Fairness Opinions: Increasingly Relevant for Private Deals

The Standard Best Practice for Public Company Boards is an Important Tool for Private Equity

While fairness opinions have most commonly been associated with mergers and acquisitions (M&A) involving public companies, largely due to legal precedent and disclosure requirements, obtaining a fairness opinion in private capital market transactions has become increasingly prevalent. In the early 1980s, the Chancery Court of Delaware established that public company boards of directors were obligated to perform their own diligence on material M&A transactions-to meet their basic fiduciary responsibilities (including oversight and disclosure). Today, obtaining a third-party fairness opinion, although not explicitly required by law, has been firmly established as best practice for public company boards seeking to gain shareholder approval of a transaction.

Private company boards share the same fiduciary responsibilities as their public counterparts but are not burdened with the same level of disclosure requirements and oversight from the SEC (U.S. Securities and Exchange Commission). It follows that fairness opinions, while valuable to private company boards and stakeholders, have not historically been a standard operating procedure in deals involving private companies. In private capital market transactions involving private equity funds—especially those in which conflicts of interest are perceived—fairness opinions have been increasingly relevant and expected by investors.

In this article, we explore a recent private equity transaction in which the fund and its directors’ fiduciary responsibilities were called into question.

What Is a Fairness Opinion?

In short, a fairness opinion is a third-party expert analysis that assesses whether a proposed purchase price is fair. It is usually completed when an M&A transaction is imminent but has not yet closed. Companies, boards of directors, and key stakeholders will rely on these independent value assessments to affirm that they are upholding their fiduciary responsibilities in approving the transaction. Unlike other valuation analyses or opinions, a fairness opinion does not establish a transaction price or conclude a specific value, nor does it tell a seller whether or not they are maximizing their value in a given transaction.

A fairness opinion involves rigorous valuation analysis that provides clients with an independent assessment that mitigates risk, enhances transparency with stakeholders, and enables informed decision making when assessing transactions that can have a material impact on shareholder value.

When conflicts of interest, perceived or otherwise, are present in an M&A transaction, a fairness opinion can serve as the first line of defense against claims that the conflicts in questions negatively impacted shareholders and led to something other than a fair deal.

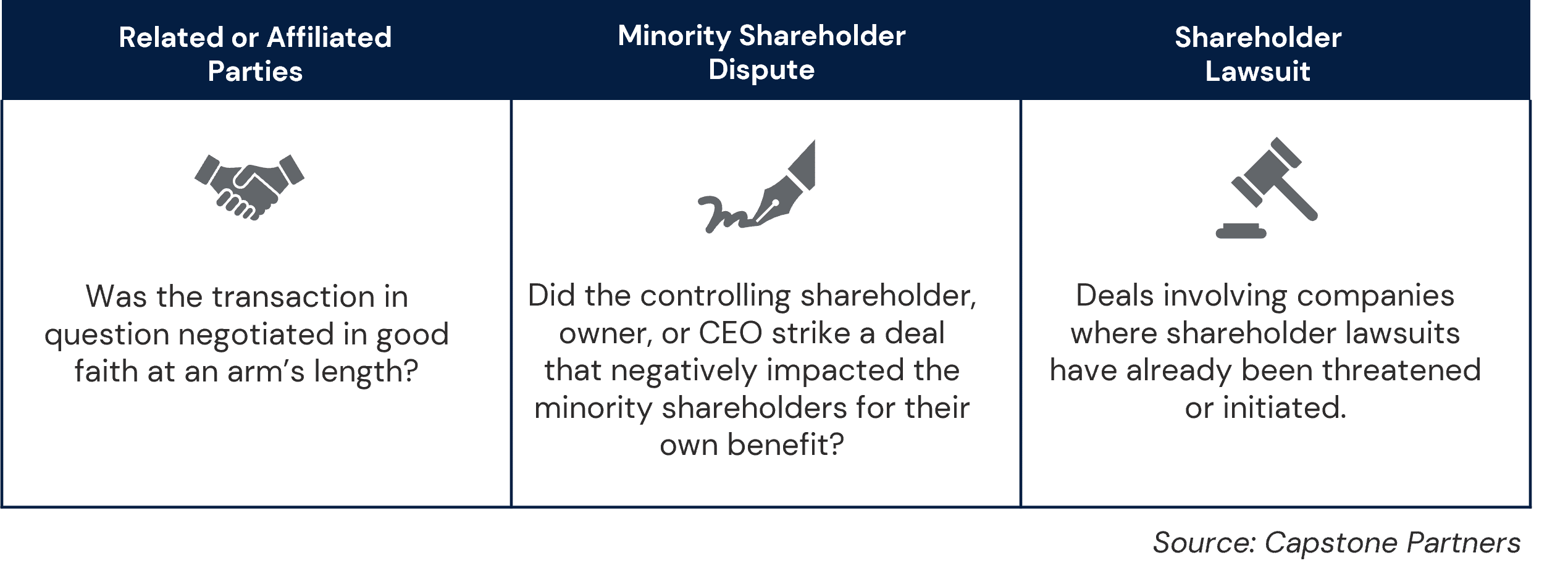

Common M&A Conflicts Addressed in Fairness Opinions

Litigation Considerations

Litigation Considerations

CEOs and boards of directors often view fairness opinions as an insurance policy to safeguard themselves from personal liability in the case of shareholder lawsuits. Notably, 90% of public company M&A transactions are met with shareholder litigation challenging some aspect of the deal, according to Hogan Lovells.¹

The private equity community is not immune to this litigious environment either as evidenced by a high-profile case involving the Carlyle Group (Nasdaq:CG). In June 2022, the Delaware Court of Chancery, in Manti Holdings, LLC v. Carlyle Group Inc. held that a minority shareholder could proceed with a claim against Carlyle and its directors which alleged that they breached fiduciary responsibilities in approving the sale of a portfolio company in a transaction that did not maximize shareholder value.

The deal in question was Carlyle’s 2017 sale of Authentix to Blue Water Energy for $77.5 million in upfront consideration and $27.5 million in contingent earnout consideration. Under the transaction, Carlyle maximized value on its $70 million preferred holdings, but common shareholders received nominal consideration. A dissenting board member, who represented minority shareholder Manti Holdings, on multiple occasions urged the board to end negotiations and reenter the market at a later date when market conditions were more favorable and Authentix’s financial performance were improved. Manti also argued that the transaction sacrificed value to shareholders in exchange for a timely sale that would enable Carlyle to shut down a legacy fund. The board ultimately obtained majority approval and went through with the transaction, but not without facing significant legal battles.

The Authentix case provides critical takeaways for boards of private equity firms as they endeavor to uphold their fiduciary responsibilities. The litigation arising from the Authentix case highlights the complexity and depth of issues that business owners, boards, and shareholders need to take into consideration when assessing an M&A transaction. A fairness opinion does not prevent litigation, but it provides an independent assessment of the transaction, taking into consideration the same facts and circumstances the key stakeholders are balancing in arriving at a decision to transact. Two key considerations in this example that should have been addressed were:

- Investment Horizon – “Speed and certainty to close” is always a consideration when contemplating an M&A transaction. Private equity funds at or near the end of their investment horizons often feature dynamics where quickness to closing holds greater weight than maximizing price. The recent Authentix ruling however made clear that speed to close cannot be the only consideration, especially when a board’s fiduciary duties of loyalty and care are compromised or reasonably questioned through the transaction.

- Conflict of Interest Amongst Shareholder Classes – There are a variety of stakeholders impacted by an M&A transaction. Even within the capital stack there are often competing priorities amongst share classes. In the Carlyle case, the court ruled that the directors—who were fiduciaries of both Carlyle and Authentix—were likely conflicted by the transaction and potentially acted disloyally given the differing levels of consideration received by preferred shareholders (Carlyle) and Authentix stockholders. The expedited sale enabled Carlyle to maximize its return on its preferred stock investment while Authentix’s common shareholders stood to benefit only if the company sold for a higher price, which the minority shareholder argued would have occurred with better market timing.

Capstone Partners Case Study: Fairness Opinions for Continuation Funds

A continuation fund, also known as a continuation vehicle (CV), has been an increasingly popular secondary transaction in the private equity world. Generally speaking, the general partners (GPs) of a sponsor-advised fund arrange to sell one or more of the fund’s portfolio companies to a specially created continuation fund. This transaction allows existing limited partners (LPs) to exit the investment entirely while permitting new terms to be issued for new or renewing investors.

For one such transaction, the private equity fund hired Capstone Partners to provide a valuation of the portfolio company that was being sold to/acquired by the continuation fund to assure LPs and regulators of the fairness of the purchase price used in the transaction.

This type of transaction is growing in frequency and popularity, a fact that is likely to drive an increased demand for valuation services.

Conclusion

Although not currently required for all private transactions, third-party fairness opinions can still be a valuable tool to help mitigate risk, reduce the likelihood of a post-transaction dispute among stakeholders, and increase the speed and certainty of close – all of which typically preserve, if not bolster, the value of the transaction.

Capstone’s Financial Advisory Services Group has an extensive array of valuation advisory services and litigation support services to help owners, boards, special committees and investors fulfill their fiduciary responsibilities. To learn more about Capstone’s fairness opinion capabilities, contact us.

Endnotes

Related Transactions

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.