Fundamentals of Transaction Due Diligence: Assessing Technological Assets to Protect Transaction Value

Many middle market businesses have long viewed technology as a key tool to level the playing field against larger competitors. The challenges of the global pandemic—from the widespread pivot to remote or hybrid workplaces to supply-chain disruptions and labor shortages—has resulted in even more pronounced investments in technological solutions to survive the unprecedented disruption to normal operations.

The speed at which technology evolves and the complexity that it drives into businesses across all industries, puts it into a class by itself when it comes to the transaction due diligence process.

Assessing Technology During Transaction Due Diligence

The organic and crisis-driven adoption of technology into most areas of business operations has resulted in many middle market companies having a comparatively complex technology profile. Additionally, the rapid deployment of cloud-based solutions to manage costs and facilitate work-from-home solutions has heightened a company’s cybersecurity risk. Some organizations have been extremely thorough in documenting and managing implementations, while others have struggled to realize the anticipated value from their technological upgrades.

While finance and accounting practices are often consistent from business to business and have not varied significantly over time, technology and digital platforms evolve and change rapidly. Combined with extreme variety in the scalability and success of their real-world execution, this can pose a significant challenge during the due diligence phase of a potential transaction.

Introducing an Expanded Transaction Due Diligence Offering: Quality of Technology Assessment

Our mission to help provide business owners, acquirers, and investors with the most accurate and comprehensive information on which to base important decisions has grown to include a specific focus on technology. Similar to the Quality of Earnings (QofE) analysis that is a standard item in the transaction due-diligence process, our Quality of Technology (QofT) assessment is designed to provide a detailed analysis of a target company’s technology, cybersecurity, digital sales, and marketing platforms and practices.

The Quality of Technology assessment can provide transparency into risks and opportunities, and ultimately help a business owner or investor create an actionable integration strategy that contributes to their desired outcomes.

What Does the Quality of Technology Review Assess?

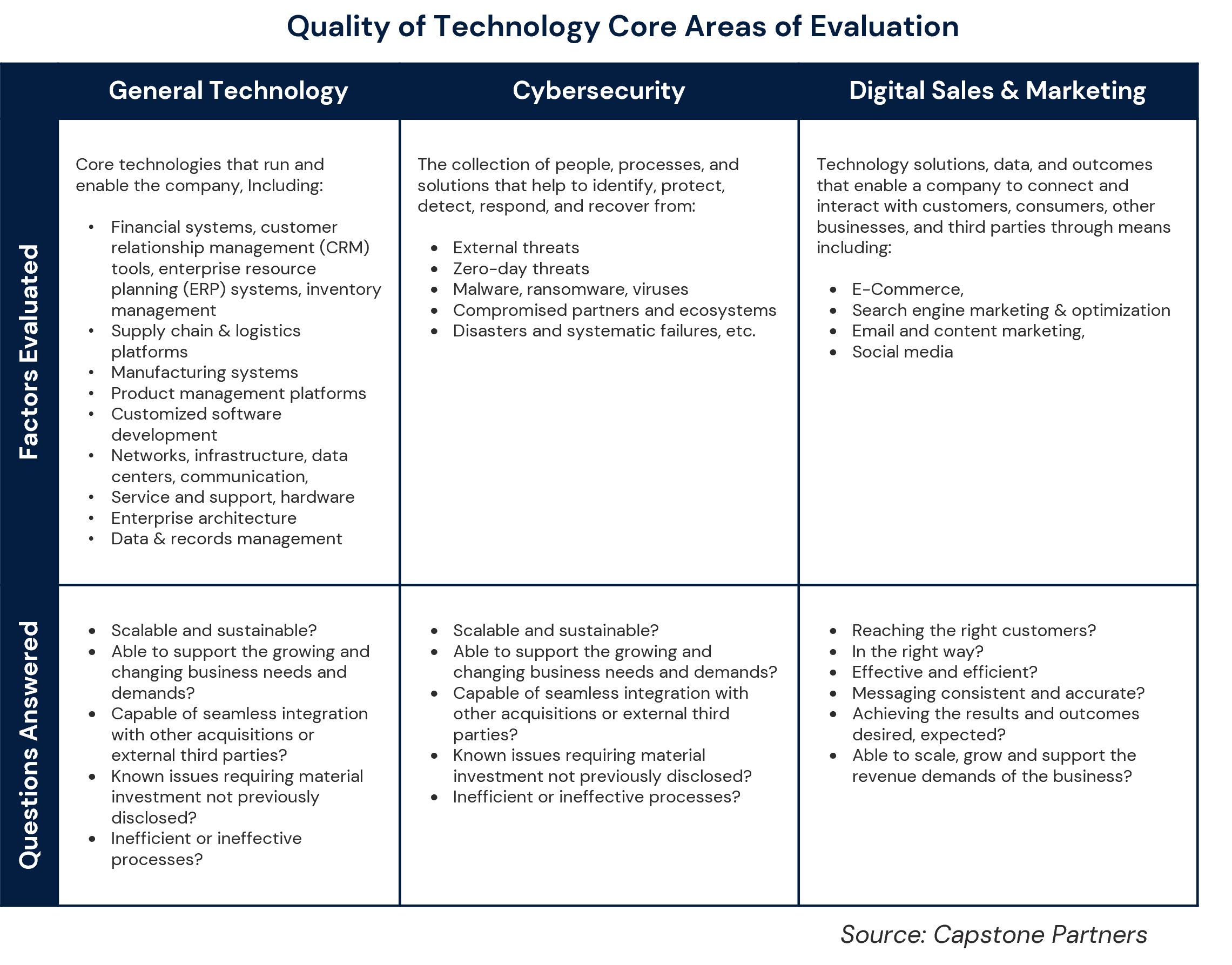

Just as a Quality of Earnings analysis typically assesses the strength of a company’s balance sheet, P&L (profit & loss), and cash flow statements, a Quality of Technology report assesses the strengths and efficiencies of a company’s IT (information technology) infrastructure, the hardware and software that run the business; the cybersecurity systems that protect and defend the business from digital threats; and the digital sales and marketing tools and strategy that grow the business.

Our exact scope depends on the needs defined by the client, but in general, a complete Quality of Technology review addresses three core areas that are critical to understanding the acquisition target’s strengths and challenges.

Giving Clients Better Information to Make Better Decisions

Capstone’s technology assessment allows clients to understand gaps in strategy and functionality to minimize risk. It also provides sufficient detail to help them calculate remediation costs, including time and human effort involved. When the assessment is complete, clients should have a clear picture of the overall complexity of the various proposed solutions, their potential value to the transaction, and the long-term profitability of the business.

Our reports include comprehensive planning tools that will help clients understand the order and timing of any remediation actions they might choose to take. The report also defines any systemic interdependencies that will need to be addressed in tandem.

While an internal team may possess the ability to identify and address these open items, in-house resources often lack the capacity of time to fully execute on remediation plans, especially If they are critical to the timeline of the deal. So, in addition to having the expertise to evaluate technological assets and liabilities, Capstone can also provide on-the-ground assistance to help with implementation and integration if the client pursues the transaction.

Real-World Results

The example below provides a real-world example of how Capstone’s Quality of Technology assessment delivered a superior outcome for our client, a private equity backed company in the Healthcare industry.

The client was an innovative medical device company with $60 million in enterprise value. It was seeking to expand its topline revenue, grow its customer reach, extend its product development pipeline, and improve profitability—all to help support securing the next round of Series B funding.

The company created an intuitive platform-based set of services that were delivered through smart watches. Individuals could use the platform to join a healthcare ecosystem powered by patient journeys, data, analytics, and real-time healthcare monitoring systems.

Faced with operating losses, delayed delivery schedules, a complex product architecture and an incomplete product roadmap, the private equity investor brought in a new CEO charged with improving the pace and trajectory of the company.

Based on our team’s relationship with the new CEO, we were asked to conduct a complete Technology Assessment, including reviews covering talent, product and architecture, cybersecurity, infrastructure, hardware, and vendor management.

Our Quality of Technology assessment uncovered significant gaps and opportunities in the product road map, while validating the cybersecurity program. We also identified other gaps concerning financials, data management, and product testing and development.

We produced a set of prioritized action plans to close the product roadmap gaps, accelerate delivery, and remediate the remaining issues.

As a result, the company was able to deliver on its operating plan, forecasted profitability for the first time, and subsequently oversubscribed their Series B funding round.

Taking the Next Step

Capstone’s Financial Advisory Services group consists of professionals with deep experience advising clients across all states of the business lifecycle including navigating a transaction on both the buy- and the sell-side of the process. If you would like more information about our services or have a specific question, please contact us.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.