Advantages and Disadvantages of Equity Financing

What are the Advantages and Disadvantages of Equity Financing?

As with everything, equity financing has its advantages and disadvantages. Before we explore them, let’s first define what equity financing is, what the primary methods of obtaining equity financing are, and what the investor universe is like.

What is Equity Financing?

Equity financing is a method of raising capital for a company by selling shares of the company to investors. Companies will often go through several rounds of equity financing as they grow and scale operations, using different equity instruments based on their specific needs. While equity financing is often critical to finance operating expenses during a company’s earliest stages, it can also be an effective financing tool for long-term growth initiatives in more mature companies.

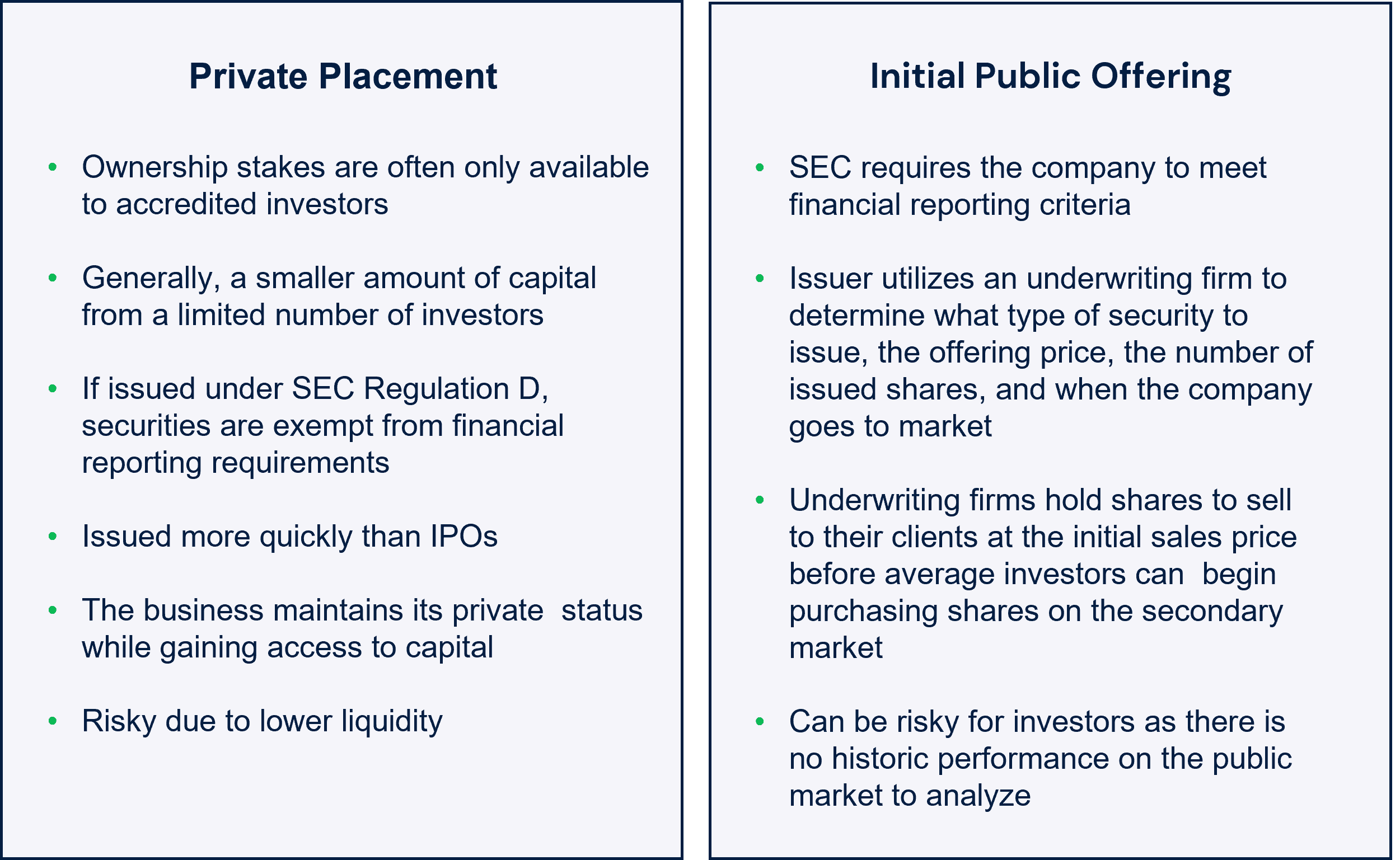

There are two primary methods of equity financing:

- Private placement of stock: sale of shares into the private, non-public capital markets to institutions (i.e., venture capital, growth equity, and private equity firms) and accredited individual investors.

- Initial public offering (IPO): sale of shares to the public in a new stock issuance. Following an IPO, companies can also sell additional shares to the public in a “follow-on” offering.

Private Placement vs. Initial Public Offering

Source: Investopedia and Capstone Partners

Private Placement Financing

When a business pursues private financing, it raises capital through the sale of equity, which can be structured in various ways, including:

- Common Shares: junior equity issued to investors in exchange for capital.

- Convertible preferred stock: securities that are of higher priority than common equity. In other words, when the proceeds from a company sale or other liquidity event are distributed, both lenders and preferred stockholders are paid before distributions reach common stockholders. Any dividends paid to shareholders must be paid to preferred stockholders before common stockholders.

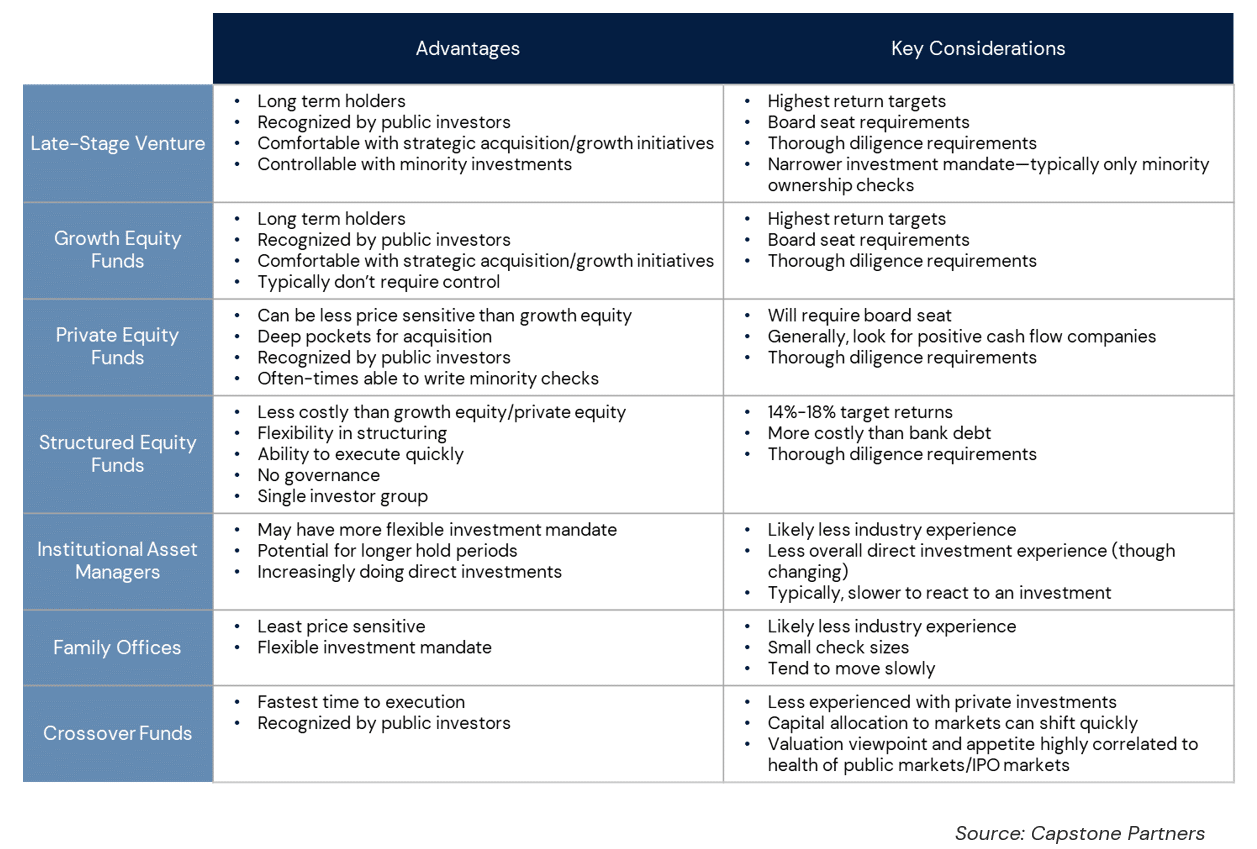

Private placement investors include: late-stage venture funds, growth equity funds, private equity funds, family offices, structured equity funds, crossover investors, and institutional asset managers. Each possesses distinct qualities that business owners should consider when seeking funding, as shown the chart below.

Investor Universe: Advantages and Key Considerations by Type

Advantages of Equity Financing

There are many advantages of equity financing for companies seeking to raise capital, including:

- There are no repayment obligations.

- There is no additional financial burden.

- The company may gain access to savvy investors with expertise and connections.

- Company health can improve by decreasing debt-to-equity ratio and credit score.

Disadvantages of Equity Financing

Equity Financing also has some disadvantages as compared to other methods of raising capital, including:

- The company gives up a portion of ownership.

- Leaders may be forced to consult with investors when making a decision.

- Equity typically costs more than debt financing due to higher risk.

- It is often harder to find an investor than to find a lender.

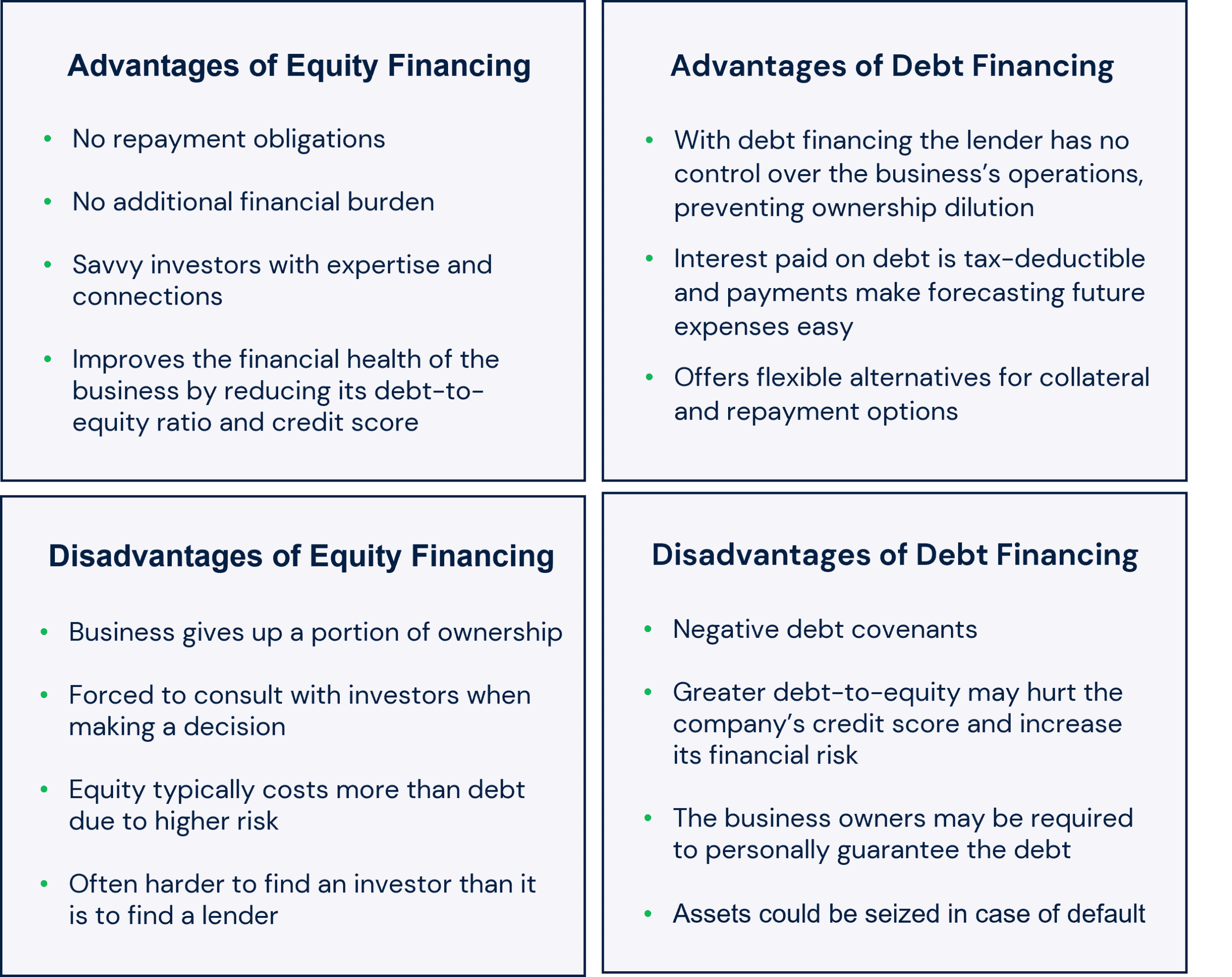

Equity Financing vs. Debt Financing

There are two primary options for capital raising: debt financing and equity financing. Businesses typically utilize a combination of debt and equity to fund growth as both classes have advantages at different stages in a business’s lifecycle. In debt financing, a business borrows money to be paid back to the lender, with added interest. Once the loan is paid back, the relationship between the business and its lender ends. Creditors typically look at businesses with lower debt-to-equity ratios more favorably, although the ideal amount of debt depends on the industry.

Comparing the Advantages & Disadvantages of Equity and Debt Financing

Source: The Hartford, Investopedia, and Capstone Partners

Important Considerations for Business Owners

It is critical that business owners identify their values and company goals before seeking funding from investors or lenders. Owners contemplating financing options may want to consider the questions outlined below.

- What source of funding is most easily accessible for the company? Debt financing can be easier for a business to attain as it is more difficult to find an equity capital provider. However, private equity and growth capital investors continue to display a significant appetite for stakes in strong businesses serving growing markets. In addition, traditional debt financing is not available to early-stage companies.

- How important is it for principal owners to maintain complete control of the company? In equity financing, the business owner is selling shares of the company and often retains majority ownership, albeit diluted on a pro rata basis tied to the valuation of the company. When utilizing traditional debt financing, the owner maintains complete ownership without dilution.

- What resources do the investors provide? Venture capital, growth equity, and private equity firms, along with large strategic acquirers, are experienced in improving businesses’ scale, management teams, operational efficiency, and profitability. In addition, these investors may have strong connections in the market that can help form accretive partnerships and establish knowledge-sharing relationships.

- Do the investors often make add-on investments in companies? Private equity acquirers often use add-on acquisitions to form synergies and increase the scale of portfolio companies. A business owner that seeks investment from a private equity firm should consider how add-on acquisitions would impact the business’s culture and performance.

- Does the investor’s culture align with your brand? Cultural preservation may be important to business owners. Before seeking investment, business owners should consider the culture and track record of potential investors.

- Do the investor’s goals align with your vision for your company? It may also be important to a business owner that the company goals are left unchanged. Business owners should have a clear understanding of the investor’s aspirations before closing the deal.

- Is now a good time to borrow? A business will want to consider the overall debt financing environment with respect to current interest rates to determine if now is the best time to borrow. The professionals on Capstone’s Debt Advisory Group closely follow leveraged finance market conditions and provide insights to business owners that are considering a debt capital raise.

Capstone Partners offers a full suite of services to help business owners achieve their goals. If you are considering an equity or debt capital raise to support the goals of your company and would like professional guidance on finding an investor to help meet those goals, please contact us.

About Capstone Partners Equity Capital Advisory Group

The senior professionals in our Equity Capital Advisory Group bring 30+ years of combined experience and have worked on capital formation transactions that exceed $20 billion in aggregate financing value. As a fully-dedicated group focused exclusively on the equity capital markets, the team has established a distribution channel comprised of diverse global investors, including the leading late-stage venture funds, growth equity funds, private equity funds, family offices, structured equity funds, crossover investors, and institutional asset managers.

About Capstone Partners Debt Capital Advisory Group

Our Debt Advisory Group has developed established relationships with over 300 institutional lenders across the credit universe, including commercial banks, finance companies, credit opportunity funds, business development companies (BDCs), insurance companies, private debt funds, and family offices. The firm’s deep credit experience and entrenched relationships allow us to deliver tailored debt solutions and provide real-time market intelligence on current market terms, lending trends, and structural alternatives

Note: This article was originally published on July 5, 2022 and was recently updated on October 16, 2023.

Related Transactions

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.