How to Prepare Your Business For Sale

M&A Readiness Enhances Probability, Valuation & Speed

3 Tips to Actively Prepare Your Business for Sale and Maximize Your Outcome

Consider the decades (and sometimes generations) of effort that private business owners dedicate to building successful companies, which often represent the lion’s share of their personal and family wealth. Ironically, most business owners do not apply the same rigor towards planning in advance for a liquidity transaction that they do in managing their business and taking care of their employees. Transactions typically represent one of the most critical professional, financial, and emotional decisions in a founder’s lifetime. Achieving a state of “transaction readiness” and taking the time to actively prepare your business for sale is a strategic weapon with tangible outcomes: it will increase the probability of a transaction happening; it will increase the valuation of the business; and it will increase the speed of the closing process.

Before launching a merger and acquisition (M&A) transaction process, it is important for owners to take mindful inventory of their personal and professional goals, which may include valuation expectations, timing of a transaction, the cultural profile of the optimal acquirer, personal role post-closing, management rewards and incentives, impact on long-term growth opportunities, leadership succession, and customer and employee fit. With these goals established, the right transaction option will start to become clearer, which can range from a minority sale to a full exit, from an employee stock ownership plan (ESOP) to an initial public offering (IPO), from a private acquirer to a public acquirer, and from a strategic acquirer to a financial partner. The options are broad and complex, so the best blueprint starts with the business owners’ goals—what do they want this chapter of their legacy to look like? That is how the best transactions are engineered.

As business owners begin their transaction journey, they may quickly realize that there is more involved than anticipated. It takes a lot of time—and work—to prepare your business for sale and achieve a state of M&A readiness, and time is a scarce and valuable resource for business owners. However, there are some fundamental stepping stones that should be considered and embraced. There are three measures in particular that the business owner will have direct and immediate control over, often with the help of others. Serving as a great starting point, these initial efforts include:

- Operating the business to maximize appeal and valuation.

- Organizing information to optimize impressions and alleviate deal processing pain.

- Build a “dream team” of professionals to ensure flawless execution and mitigate risk exposure.

Tip #1 – Operate to Maximize Valuation

Owners often have a value they believe their private company is worth without a complete understanding of how the business will be viewed and valued by prospective acquirers. If key valuation drivers are identified and incorporated, there are steps business owners can take prior to engaging in a transaction process or discussions with would-be suitors that will not only make the company more attractive in the market, but also have a demonstrable positive impact on the value of the business.

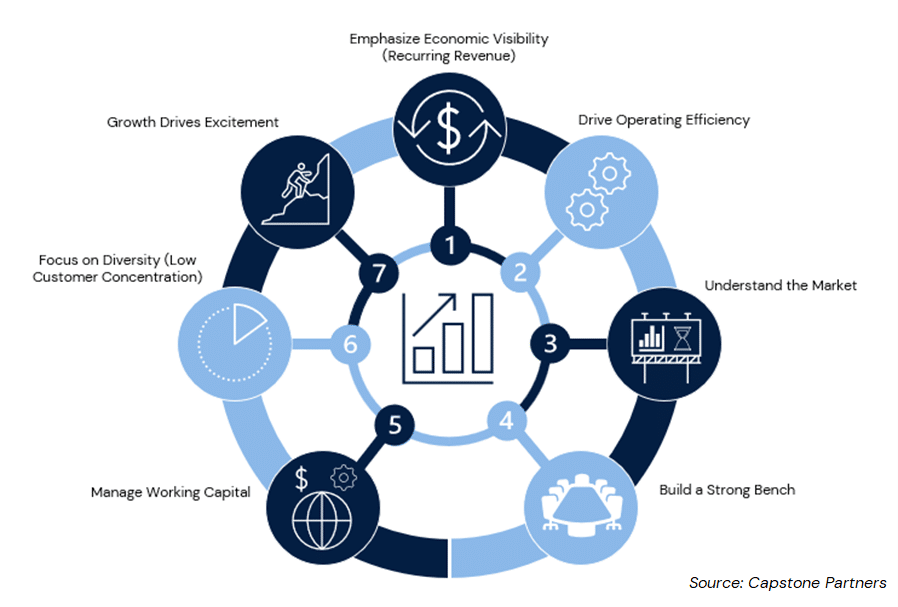

Key Operational Value Drivers

Key Operational Value Drivers

- Emphasize Economic Visibility – Recurring revenue streams are king. They provide a clear, stable view of the future potential of the company. If recurring revenues are not part of the business model (i.e., multi-year, fixed contracts), then reoccurring revenue is the next best thing. Business owners can highlight the value of this revenue through low customer loss ratios, high switching costs, and long customer tenure metrics. In all cases, not all revenue is created equal and business owners should be prepared to articulate their chosen business model and its unique characteristics.

- Drive Operating Efficiency – While not applicable to all companies, a low fixed cost structure is important to drive attractive margins. Some companies achieve this through automation initiatives or through operating capabilities that are highly scalable to help drive profit margins. Other business owners simply remain mindful that it is easy for companies to carry underproducing assets (or people).

- Understand the Market – Timing an M&A transaction is one of the most crucial factors from a valuation standpoint. Owners need to be up-to-date and informed on the trends impacting their industry and valuations for comparable companies that have recently transacted. Resources including Capstone’s Industry Insights and Middle Market M&A Valuations Index can provide business owners with transparency into the ever-evolving industry dynamics. It is never too early to contact a Capstone banker to learn about current market trends from a sector expert.

- Build a Strong Bench – Most transactions involve some consideration of leadership transition. This can be a major issue for prospective acquirers if the business owner does not have a plan in place, or better yet already in process, and is a major consideration as you prepare your business for sale. The business that is reliant on the founder/leader to maintain value is less valuable. Business owners are well served to have groomed a strong supporting executive leadership team with a (or several potential) clear heir apparent(s). Likewise, a pipeline of emerging leaders below them is also important. Acquirers love continuity and are allergic to potential disruption.

- Manage Working Capital – This is a well-kept secret among dealmakers: nobody enjoys negotiating this term, it is always left to the last minute during the transaction process, it has a real economic impact, and business owners generally do not understand it or do not actively pay attention to it. Buyers like capital-efficient businesses, which means cash conversion cycles and low capital expenditures matter. It is important for business owners to maintain state-of-the-art status and manage their company efficiently to send an obvious message of strength.

- Focus on Diversity – Customer concentration (and to a lesser degree, supplier concentration) can be either the single biggest threat to achieving a premium valuation or may even eliminate the possibility of a transaction altogether. Some dealmakers estimate that high customer concentration can detract value by as much as 40-50%. It is difficult for a business owner to avoid pursuing a large customer, or continue to grow within that customer, but effort has to be invested in building diversified revenue sources. Any customer that accounts for more than 20-30% of the business will start to cause issues for an M&A process. As you prepare your business for sale, ensure you have a diversified client base in place.

- Growth Drives Excitement – It’s not rocket science that buyers get excited over “all things” growth-oriented: growing revenues, profitability, employee base, customer roster, end markets, etc. Revenue and EBITDA growth have a direct impact on valuation multiples, but business owners are fundamentally selling futures—what will the business look like three, five, and seven years from now. It is important for all companies to have a formal, well designed growth strategy that identifies the opportunities, the timing, the anticipated economic impact, the required investment of capital and resources, and the related risk management plans.

Each business is unique and benefits from a bespoke value enhancement strategy that needs to be carefully managed. Business owners should not make decisions, or postpone decisions that need to be made, solely to improve a short-term operating metrics. Any sophisticated buyer will focus on moves that were made immediately prior to a transaction to ensure that they were in the best interest of the company and reflective of a sustainable, consistent business.

Tip #2 – Get Your Business “House in Order”

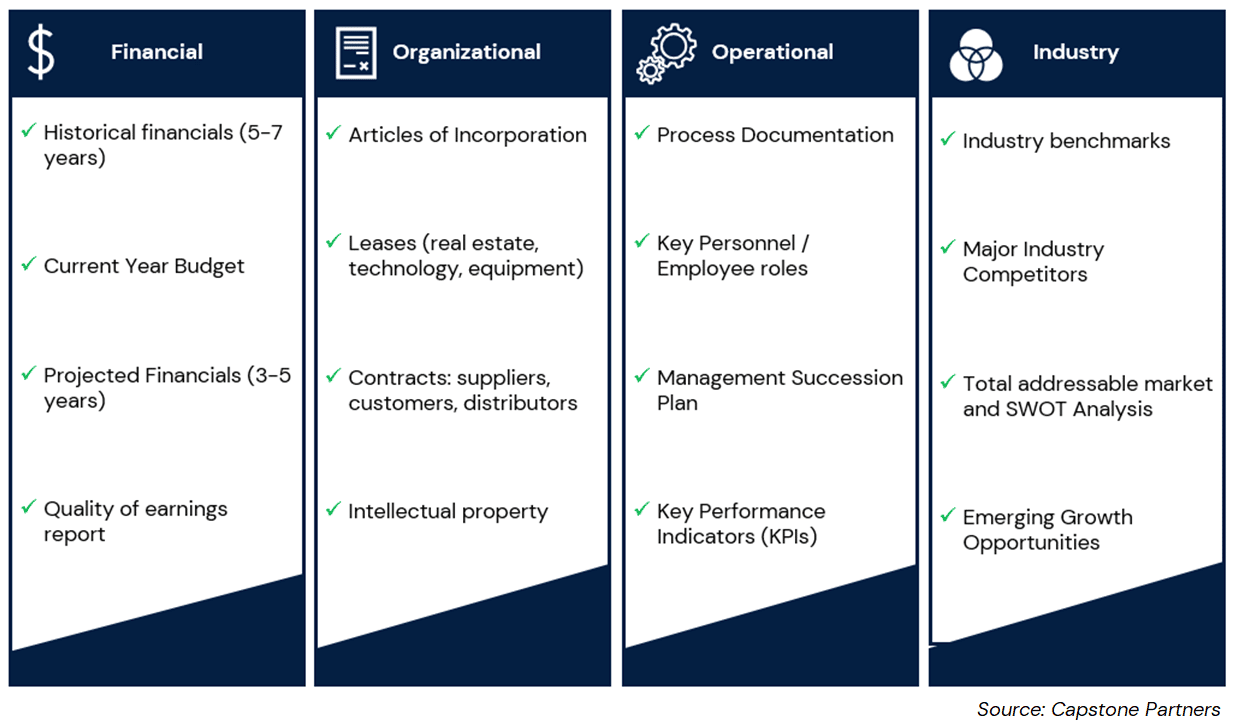

First impressions matter in the M&A and capital markets. Well organized companies denote a strong business, which in turn denotes a talented management team, which supports higher valuations. Hence, before preparing for an M&A transaction, business owners should confirm that the necessary corporate information is gathered, organized, complete and accurate. Early preparation not only enhances the first impression factor but also enables the company to swiftly respond to optimal market conditions and move to execute attractive transactions with speed and surety. While information varies from deal to deal, there are certain materials that will almost always be required, as highlighted in the chart below.

Sample Preliminary Information Checklist

- Financial information allows prospective acquirers to value the business by assessing its financial performance and growth potential. Typically, five to seven years of historical financial statements are required (preferably audited). Likewise, a current year budget with three to five years of projected performance will be expected, including all three financial statements (i.e., Income Statement, Balance Sheet, and Cash Flows). In addition, business owners that are targeting a more immediate transaction process will have a Quality of Earnings (QoE) review completed by a credible third-party accounting firm. If a company does not have internal systems to provide consistent and organized financials, this should be addressed immediately. Inability to produce this baseline financial information as expected can reflect negatively on management, valuation, and likelihood of closing a transaction.

- Organizational information offers visibility to a company’s legal and tax structure as well as significant business contracts. Beyond essentials like the Articles of Incorporation, buyers will want to review the company’s leases and other major contracts or related financial commitments. Any relevant contracts a company may have with a supplier, distributor, or customer will provide validation of the company’s current “good standing” relationships (and any change of control rights will be flagged). When applicable, intellectual property verifies that a company owns or has the right to anything that may be essential for its operations.

- Operational information provides insight into business processes, technology, performance metrics and key employees. Oftentimes, businesses are extremely reliant on the founder/owner, which can add risk for potential acquirers. Process documentation and protocols can help boost confidence that the company will continue to run smoothly after a transaction. Interested acquirers will look to management’s systems and reporting packages (Key Performance Indicators) to understand how they operate and measure the business (or potentially identify areas of improvement). Finally, buyers will want to understand the talent base, organization structure, and succession planning to gain a sense of how the team functions and identify key personnel (or potential holes).

- Industry information helps acquirers understand the company’s core value proposition and competitive differentiation. Acquirers that are in the same industry will understand the landscape and the competitive dynamics. However, strategic acquirers and private equity firms that are venturing into new products, services or end-markets will value industry analyses. The typical body of work includes industry research reports, a SWOT analysis, a chart comparing capabilities against major industry competitors, an inventory of emerging growth opportunities, and information to assess the size of the market and the commercial opportunity. Buyers can perform much of this work on their own, but they always like to see management who are students of their markets and compare it relative to their perspectives.

Gathering this information can seem daunting at the onset. The key is to start with a comprehensive due diligence list, then start chipping away. If this endeavor is started ahead of a potential process, it can be wildly helpful and efficient for all parties involved. As mentioned previously, virtual data rooms serve as a great way to assimilate and organize the vast sources of information that owners have accumulated on the business. A great general rule to use is: “if the information exists, put it in the data room.” Such information could include a host of other topics such as board minutes, records of prior capital raises, research and development (R&D) plans, asset roster, prior and pending litigation matters, borrowing records, ownership structure, and so forth.

Tip #3 – Build a Professional Deal Team

Engaging in a transaction process is a full-time job. To help navigate the complex demands, business owners are best served by building their “dream team” of trusted advisors to ensure success, maximize value, and manage risk. One of the biggest threats to a successful outcome is if the business does not perform well during the transaction process; having a balanced deal team will help ensure that the owner remains focused on the business’ operations, growth, and people. Every business has unique needs, but the core group of professionals listed below are illustrative of a typical transaction team.

- Investment Banker – The M&A advisor serves as the gateway to the market and should act as the lead professional, coordinating the activities of the collective team. The investment banking team will be in the trenches with the business owner from start to close preparing the company and management, marketing the business to the right buyers, negotiating purchase price and terms, and managing the due diligence and deal closing process.

- Deal Lawyer – Hiring a lawyer that specializes in M&A is particularly important. Many lawyers claim to be able to represent a client in a transaction but paying the fee premium to hire a firm with a dedicated M&A practice will yield a strong return on investment. While the investment banking team should be primarily focused on capturing maximum value, the M&A legal team will be focused on protecting the shareholders by mitigating transaction risk. Once the purchase & sale document has been delivered, the legal team will assume the front-line role, helping the business owner manage disclosure requirements, legal and tax structures, representations and warranties, and a host of other complexities that will inevitably arise during the final closing processes. In most transactions, the investment bankers and legal teams work together hand-in-hand.

- Estate & Wealth Manager – By the time a business owner hires investment banking and legal teams, chances are that advanced wealth management strategies (often multi-generational in nature) are already in place. However, given that a large amount of a business owner’s wealth can be tied up in the business, if these strategies are not in place prior to a transaction, the investment banking and legal deal team members will make the appropriate introductions. This capability and planning discipline can have a dramatic impact on the net outcome, largely driven by sophisticated estate, legal and tax structures that can be pursued.

- Accountant – The fourth leg of the stool (and there can be more, depending upon the transaction) is the accounting team. Like the wealth management team, this team has most likely been in place prior to the transaction. However, deals will generate the need for new capabilities that the certified public accounting (CPA) firm may or may not have. Ultimately, business owners will need an accounting firm that can be engaged during the entire process: from ensuring historical financials are in order, to mobilizing for preliminary due diligence, to delivering a QoE report, to defending arguments and supporting negotiations, to ensuring accurate disclosures throughout.

Beyond the external deal team required to optimize results, business owners need to consider how to construct, and communicate to, their internal deal team. This often raises sensitive questions: Who do I include? When do I include them? What distractions will it cause? How do I maintain confidentiality? Do I need to provide incentives? And so forth. There are two absolutes that business owners need to be aware of: (1) you cannot do it alone—there are certain members of your management team that have to be involved to handle the workflow and prepare your business for sale, and (2) showing the strength of a broad, well-prepared management team will increase the value of the business. Having the right external deal team in place will help business owners ask the right questions and plan the course of action with respect to the internal deal team.

Capstone Can Help Prepare Your Business for Sale

An M&A transaction is a high-stake game. It generally represents decades of business building, sacrifices and risks, as well as the majority of a business owner’s personal (and family) net worth. There is no room for small missteps. There are a host of considerations to get a handle on, from the way the business is operated, to how to best prepare your business for sale, to making sure you have the best execution resources available. Capstone Partners was founded to help private business owners navigate through these decisions en route to a potential M&A event. We have successfully served thousands of business owners over the past 20 years and can help pave the way long before the start of a transaction. If you are interested in learning more about preparing for a liquidity event or simply connecting with an M&A advisor in your industry, please contact us.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.