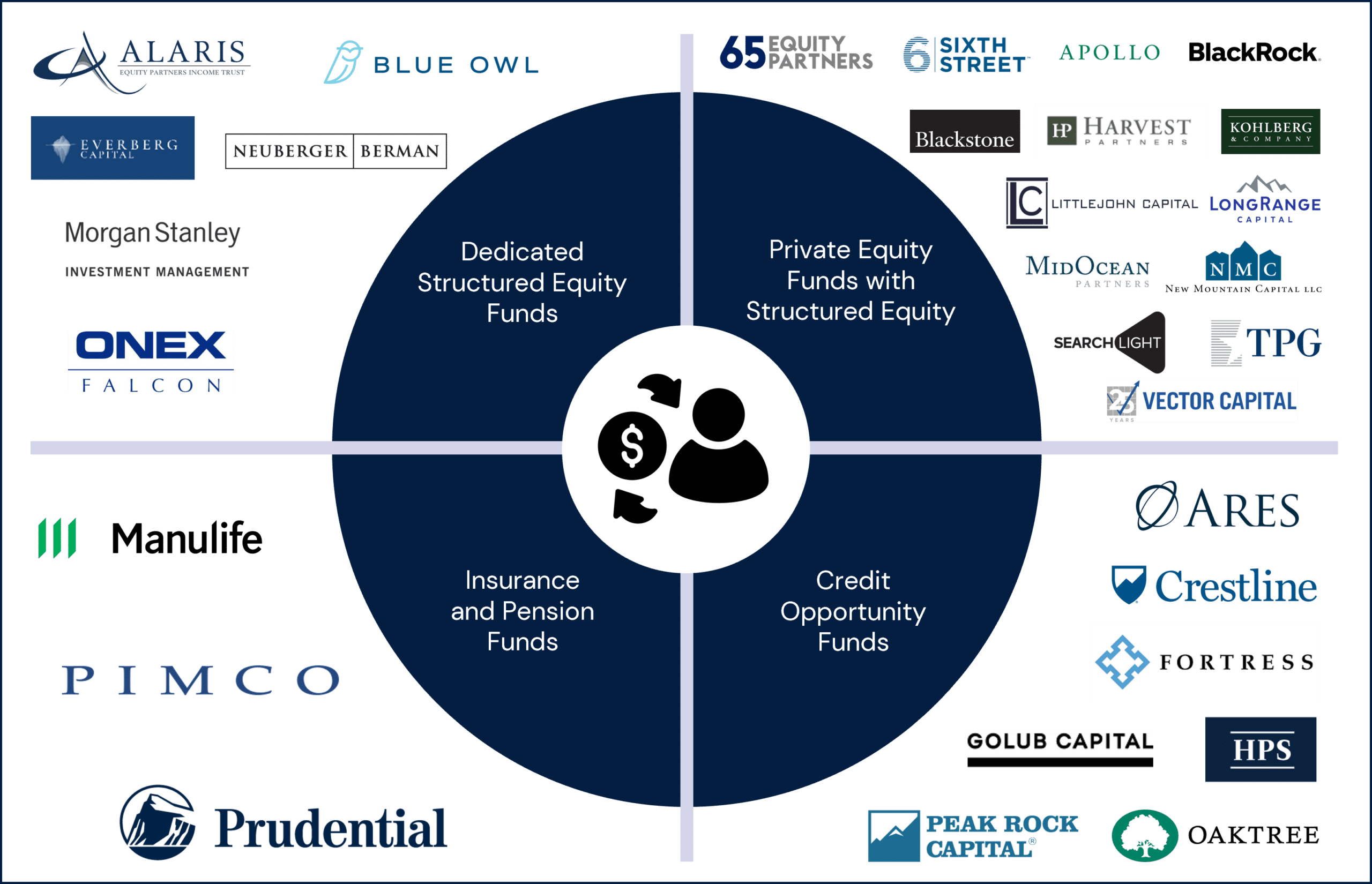

The different groups of traditional structured equity investors typically target varying levels of return profiles, governance, and operational involvement, with a summary shown below.

Differences in Structured Equity Investors

*Multiple on invested capital

Source: Capstone Partners

#2. Structured Equity for Growth Investors

The second type of structured equity is used by growth investors to mitigate near-term investment uncertainty, in which the return hurdle for the equity investor is the same as for any growth equity investor (25%+). In these cases, traditional growth investors may add stricter terms to convertible preferred investments as a means of protecting downside risk. Structure can be included in a convertible preferred investment in multiple ways so that the growth investor can achieve the return hurdle of 25%+ IRR while protecting downside risk:

- Participating preferred feature: Rather than using a traditional convertible security, investors may ask for participating preferred stock, which allows the investor to receive the face amount of investment amount at exit, in addition to proceeds based on equity ownership. This “double-dip” feature contrasts with a traditional convertible security in which an investor is entitled to receive the face value investment amount, or their equity ownership at exit.

- Increase in liquidation preference: Typically, convertible preferred investors are entitled to 1.0x their capital at exit if not converted to common stock. For further downside protection, investors may increase this to 1.5x, 2.0x, etc.

- Additional capital tranche: Enables an investor to deploy more capital if certain financial milestones are achieved.

- Valuation ratchet feature: Allows investor to adjust valuation of investment if certain performance milestones are not met.

Capstone’s Equity Capital Markets Advisory Group is now seeing non-traditional investors take a closer look at their current portfolios and assess whether now is the time to shift to new areas of opportunity or continue to participate in traditional growth equity investments. Regardless of strategy, investors are seeking more favorable terms to protect against downside. In terms of use of proceeds, some investors are more interested in seeing that proceeds from their capital be used for working capital, rather than providing liquidity for existing stockholders. Although, for companies with proven scale and profitability, there remains an option for shareholder liquidity to accompany a primary component.

Growth Equity Investor Universe

Source: Capstone Partners

Capstone Partners offers a full suite of services to help business owners achieve their goals. If you are considering an equity capital raise to support the goals of your company and would like professional guidance on finding an investor to help meet those goals, please contact us.

About Capstone Partners Equity Capital Markets Advisory Group

The senior professionals in our Equity Capital Markets Advisory Group bring 30+ years of combined experience and have worked on capital formation transactions that exceed $20 billion in aggregate financing value. As a fully dedicated group focused exclusively on the equity capital markets, the team has established a distribution channel comprised of diverse global investors, including the leading late-stage venture funds, growth equity funds, private equity funds, family offices, structured equity funds, crossover investors, and institutional asset managers.

Related Transactions

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.