Leveraging Business Performance Improvement Consulting Services to Build Enterprise Value

Business owners constantly face shifting macroeconomic and operational landscapes, necessitating consistent evaluation of company performance. As a result, all companies, whether struggling or excelling, can benefit from the assistance of a business performance improvement professional. Capstone has found that while founders and entrepreneurs can typically identify symptoms of operational challenges, they often benefit from support in uncovering root causes and executing effective solutions. A business performance improvement consulting engagement, simply defined as the process of diagnosing and solving operational challenges for a company’s management team, is appropriate for a variety of situations including, but not limited to:

- Struggling organizations aiming to realign strategy and functions.

- Healthy companies looking to enhance or optimize operations.

- Business owners preparing for a merger or acquisition.

- Family and management succession planning.

Because of the widely applicable nature of performance improvement engagements, it is one of Capstone’s Financial Advisory Services (FAS) team’s most frequently sought after services. By leveraging Capstone’s performance improvement offering, founders can remain focused on their product or service while the FAS team facilitates sophisticated analysis to drive value creation, leveraging its financial and operational expertise to discover and solve inefficiencies that would otherwise continue to hamstring business performance.

Business owners don’t have time for guesswork. Our performance improvement engagements are designed to deliver clarity, control, and confidence—whether you’re preparing for a sale, navigating growth, or simply trying to run a tighter ship. We help you uncover inefficiencies, unlock value, and build a more resilient business.

Common Performance Improvement Categories and Process Overview

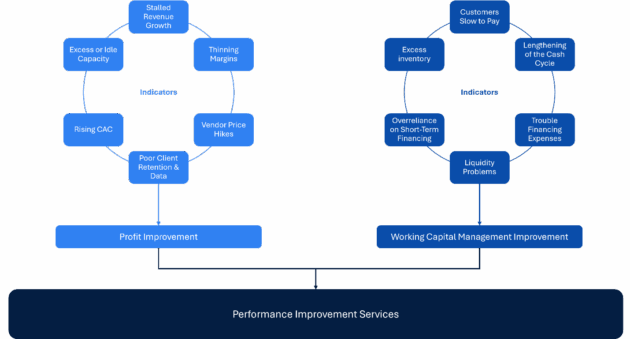

Performance improvement initiatives commonly fall into two categories, improving profitability and improving working capital management. It is common for a company to require both, or some combination of initiatives from each category. Business performance improvement project timelines may differ drastically as engagements often vary in scope; some projects can be completed in a matter of weeks while others take much longer.

During the process, data analytics and data-driven decisions are critical tools for diagnosing operational challenges. While the analysis and strategies may differ between profitability and working capital management initiatives, the typical engagements follow three major stages:

- Discovery: data analytics and decision modeling are used to pinpoint trends in revenue and cost drivers, transaction cycles, and other critical operating functions.

- Implementation: insights gained in the discovery stage are leveraged to create strategies that target specific functions. Execution may run through existing management or newly hired personnel.

- Embedding: Capstone builds lasting impact and embeds solutions by training stakeholders to sustain and refine the new playbook over time, long after the engagement ends.

This three-step framework ensures an exhaustive review of operations, enables a long-lasting outcome for the client, and readies the company for its next stage of growth, whether it is a liquidity event or a strategic pivot into new markets.

How to Strengthen Profitability through Business Performance Improvement Consulting Engagements

Profit improvement initiatives aim to increase net income through operational, financial, and strategic changes and are one of the two main categories for business performance improvement consulting engagements. Typically, profit improvement focuses on revenue enhancement and cost optimization. Capstone will run data analysis on key revenue metrics—which vary by business type—to identify inefficiencies impacting company profits. For product companies, a key revenue metric is stock keeping unit (SKU) velocity, or how quickly certain inventory is sold. Additionally, the FAS team will examine and benchmark product pricing against competitors to determine if goods are priced effectively for the intended consumers. Moreover, Capstone will help improve overall efficiency by assessing historical gross margins to identify underperforming business areas.

This analysis differs for services companies. Key revenue metrics for these engagements include average ticket (average amount a customer spends per visit/transaction), repeat business rate (how often are customers coming back for additional services/visits), and utilization rate (human capital productivity). For software businesses, recurring revenue mix, pricing strategies, and net new user growth offer critical insights into potential revenue inefficiencies or opportunities. Cost drivers are the other key component to diagnosing profitability inefficiencies. Capstone will typically analyze three years of cost driver data on a monthly or weekly basis to identify patterns, anomalies, relationships, and trends in costs of goods sold (COGS) such as customer acquisition costs (CAC), raw material expenditures, and manufacturing overhead.

Implementing functional improvements is the next step once inefficiencies are identified through data analysis. Capstone can drive improvements through all functions of a business, from the back- to middle- and front-offices. In the back office, the FAS group can address staffing imbalances and compensation inefficiencies to bring overhead under control. Compliance functions can also benefit from automated reporting and streamlined documentation, enhancing efficiency and reducing time-consuming tasks. Recruitment operations may be redesigned for scalability, supported by improved systems and processes. In accounting, Capstone’s team focuses on developing more accurate cash flow forecasts and working capital models to strengthen financial planning and company decision-making.

Shifting to the middle office, manufacturing improvements might include divesting underperforming production lines or introducing automation to boost capacity. Supply chain initiatives range from optimizing supplier mix and contracts to reducing freight costs. On the information technology (IT) side, Capstone targets high-return projects such as cloud migration and enterprise resource planning (ERP) upgrades. Lastly, in the front office, the team supports sales force restructuring and revamps compensation models to better align with performance goals. Capstone’s ability to drive functional improvements is not limited to the examples above and varies based on the needs of each unique client and the challenges they are facing.

Capstone’s Profit Improvement Process Summary

Source: Capstone Partners

The numerous variables impacting net income and metrics available to analyze profitability drivers make it challenging for private business owners to self-diagnose problems, enhance revenue, and optimize costs, contributing to its status as one of the most common Capstone performance improvement categories.

How to Strengthen Working Capital Management through Business Performance Improvement Consulting Engagements

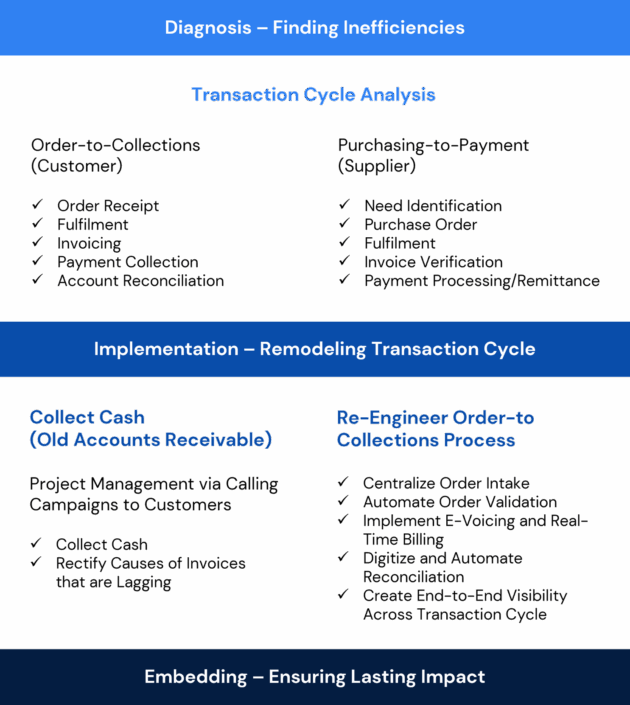

Working capital management improvement aims to optimize cash flow and bolster the company’s short-term liquidity position through the rebalancing of current assets and liabilities and is the second of the two main categories for business performance improvement consulting projects. Working capital management issues often come top-of-mind sooner and can be more apparent in day-to-day operations than profitability challenges. Typically, companies strive to collect revenue from customers quickly while paying bills at a slower pace. Issues often arise when accounts receivables (AR) build while accounts payables (AP) remain in line—or the cash conversion cycle lengthens. To diagnose issues in the transaction cycle, Capstone will analyze the order-to-collections (customer to business) and purchasing-to-payment (business to supplier) cycles. The order-to-collections cycle usually flows from an order receipt, purchase fulfillment, invoicing, payment collection, to accounting reconciliation. Similarly, the purchasing-to-payment cycle begins with need-based service identification for the business, purchase order, fulfillment, invoice verification, and payment processing/remittance. By analyzing the end-to-end processes in each direction, Capstone can identify and rectify breaks in the cycle to improve working capital.

The solution to working capital management inefficiencies is often two-pronged, with the actions occurring simultaneously. Capstone will re-engineer the order-to-collections cycle. This may involve centralizing order intake, automating processes such as order validation, implementing e-voicing and real-time billing, or digitizing and automating reconciliation. Additionally, the FAS team will collect outstanding AR by instituting a project management function and leading call campaigns to customers. These solutions enable the business to collect cash and rectify the cause of lagging invoices while moving forward with a bulletproof order-to-collections cycle that will prevent future liquidity issues related to AR.

Capstone’s Working Capital Management Improvement Process Summary

Source: Capstone Partners

Capstone Case Study: Manufacturing Company’s Inconsistent Pricing Leads to $800,000 in Annual Losses

Indicators: Capstone opened an engagement in May 2025 with a long-established tableware producer. The client was under pressure from low-cost overseas competitors and rising input costs. Margins were eroding despite the company’s strong brand recognition. The client needed fast, actionable insights to regain profitability without compromising product quality or customer relationships.

Capstone’s Analysis & Solutions Implementation: Over the course of three weeks, Capstone analyzed sales and account records covering hundreds of thousands of transactions. The analysis exposed multiple issues: inconsistent pricing across customers, systematically loss-making accounts, and unprofitable SKUs. For example, a single item was sold to the same customer at a threefold price variation—resulting in $800,000 in annual losses for the company. Capstone also analyzed the business’ SKU portfolio. The analysis revealed that thousands of SKUs (including color variations) diluted operational efficiency and tied up working capital. Further, 20% of SKUs drove 80% of sales while the remaining sat idle in inventory, highlighting the need for SKU rationalization. Capstone developed an interactive dashboard that gave sales and leadership real-time visibility into pricing, profitability, and customer trends to ensure the team could take immediate action and track progress. This implementation empowered frontline decision-making and laid the groundwork for longer-term strategic adjustments.

Outcome: The added visibility into company operations delivered a quick set of wins—eliminating loss-making items, targeting unprofitable accounts for renegotiation, and prioritizing high-performing SKUs. While the engagement was still ongoing as of September 2025, the client was already using Capstone-enabled insights to make confident, data-backed decisions and had begun a broader transformation towards a more disciplined, margin-focused operations.

Capstone Case Study: Payment Technology Company’s Fragmented Data Hinders Decisions and Profitability

Indicators: Capstone opened and completed an engagement with an early-stage payment processing company in 2025. This client was experiencing strong business momentum but lacked the internal resources to support complex financial modeling. Their operations generated millions of transactions monthly but they had difficulty assessing customer profitability and testing pricing strategies, which ultimately led to delayed decision making.

Capstone’s Analysis & Solutions Implementation: Capstone analyzed internal resources dedicated to the company’s finances and data collection. As a result, the FAS group found that the business had fragmented data spread across multiple inconsistent and disconnected reports. The disconnected data hindered decision making from actionable insights. Capstone provided end-to-end modeling support, consolidating and cleansing raw transaction data, designing a flexible pricing model, and enabling scenario analysis. This involved developing logic to identify customer segments based on monthly transaction volume and layering in dynamic pricing components—such as fixed subscriptions and variable transaction or application programming interface (API)-request fees. To simulate real-world conditions, Capstone’s FAS team reconstructed and prepared historical transaction data, allowing the company to test the new pricing model against actual customer behavior. This made the results significantly more credible and practical for decision-making. Using this foundation, the team created a two-dimensional scenario matrix that combined customer segments with pricing model variants. This allowed the client to run what-if simulations across all possible pairings, quantify financial outcomes, and assess the risk/reward trade-offs of each path.

Outcome: With a clear view of how different pricing strategies would perform across its customer base, the client was able to identify a high-potential model that improved expected profitability, offered greater flexibility to clients, and strengthened its market competitiveness without having to scale up internal resources.

Capstone Case Study: Wholesale Distributor Seeks Cleaner Financials and Accounting Processes Ahead of Liquidity Event

Indicators: Capstone’s client was a leading wholesale distributor of bakery ingredients and other food products to commercial bakeries and retailers. The engagement opened and closed over a 12-month period. The business owners were interested in pursuing a liquidity event but realized that the company’s financial and accounting processes needed to be updated in preparation for a prospective buyer’s due diligence process.

Capstone’s Solutions Implementation: Capstone’s FAS team provided senior-level advisory support for the client’s management team before, and during, the business’ sale process and helped prepare the finance and accounting office for a transaction. Once the sell-side M&A process began, the FAS team worked with the client’s accounting staff to quickly fulfill information requests form the buyer, enabling a timely and successful closing.

Outcome: Capstone’s Food & Beverage Investment Banking group represented the company in the transaction and was ultimately able to identify the perfect buyer—an operationally-oriented private equity firm focused on transforming family/founder-owned companies into dynamic, data-driven platforms able to achieve and manage significant growth.

Key Considerations for Business Owners Considering Performance Improvement Projects

Proprietors should continually evaluate operational efficiency and be aware of common scenarios that indicate they may benefit from a performance improvement engagement. These considerations are outlined below.

Common Indicators of Business Performance Improvement Demand

Source: Capstone Partners

Business owners will undoubtedly continue to face shifting macroeconomic and operational landscapes through their company’s lifetime. Therefore, it is necessary to keep profitability and working capital management top of mind as the business evolves to ensure operations run smoothly and effectively. Capstone’s FAS team leverages robust data analytics and decision modeling while working with founders and entrepreneurs to trouble-shoot inefficiencies, instill long-term growth, unlock value, and prepare companies for corporate events—like family succession and a merger or acquisition.

Capstone Partners offers a full suite of corporate finance solutions to help business owners achieve their goals. If you are considering a transaction, experiencing operational challenges, or looking to support the next stage of your company’s lifecycle, you may be in need of business performance improvement services. To learn more about Capstone’s FAS team and the group’s wide range of performance improvement directives, please contact us.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.