Founder Liquidity – Is a Minority Stake Equity Investment Right for You?

Using a Minority Stake Equity Investment Strategy to Take Two Bites of the Apple

What should you do if it’s not the right time to sell your company, but you want to source capital without ceding control? For business owners and operators who are hesitant to begin a traditional sell-side process amid dynamic market conditions, or those who see significant growth opportunities taking place in the next two to three years, a two-step sell-side process, where you initially take on a minority stake equity investor, can be a compelling option.

The Impact of Market Dynamics on a Sell-Side Process

Market participants have started 2024 with cautious, but encouraging, optimism. Public valuations finished 2023 on a strong note, inflation has continued to moderate with growth in-tact, and investors have been increasingly convinced that the Federal Reserve (Fed) will soon begin cutting rates.

For private business owners, these factors provide welcomed tailwinds for a merger and acquisition (M&A) market that has experienced two subsequent years of decline. Many of these owner/operators will likely see 2024 as a strong window of opportunity to experience a liquidity event.

Other business owners/founders are weighing the above factors against a backdrop that still contains some tail-risk scenarios. Ongoing wars in Europe and the Middle East, as well as shipping instability in the Red Sea, have contributed to a more volatile geopolitical dynamic that risks a shock to supply routes and oil prices. Meanwhile in the U.S., the upcoming presidential election provides a highly uncertain pathway forward for U.S. fiscal and foreign policy. Even as background noise, these factors risk shortening or suppressing the current market recovery. Furthermore, while S&P 500 index levels have recovered and are trading near all-time highs, the LTM P/E (last twelve-month price-to-earnings) ratio of the S&P 500 has yet to fully recover to pre-2022 levels.

For business owners and operators who are hesitant to begin a traditional sell-side process amid these dynamic market conditions, or those who see significant growth opportunities taking place in the next two to three years, a two-step sell-side process can be a compelling option.

Taking Two Bites of the Apple – Taking on a Minority Stake Equity Investor

The two-step process (colloquially called “two bites of the apple”) allows a business owner/founder to take on a minority stake investor, receive liquidity for a portion of their ownership stake, and have the option to take on additional investment into the business to accelerate growth. Once the business reaches a more mature margin and revenue profile, the owner still maintains a majority of the business and can then seek a full-liquidity event—a “second bite of the apple.”

This two-step process may allow:

- Business owners to receive a larger combined liquidity event through the stronger growth and multiple expansion that comes with a strategic partner.

- The majority of that liquidity to price at a more opportunistic time in the capital markets.

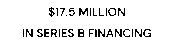

To further illustrate, consider the following two paths for ABC Company.

- Scenario 1: the founder of ABC sells the entire company today, receiving total equity value of $160 million.

- Scenario 2: the founder of ABC decides to take on a financial partner to i) take partial liquidity and ii) accelerate ABC Company’s strategic growth plan. After scaling the business to 2027, the founder exits the remainder of their stake at a higher EBITDA threshold and exit multiple—receiving a net-present value on equity higher than in Scenario 1. Notably, the two-step process results in $280 million of proceeds to the owner compared to $160 million in Scenario 1—a 75% increase.

Illustrative Example: Taking on a Minority Stake Equity Investor

EV = Enterprise Value

EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization

Source: Capstone Partners

Common Questions from Founders Regarding Taking on a Minority Stake Equity Investor

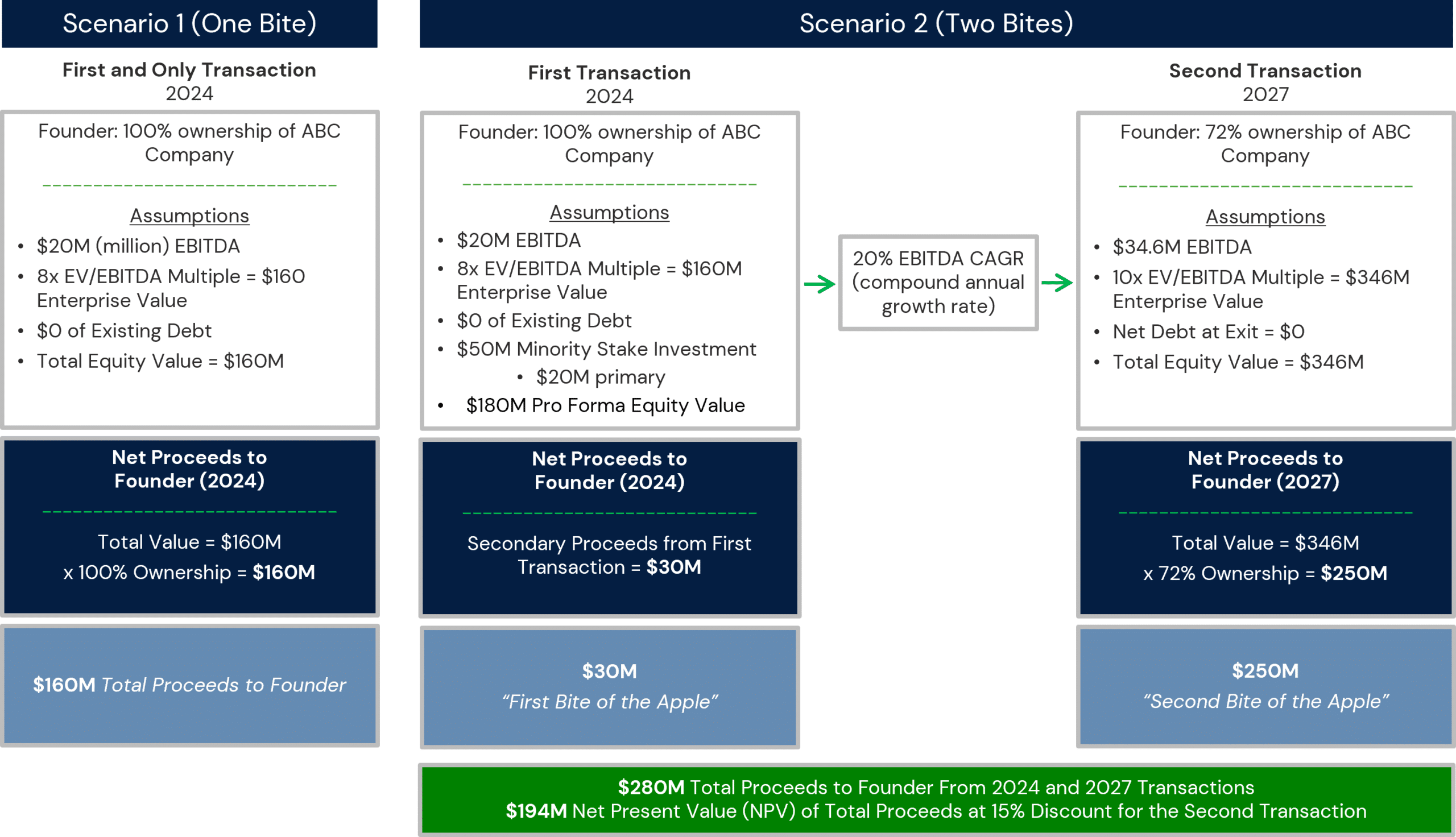

- Will I retain control of my business? For founder-owned companies, the short answer is, yes. A minority stake investor—as its name would suggest—targets a <50% ownership position. In exchange for a minority economic stake, the investor will typically invest via Preferred Equity, which includes certain protective provisions which would require investor approval for substantial changes in the business. These may include i) new capital raises that rank pari-passu or in seniority to the investor, ii) change in business line, iii) sale of the company below a threshold valuation, and iv) possible board representation or board rights. See below for a fulsome sample term sheet.

- Do private equity investors add real strategic value? With the growth in the private equity markets—and particularly in minority stake equity investors—there is an increasing number of investors who provide operational and financial expertise to their portfolio companies. Some even include in-house consulting or data teams to help supplement the workforce of their portfolio companies.

- Will a minority stake investor seek to increase financial leverage? Due to their minority position, the new investor would not be able change the financial profile of the company without the owner’s approval. Furthermore, the core value creation strategy of minority stake equity investors is operationally-focused, and not focused on financial engineering.

- Which types of investors focus on growth investing? The universe of funds that invest in minority positions has grown steadily in recent years. In 2023, approximately 1,400 growth transactions occurred across 3,000+ investors, according to PitchBook.

Minority Stake Equity Term Sheet Example

Source: Capstone Partners

Exploring a Minority Stake Investment for Your Business

In summary, there are multiple paths for realizing liquidity in a founder owned company. Founders who see greater opportunities two to three years away may not want to sell their entire company today—particularly if multiples continue their recent expansion. In such cases, the founder may consider selling shares in the company prior to an exit, typically called minority stake equity sale or secondary sale, to satisfy needs for liquidity allowing for the future growth of the company prior to an eventual exit when multiples are higher.

If you have any questions, Capstone Partners Equity Capital Markets Advisory Group has been raising equity capital for growth-oriented enterprises, ranging from mid-stage ventures to more mature middle market companies since 1999. The team works closely with the firm’s industry-focused M&A teams and other service groups to provide clients with maximum market coverage and innovative solutions to complex situations.

To request a consultation with our team, contact us.

Related Transactions

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.