How Does an Investment Bank Get Paid?

Aligning Investment Banking Fees With Client Interests

If you are a business owner interested in selling your company or raising capital, or you are a strategic buyer seeking to make an acquisition, you most likely will be considering engaging the services of an investment banking advisor. An important step in securing an investment banking partner is to understand their approach to compensation. This article will discuss the various investment banking fee structures associated with mergers and acquisitions (M&A) and capital raises to better inform your growth initiatives.

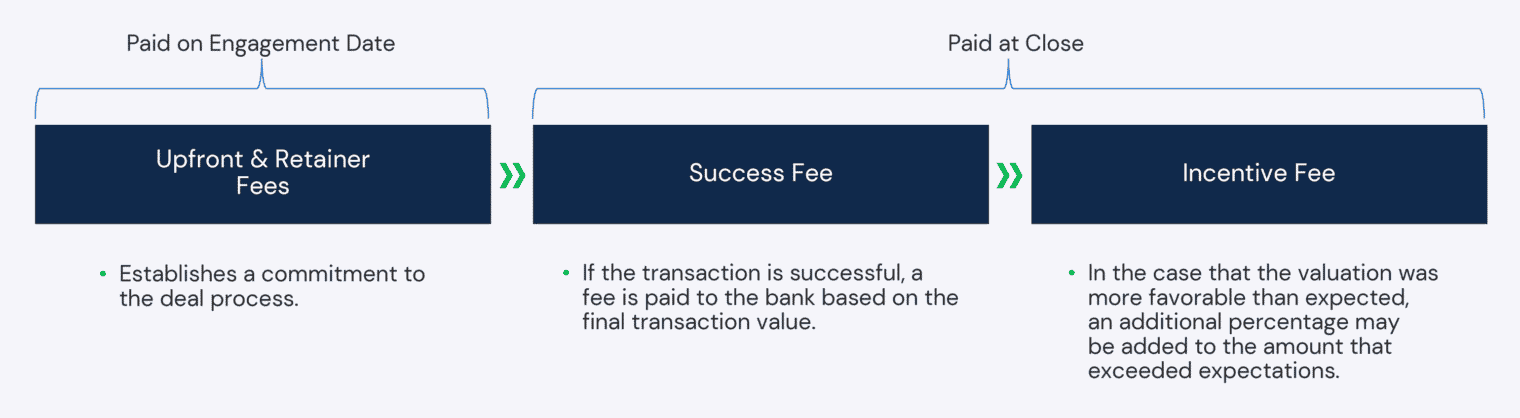

Fee Overview in the M&A Process

Investment banking fee structures serve as an essential component in the execution of a M&A deal. There are multiple components to the fee structure that are all centered around creating an optimal outcome for both the client and banking team. The client and the bank negotiate the fee structure at the beginning of the deal process to ensure that there are agreeable terms and that there is transparency moving forward. Business owners should weigh several factors to ensure that they are receiving the best value from their investment bank including services offered, composition of the deal team, firm success record, industry expertise, and access to the most relevant investor and buyer relationships. The fee structure for M&A transactions is typically comprised of three components, as shown below.

Components of the M&A Advisory Fee Structure

Source: Capstone Partners

Types Of Fees and Timeline

Upfront & Retainer Fees

The retainer fee is an upfront cost paid by the client to the investment bank. The retainer is determined based on various characteristics of the deal such as due diligence, associated risk, and current market activity. The retainer ensures that both parties are committed to the deal process and that there is an exclusive partnership to achieve the best possible outcome. For many investment banks, the retainer fee represents a fraction of the true costs to mobilize a deal team. Retainers are often compared to a deposit, or a slotting fee, so that the investment banking team is assured the client is serious about the transaction. In most instances, depending upon the situation, retainers are credited against the success fee paid at the closing.

Investment Banking Retainer Fee Goals

Source: Capstone Partners

Success & Incentive Fees

The success fee is paid out to the investment bank based on a successful transaction closing. It is a predetermined percentage that is calculated from the total value of the deal paid at close. Often there are incentives included in a proposed success fee that encourage investment bankers to achieve the transactional goals of the client, there are usually focused on maximizing value, but time considerations are often used as well. The success fee should be the most important fee consideration for both the client and the banker. As an investment bank is ultimately hired to close a transaction, ensuring that the proper pricing formula is in place is an important consideration.

As a general rule, the success fee percentage is higher on smaller transactions and lower on larger transactions. The success fee must be aligned with the needs of the client. An appropriate success fee structure will ensure the investment banker is motivated, and rewarded, to achieve the client’s pre-determined goals. Likewise, success fees should be representative of the value contributed by the investment banker. At Capstone Partners, part of our process to establish a consensus with the client includes creating a bell curve analysis of an appropriate trading range for the business. Assuming there is agreement on that range, it is a considerably straightforward process to determine a fee structure that rewards the banker for super-performance. There are many ways to structure an investment banking fee, and an apt investment bank partner should be able to negotiate the proper agreement with their client.

Capital Raise Fee Structure

Similar to a M&A transaction, debt and equity capital are likely to include a retainer and success fee. The difference between the equity or debt advisory fee structures lies within the amount of capital being raised. Fee percentages for these deals are often higher than they are in M&A transactions as the deals are typically smaller. Additionally, warrants or other enhancements might be included in the fee structure as an alternative form of incentive or risk mitigation.

On the debt side, the fees are subject to their location on the capital structure; the deeper the fees are in the capital structure, the higher the fee rate to the committed capital. For example, Senior Secured debt, debt which is prioritized in the case of a bankruptcy, will have a low fee rate compared to Mezzanine financing, which is typically riskier. In addition to the type of debt, determinants of the fee structure include the leverage profile of the business, the use of capital, risk, and overall size of the capital raise. A crucial component of debt capital raises is the network from which the bank can pull funds. Capstone’s Debt Advisory Group has built relationships with more than 300 institutional lenders across the credit universe including commercial banks, finance companies, credit opportunity funds, business development companies, insurance companies, private debt funds, and family offices.

Financial Advisory Services

Not all services provided by an investment bank follow a typical fee structure as discussed above.

In many instances, it may be beneficial for businesses to take advantage of transaction advisory services such as quality of earnings reviews, due diligence, or consulting. For these services, businesses often pay either an hourly rate or fixed project price to financial advisory teams to help prepare them for a sell-side transaction. An hourly rate is also applied to other financial advisory services including performance improvement, interim management, and valuation advisory. Capstone Partners’ Financial Advisory Services (FAS) team specializes in creating customized, enterprise-wide solutions to improve organizational performance and generate shareholder value across all stages of the business cycle.

Speak to One of Capstone’s Senior Bankers

As investment banking fees are heavily dependent on the transaction type and clients’ circumstances, starting the dialogue sooner rather than later is always best practice when seeking assistance from our advisory teams whether it is M&A advisory, debt or equity advisory, or other financial services through Capstone’s FAS team.

For questions about our fee structure or to learn more about Capstone’s fully integrated range of investment banking and financial advisory services, please contact us.

This article was originally posted on 7/21/22 and was updated on 2/6/23.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.