Food Mergers & Acquisitions Update – November 2025

Regulatory Initiatives Fuel Better-For-You Food Mergers Despite Challenged M&A Market

The Food sector has continued to grapple with sweeping tariff implementations and supply chain disruptions that have dampened merger and acquisition (M&A) activity year to date (YTD) as business owners focus internally to protect margins in the near-term. High-income consumers have remained financially healthy with low household debt and rising real incomes driving economic growth and spending. However, lower-income consumers have continued to feel pressure from inflation, waning income gains, and the resumption of student loan payments, leading to continued market share gains for private label foods and value grocers. This bifurcated consumer health has seen value grocers, such as Aldi, and Dollar General (NYSE:DG) capture almost a third (30.5%) of grocery visits as of Q2 2025, according to Placer.ai.1 Notably, cross-shopping between traditional grocer Kroger (NYSE:KR) and Dollar General has increased 11% between Q2 2019 and Q2 2025 to 51.6%, underscoring a flight to value-oriented products and retailers. Political pressure to remove synthetic dyes and increase ingredient transparency in the U.S. food supply has emerged as an additional variable for many food businesses to address. This increased scrutiny from governing bodies has provided select Food sector participants with clear near- and mid-term tailwinds while ultra-processed food brands look to reformulate products under new guidelines. Better-for-you (BFY) consumption preferences have compounded the opportunity stemming from this regulatory pressure as consumer demand for less processed and healthier options that were accelerating pre-pandemic remain strong. These factors will likely accelerate food M&A activity moving into 2026, with BFY brands expected to meaningfully support the rebound.

The U.S. is experiencing extreme bifurcation of the consumer which is affecting food purchasing behaviors. More affluent consumers have a heightened awareness of health and wellness, while less affluent consumers are forced to shop largely on price. If given a choice, however, both cohorts are seeking more transparency with ingredients and less ultra-processed foods.

Make America Healthy Again Spurs Reformulation Commitments, Supports Outlook for BFY Ecosystem

Robert F. Kennedy’s appointment as Health and Human Services (HHS) Secretary and the establishment of the Make America Healthy Again (MAHA) Commission has created a shifting Food sector landscape. The new secretary’s initiative has been focused on ingredient transparency, phasing out petroleum-based artificial food dyes, and restricting the use of Supplemental Nutrition Assistance Program (SNAP) benefits for junk food. The initiative has also focused on updating the Food and Drug Administration’s (FDA) Generally Recognized as Safe (GRAS) designation to remove loopholes that have allowed companies to introduce new ingredients and chemicals as well as self-certify safety without FDA oversight. Action has taken the form of incremental, specific regulation rather than a sweeping executive order, with the first federal ban targeting Red Dye No. 3 mandating compliance by January 2027, according to the FDA.2 Blue No. 1, Blue No. 2, Green No. 3, Red No. 40, Yellow No. 5, and Yellow No. 6 have also been targeted for a ban and phased removal but have not yet been enacted by federal legislation. The FDA is expected to work with manufacturers on a voluntary basis to eliminate these additional synthetic dyes from the food system. Additionally, proposed rule changes to front-of-package labeling would require companies to categorize the product’s saturated fat, sodium, and added sugar content as low, medium, or high, further incentivizing product reformulation toward healthier products and increased transparency.

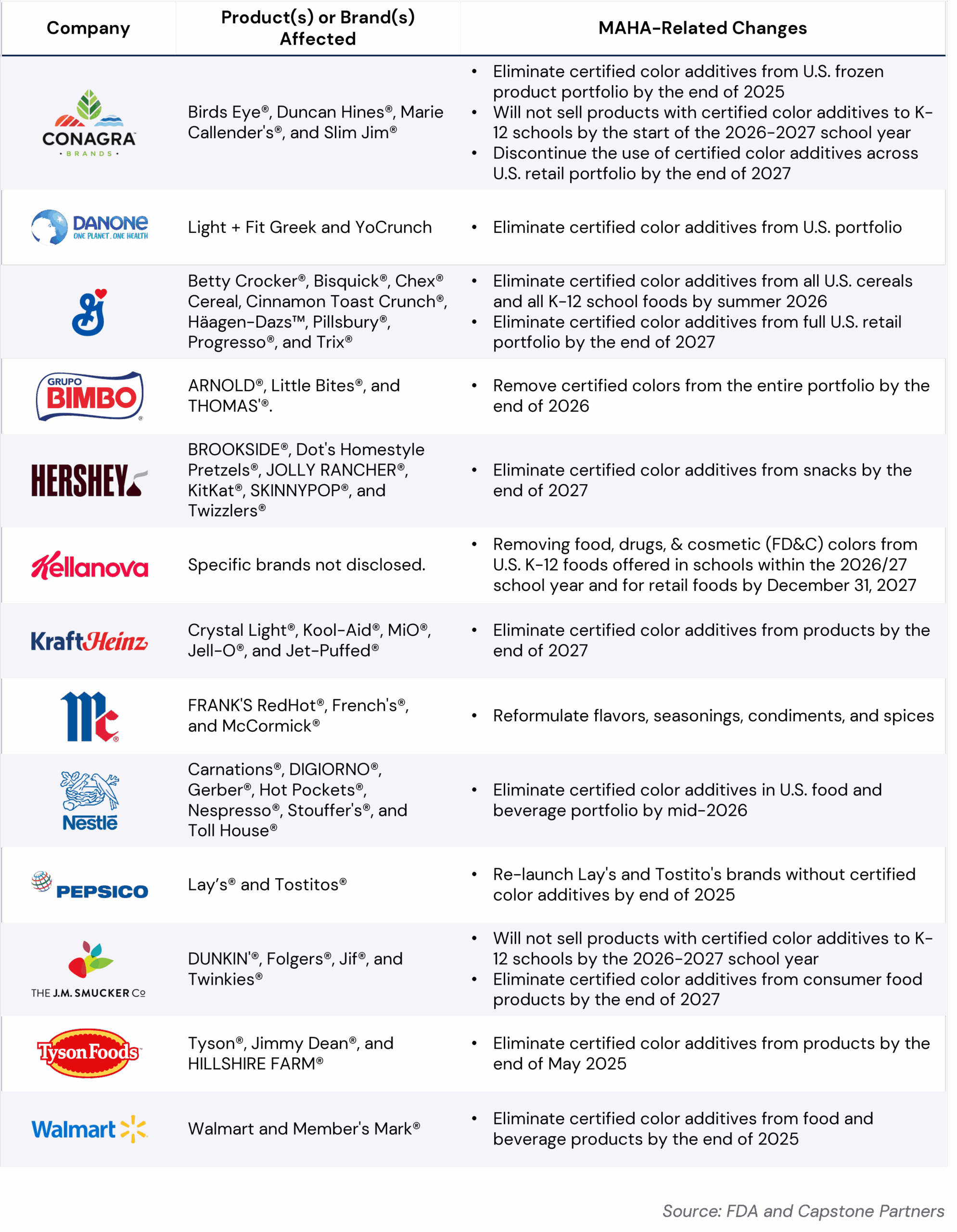

Companies, organizations, and state legislators have already reacted to these initiatives. At the state level, Louisiana and Texas now require warning labels on products with unsafe ingredients. Eight states (Arizona, Delaware, Louisiana, Tennessee, Texas, Utah, Virginia, and West Virginia) have banned synthetic dyes or certain additives from school meals. Another 12 states (Arkansas, Colorado, Florida, Idaho, Indiana, Iowa, Louisiana, Nebraska, Oklahoma, Texas, Utah, and West Virginia) have received approval to implement SNAP waivers restricting products like candy and sugary drinks, according to the HHS.3 Additionally, many public companies in the Food sector have introduced pledges to phase out color additives, as summarized below.

Public Players Address MAHA Agenda with Corporate Action

This increased regulatory scrutiny over ingredients and processed foods has represented mid-term headwinds for U.S. packaged food producers heavily utilize synthetic coloring and other controversial additives as they work to reformulate products in accordance with evolving guidelines. However, ingredient suppliers are expected to see positive tailwinds as brands look to reformulate products in favor of natural colorants, clean-label flavoring, sugar-reduction solutions, and other health-oriented levers. The BFY category has been well-positioned to capitalize on this increased regulatory oversight, backed by shifts in consumer preferences toward clean label and healthy options that accelerated during the pandemic. “What we’re hearing is, and I would say an even stronger desire for cleaner labels—cleaner labels for innovation to help reduce sugar, salt, fat, increase protein, all the things that we are good at, and we’re seeing the continued healthy reformulation to do those things. And I would say the MAHA movement in the U.S. is helping that,” noted Jon Erik Fyrwald, CEO of International Flavors & Fragrances (NYSE:IFF), in its Q2 2025 earnings call.4 Taste will likely remain paramount for branded and private label food businesses higher up the value chain as demand builds for ingredient suppliers such as International Flavor & Fragrances and other manufacturers with robust BFY capacity. Brands able to balance reformulations under the evolving regulatory landscape with consumer demand for cleaner but still tasty foods will likely see strong market share gains and drive continued food mergers through the mid-term.

Food Mergers Subdued Amid Tariff Uncertainty, Private Strategics Lead Deal Flow

M&A activity in the Food sector has remained below the prior year period as general macroeconomic uncertainty and tariffs have continued to induce caution for acquirers and sellers alike. Total sector deal volume has declined 28.9% year-over-year (YOY) to 135 transactions announced or completed in YTD 2025. All buyer types have contributed to this contraction in Food sector M&A. Strategic buyers have displayed a material retraction in acquisition appetite, with public and private buyers reducing their deal activity by 45.8% and 26.1% YOY, respectively. Shareholder pressure to maintain dividend payments, solidify supply chains, and continue optimizing portfolios have contributed to the greater pullback of public strategic deal flow in the Food M&A market. As a result, private business owners have taken share of sector M&A activity despite the YOY decline in deal volume, comprising the majority (50.4%) of transactions in the space to date.

Private equity (PE) activity in the sector has similarly declined, falling 27% YOY to 54 transactions in YTD 2025. The decline has been primarily attributable to a 37.8% YOY drop in add-ons. Sponsor platform investments have nearly kept pace with the prior year period, totaling 26 deals YTD compared to 29 in YTD 2024. Platform deals have also captured additional share of the sector’s M&A market, rising from 15.3% to 19.3% of total deals YTD. These transactions have been supported by more favorable debt financing conditions, with Federal Reserve (Fed) interest rate cuts in the second half of 2024 combined with spread compression in the Broadly Syndicated Loan (BSL) and Direct Lending markets through the first half of 2025 keeping the Credit market in borrower-friendly territory. Moreover, dry powder reserves have remained robust and limited partner (LP) pressure to put these funds to work has continued to prompt platform formations despite macroeconomic volatility.

Acquirers Show Bifurcated Preference for Large and Small Food Merger Deals

Food sector M&A deal size has been largely bifurcated to date. Lower middle market (less than $100 million in enterprise value) transactions have retained the bulk (50%) of disclosed deals. Large scale deals (more than $500 million in enterprise value) have comprised 31.8% of disclosed deal volume, rising YOY to the highest percentage recorded between 2019 and YTD. When combined with upper middle market deals (between $250 million and $500 million in enterprise value), this figure jumps to 45.5% of disclosed deals. The barbell dynamic, with deals less than $100 million in enterprise value and greater than $250 million in enterprise value accounting for 95.5% of disclosed transactions, indicates a buyer universe targeting deals with low execution risk or large strategic impact. As a result, defensible margins and growth have remained paramount for sellers looking to achieve a liquidity event at favorable valuations in the current environment. Notably, average sector M&A EBITDA multiples have reached 14.7x in the 2023-YTD period, more than three turns higher than the 2020-2022 period (11.5x), underscoring a strong flight to quality. Capstone expects core middle market deals to return as macroeconomic pressures ease and business owners emerge from the cloud of tariff uncertainty with fortified supply chains and growth playbooks moving into 2026.

Buyers Continue to Target BFY Acquisitions Amid Strong Fundamental Demand Drivers

Regulatory tailwinds and consumer preferences for healthier food products have supported BFY deal activity. These deals have comprised more than a quarter (25.9%) of total sector volume to date, a record high percentage since 2019. Strategics have been the most prominent buyer of BFY businesses, executing 24 BFY transactions in both YTD 2024 and YTD 2025. Meanwhile, PE firms have announced or completed 11 BFY deals to date, a drop off from 18 in YTD 2024. Sector participants are projected to continue building BFY portfolios in the mid-term as fundamental demand drivers remain strong from a regulatory and consumer standpoint. A sampling of key BFY food mergers in YTD 2025 are outlined below.

- Capol Acquires Blue Pacific Flavors (September 2025, Undisclosed) – In September 2025, Germany-based value-added food ingredient solutions manufacturer, Capol, acquired Blue Pacific Flavors for an undisclosed amount. California-based Blue Pacific Flavors develops and supplies natural and organic-compliant fruit and sweet flavors for food and beverage brands. The acquisition is expected to support new opportunities in Health, Wellness, and Indulgence categories, market expansion, and innovation through cross-category collaboration. “Together with Capol, we can deliver greater innovation, faster speed to market, and enhanced value for our customers—while staying true to our roots in clean-label, natural flavor development. Importantly, this partnership also expands our manufacturing footprint into Europe, giving customers more flexibility, supply security, and global scale,” said Donald Wilkes, CEO of Blue Pacific Flavors, in a press release.5 The acquisition underscores Capol’s appetite for capability-enhancing inorganic growth opportunities. Under similar deal rationale, the company acquired German flavor house Curt Georgi in July 2025, to expand product development capabilities and speed to market (undisclosed).

- Apheon Acquires Cain Food Industries (September 2025, Undisclosed) – PE firm Apheon acquired value-added clean label bakery ingredients manufacturer Cain Food Industries in September 2025 for an undisclosed sum. Apheon merged Cain Food with its existing portfolio company Millbio, an Italian producer of natural food ingredients, following the acquisition. The combined entity will retain the Cain Food Industries name and operate out of North America. Cain Food and Millbio boast a manufacturing and logistics footprint across North and South America, Europe, and Asia. The two companies offer research and development (R&D) services for personalized ingredient formulation development and application testing. Its product suite includes sourdough starters, natural mold inhibitors, enzyme-based improvers, softening systems, and botanical shelf-life extenders. “This partnership marks a key step forward in our mission to become a global leader in natural, clean label bakery solutions. By combining Millbio’s fermentation and technical know-how with Cain’s reach and client intimacy in the Americas, we can now offer a truly integrated value proposition—from raw materials to finished formulation and distribution—broadening our market access and customer proximity,” said Alessandro Boggiani, Founder of Millbio, in a press release.6

- Miller Poultry Acquires Gerber’s Poultry (March 2025, Undisclosed) – In March 2025, Miller Poultry, a poultry processing company focused on Amish-raised, antibiotic-free chicken products, acquired chicken producer Gerber’s Poultry for an undisclosed sum. The acquisition combines the 22nd (Miller) and 27th (Gerber) poultry producers in the U.S. and increases Miller’s capacity by more than 50%, according to WATTPoultry.7, 8 End market expansion was cited as key deal rationale, with the added premium chicken capacity in Ohio offering routes to the Northeastern and Southeastern U.S. “This acquisition provides both growth and safety for the Miller Poultry family of farm families (primarily Amish families), team members, retailers, and customers. It has been fulfilling to be one of the early pioneers of premium attributes like third-party auditing, air-chilling, and humane stunning systems,” said Galen Miller, Owner of Miller Poultry, in the press release.

- Ahimsa Companies Acquires Blackbird Foods (February 2025, Undisclosed) – Ahimsa Companies acquired plant-based frozen pizza, seitan, and wing brand, Blackbird Foods, in February 2025. Terms of the transaction were not disclosed. Ahimsa specializes in acquiring, scaling, and investing in innovative plant-based food brands. The Blackbird Foods acquisition marks Ahimsa’s third brand roll-up in the space. The firm acquired plant-based chicken brand, Simulate in October 2024, a former Gathered Foods production facility in Ohio in July 2024, and frozen plant-based food products brand, Wicked Foods, in June 2024, all for undisclosed sums. Blackbird cited expanded scale and brand collaboration as key motivation for the transaction. Of note, Blackbird sales grew 20% YOY in 2024 and increased its retail footprint to 3,500 locations, according to a press release.9 Blackbird, Simulate, and Wicked Foods will function in a shared-services model, where manufacturing and retail expertise are integrated across the brands to realize operational and logistic synergies. “We are able to combine a lot of our operations and logistics and warehousing. All of those things help us become self-sustaining and help us grow further and compete in this Retail space, whereas everyone knows it is extremely cash intensive to play in,” noted Blackbird CEO and Co-Founder, Emanuel Storch, in the press release.

Food mergers are expected to rebound moving into 2026 as businesses in the sector cycle through the first impacts of widespread tariffs on key import countries. Regulatory pressure from the HHS and FDA have already created voluntary change in processed food formulations, with many brands committing to full elimination of synthetic dyes in the coming years. These shifts will likely make best-in-class BFY food brands highly attractive acquisition targets, particularly brands that have effectively balanced consumer demand for both tasty and healthy meals and snacks.

To discuss the widespread impacts of regulatory shifts coming from the HHS and FDA, provide an update on your business, or learn about Capstone’s wide range of advisory services and food mergers knowledge, please contact us.

Andrew Woolston, Associate, was the lead Market Intelligence contributor to this article.

Endnotes

-

Placer ai, “Who’s Losing Grocery Share to Dollar General – and What Consumer Habit is Driving Its Growth,” https://www.placer.ai/anchor/articles/whos-losing-grocery-share-to-dollar-general, accessed October 23, 2025.

-

Federal Registrar, “Color Additive Petition From Center for Science in the Public Interest, et al.; Request to Revoke Color Additive Listing for Use of FD&C Red No. 3 in Food and Ingested Drugs,” https://www.federalregister.gov/documents/2025/01/16/2025-00830/color-additive-petition-from-center-for-science-in-the-public-interest-et-al-request-to-revoke-color, accessed October 7, 2025.

-

HHS, “HHS Launches ‘MAHA in Action’ Tracker as Public Health Winds Sweep the Nation,” https://www.hhs.gov/press-room/hhs-launches-maha-in-action-tracker.html, accessed October 7, 2025.

-

International Flavors & Fragrances Inc., “Q2 2025 International Flavors & Fragrances Inc. Earnings Conference Call,” https://edge.media-server.com/mmc/p/z5asjitp/, accessed October 7, 2025.

-

Capol, “Capol Acquires Blue Pacific Flavors to Expand Innovation Across Beverage, Confectionery, and Coatings,” https://www.capol.de/en/company/news/capol-acquires-blue-pacific-flavors-to-expand-innovation-across-beverage-confectionery-and-coatings/, accessed October 7, 2025.

-

Food Business News, “PE Firm Acquires Cain Food Industries, Merges it With Millbio,” https://www.foodbusinessnews.net/articles/28937-pe-firm-acquires-cain-food-industries-merges-it-with-millbio, accessed October 7, 2025.

-

com, WATT Poultry USA Top Companies Survey, 2025,” https://www.wattpoultryusa-digital.com/wattpoultryusa/library/page/march_april_2025/52/, accessed October 7, 2025.

-

WATTPoultry, “Miller Poultry Acquires Gerber’s Poultry,” https://www.wattagnet.com/business-markets/mergers-acquisitions/news/15740263/miller-poultry-acquires-gerbers-poultry, accessed October 7, 2025.

-

Food Navigator USA, “Blackbird Foods Acquisition Shows Appetite for Frozen Plant-Based Products,” https://www.foodnavigator-usa.com/Article/2025/02/18/plant-based-private-equity-firm-ahimsa-companies-snaps-up-blackbird-foods/, accessed October 7, 2025.

Related Transactions

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.