Automotive Industry Update

The Rise of the Software-Defined Vehicle

The Automotive industry is undergoing one of its most significant transformations in a century. For decades, differentiation centered on mechanical performance, efficiency, and design. Today, that edge has shifted toward software. The term software-defined vehicle (SDV) has become the new industry buzzword, signifying vehicles containing core value proposition and competitive differentiation increasingly stem from code, connectivity, and continuous software updates rather than hardware.

Automakers have stopped building vehicles that include software for basic use cases. Instead, they have begun building platforms where software defines the user experience, the business model, and the pace of innovation. The Ford (NYSE:F) Automotive Annual Report estimates that by 2035, SDVs are projected to represent a trillion-dollar global market opportunity, driven by changing consumer expectations, regulatory requirements, and advances in computing power, according to BCG’s Future of Automotive Software Report.1

A Market in Acceleration

The SDV market has begun accelerating rapidly, expected to reach a value of $400-$600 billion by 2030 with the potential to exceed $1 trillion by 2035, according to AlphaSense.2 This growth has been propelled by the centralization of vehicle computing architectures and the shift to software-managed systems capable of continuous over-the-air (OTA) updates. Automotive software content per vehicle is projected to increase by 4.8x this decade. At the same time, software and electronics investments are expected to grow at a compound annual growth rate (CAGR) near 9% through 2030.

Electrification has amplified this trend. Modern electric vehicles (EVs) have relied heavily on sophisticated software to optimize energy use, driver assistance, connectivity, and infotainment. Features once considered optional, such as advanced safety systems and real-time software updates, have become the standard consumer expectation. For example, Tesla’s (Nasdaq:TSLA) OTA-enabled vehicles, Volkswagen’s (XTRA:VOW3) CARIAD platform, and the $5.8 billion joint venture between Rivian (Nasdaq:RIVN) and Volkswagen illustrate how leading Original Equipment Manufacturers (OEMs) are leveraging software to deliver differentiated experiences and operational flexibility. Automakers that fail to invest aggressively in SDV capabilities risk losing competitive ground to more agile, software-first players.

What’s Powering the Shift

At the core of the SDV revolution is architecture consolidation. Traditional vehicles contain dozens of independent electronic control units (ECUs); SDVs replace these with a few centralized, high-performance computing nodes. This has reduced complexity, wiring costs, and development cycles while still enabling seamless software updates and feature enhancements.

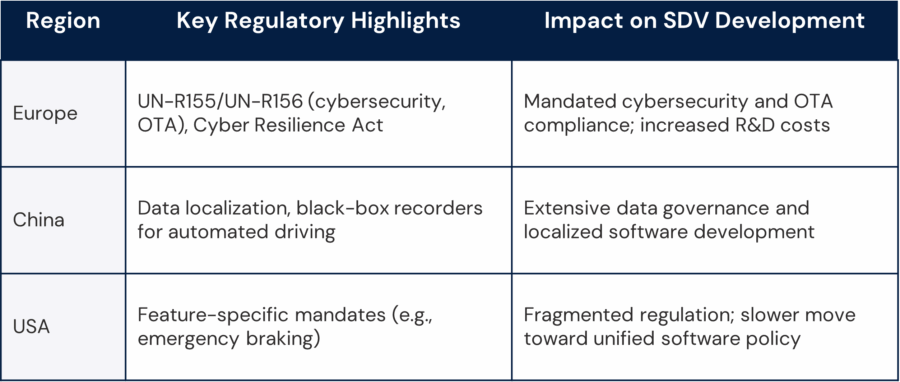

Regulation has further accelerated this shift. In Europe, mandates such as UN-R155 and UN-R156 enforce cybersecurity and OTA update requirements. Moreover, the upcoming Cyber Resilience Act (2027) will further impose software supply chain integrity standards. China has instituted data localization and automated driving “black-box” recorders. The U.S. has mandated features like automatic emergency braking but lacks comprehensive software governance policies. These regional differences have fragmented design approaches and increased compliance costs, driving OEMs toward flexible, modular architectures that can adapt across jurisdictions.

Vehicles have evolved from mechanical objects into data-rich platforms. This has opened new monetization opportunities through feature unlocks, performance enhancements, connectivity subscriptions, and data services extending revenue far beyond initial sales. For instance, General Motors (NYSE:GM) estimates that its Super Cruise and Ultra Cruise driver-assistance subscriptions will generate over $2 billion in annual recurring revenue within five years, according to a January 2025 Reuters article.3

The Big 3 Under Pressure

Traditional automakers have faced both opportunity and risk in the SDV era. Ford, General Motors, and Stellantis (BIT:STLAM) have adopted distinct strategies reflecting their technological platforms, cost structures, and regulatory environments.

- General Motors has aggressively integrated chips enabled with artificial intelligence (AI) and software developed in partnership with NVIDIA (Nasdaq:NVDA). GM’s Super Cruise and Ultra Cruise systems have exemplified the push toward monetized software services embedded in vehicle platforms.

- Ford’s initial foray into full-stack platform consolidation, via the FNV4 “fully networked vehicle,” was paused in 2025 due to escalating costs and complexity, according to an April 2025 Reuters article.4 Ford is recalibrating with a focus on incremental OTA update capabilities and connected services.

- Stellantis has focused on autonomy and connectivity through its STLA AutoDrive Level-3 hands-free system, advancing rollout cautiously amid evolving safety and regional certification hurdles.

Together, these divergent approaches have underscored the broader challenge: legacy automakers must simultaneously modernize software capabilities while managing entrenched supplier relationships, cost bases, and jurisdictional requirements.

Navigating the Regulatory Landscape

Globally, regulatory environments for SDVs differ widely, complicating development and deployment.

Source: Capstone Partners

The outcome is a patchwork of regional cybersecurity, data, and AI explainability standards, forcing OEMs to build region-specific SDV versions or invest heavily in modular, flexible platforms for harmonization.

Managing Costs in a Complex Transition

While the SDV market has promised substantial long-term benefits, short-term financial pressures are significant.

- AI transparency and cybersecurity audits have boosted European research and development (R&D) budgets by an estimated 30-50% through 2026, according to AlphaSense.5

- Regional data residency requirements have added 5-7% to vehicle bills of materials.

- Driver-monitoring systems have increased per-unit costs by $50–$70 in the near term, according to a Global Market Insights report.6

Despite these challenges, economies of scale, modular software testing frameworks, and cloud optimization are expected to moderate cost inflation over time. This investment phase has become essential. Leading OEMs treat these expenditures as strategic bets on future competitiveness in a software-driven market.

However, the magnitude of this investment—particularly when layered atop ongoing commitments to electrification—has posed a deep capital strain on traditional automakers. Ford and GM alone have each earmarked billions in software and digital engineering spend through 2030, in addition to their multibillion-dollar EV commitments, according to Bloomberg.7 The overlap of these investment cycles will likely pressure cash flow and elevate debt burdens across the Big 3 as they race to modernize both product and software portfolios simultaneously. Collaborative R&D models may help diffuse capital intensity and sustain momentum in both SDV and EV programs.

Strategic Priorities for the SDV Era

To capture SDV value, automakers are expected execute with discipline and agility by:

- Building integrated ecosystems linking OEMs, suppliers, chipmakers, and cloud service providers to enable seamless collaboration.

- Adopting modular, updatable vehicle architectures simplifying regulatory compliance and feature iteration.

- Prioritizing recruitment and development of technical talent, especially in embedded software, AI, and systems integration.

Outlook: The Decade of the SDV

The SDV has no longer been regarded as a futuristic concept but the defining feature of automotive innovation this decade. By 2030, software-centric architectures with OTA update capabilities will likely be standard across the majority of new vehicles, and monetized digital features may become a core driver of profitability. The automakers that adapt early, invest decisively, and build resilient digital ecosystems can lead the industry into its next chapter.

To discuss this information in more depth, or to connect with our team for a detailed analysis of current trends and issues, please contact us.

Select Industry News

- In Q3 2025, U.S. new light-vehicle sales surged for most major automakers, with Toyota (TSE:7203) up 15.9% year-over-year (YOY); Hyundai (KOSE:005380) 13%; Ford 8.2%; GM 8%; Stellantis 6%; and Nissan (TSE:7201) 5.3%, while Volkswagen and Honda (TSE:7267) saw declines of 6% and 2%, respectively. – Car and Driver

- Stellantis has planned a $10 billion U.S. investment push, including retooling its Belvidere, Illinois plant to build mid-size Ram pickups, partly aligning with President Trump’s manufacturing agenda. The initiative may drive supplier demand in North America as production in Europe slows. – Detroit Free Press

- Lenders to bankrupt First Brands Group have rushed to provide a $1.1 billion emergency loan after the company disclosed $2.3 billion in off-balance-sheet financing now under investigation. The funding closed in less than a month with only 10–20% of typical due diligence, as advisers raised cash needs from $600 million to $1.1 billion in ten days. Lenders described the deal as “a true rescue facility negotiated under extreme pressure,” warning they were funding “effectively a black box.” The case highlights how complex off-balance-sheet financing can mask a supplier’s financial health, exposing lenders and OEM customers to sudden liquidity crises and high-risk bailouts. – Bloomberg

- Jaguar Land Rover (JRL) has gradually resumed U.K. production after a cyberattack on August 31 shut down factories and retail systems for more than a month. Engine, battery, stamping, and assembly lines are back online at Wolverhampton, Hams Hall, Solihull, Castle Bromwich, and Halewood, with the Nitra plant in Slovakia set to follow. To support suppliers, JLR has launched a short-term financing program with upfront payments, but a nearly $2 billion U.K. loan guarantee has yet to be distributed, leaving some suppliers facing ongoing cash flow challenges. – AutoBlog

- A three-alarm fire on September 16 destroyed the hot mill at Novelis’ Oswego, New York aluminum plant, which supplies about 40% of U.S. automotive aluminum sheet. Production will likely remain halted until early next year, disrupting supply to Ford—its largest customer—as well as Toyota, Stellantis, Hyundai, and Volkswagen. Ford said it has “a full team dedicated to addressing the situation and exploring all possible alternatives” to minimize production impacts. – Wall Street Journal

OEM and Supplier News

- GM has introduced a clause allowing it to extend supplier contracts indefinitely and set prices unilaterally, drawing criticism from parts makers worried about planning and cost risks. The move signals a tougher sourcing strategy as tariffs and delays in EV programs squeeze margins. – Crain’s Detroit Business

- Autoliv (NYSE:ALV) has planned to form a joint venture with Hangsheng Electric, holding a 40% stake, to develop safety electronics for China’s Automotive market, with operations expected to begin in 2026. – Autoliv

- German auto suppliers have begun bracing for a sharp rise in bankruptcies, with insolvencies expected to climb 30% in 2025 amid weak demand, soaring costs, and mounting competition from China. From January to August, 36 companies with revenues exceeding $21.6 million went under, many tied to combustion engine components deemed to have “little chance of survival.” Analysts warn that aggressive cost-cutting is stifling innovation, while higher labor and energy expenses leave German suppliers at a disadvantage—signaling a structural shakeout that could undermine automaker stability. – Automotive News

- Typhoon Bualoi has caused at least $303 million in damage across central and northern Vietnam, disrupting power, transportation, and logistics. While major factories were spared, the storm hit regions hosting manufacturers such as Foxconn (TWSE:2317), Luxshare (SZSE:002475), Formosa Plastics (TWSE:1301), and VinFast (Nasdaq:VFS), underscoring supply chain risks in Vietnam’s growing role as an automotive and electronics hub, where recurring typhoons can delay shipments even without direct plant damage. – Reuters

- Linamar Corporation (TSX:LNR) announced it has signed a definitive agreement to acquire select assets from Aludyne’s North American operations for an enterprise value of $300 million (October 2025). Aludyne, a Tier 1 automotive supplier known for lightweight aluminum chassis and structural technologies, will bolster Linamar’s manufacturing footprint across North America, particularly in the U.S, through this strategic transaction. – Linamar

EV and Zero Emission Technology News

- In Q3 2025, battery electric vehicles (BEVs) accounted for a record 10.5% of all new U.S. vehicle sales, driven by a surge in consumer demand ahead of the September 30 expiration of the $7,500 federal EV tax credit. – CNBC

- Ford will halt F-150 Lightning production next week at its Dearborn, Michigan plant due to aluminum shortages caused by the Novelis fire in New York, a disruption that could cost the company $1 billion and intensify pressure on EV supply. – EV.com

- Wolfspeed (NYSE:WOLF) has cut its debt by 70% and exited Chapter 11 this week, securing sufficient liquidity to continue supplying silicon carbide chips for EVs—a restructuring that helps reduce supply chain risk for automakers. – Wolfspeed

- ZF plans to cut 7,600 jobs from its Electrified Drive Technologies division by 2030 as it has stopped developing certain EV components, including on-board chargers and inverters, to focus on core hybrid and thermal systems. The restructuring responds to weak EV demand and market oversupply, reflecting mounting pressure on suppliers to adapt. – Reuters

- The U.S. government has taken a 5% stake in Lithium Americas’ (TSX:LAC) Thacker Pass project—the nation’s largest lithium deposit—and provided a $2.2 billion loan to build a plant capable of producing 40,000 tons of lithium carbonate annually. Partnering with GM while opening supply to other buyers, the investment aims to strengthen U.S. control over critical minerals, reduce reliance on imports, and stabilize the EV battery supply chain. – Wall Street Journal

- Scout Motors has planned on investing $300 million in a supplier park in Blythewood, South Carolina, featuring battery assembly and just-in-time logistics facilities to support its planned EV production launch in 2027. – Columbia Business Report

Human Capital News

- Stellantis CEO Antonio Filosa has reshaped the company’s leadership to address two years of declining sales and profits ahead of a 2026 strategy update. Emanuele Cappellano has begun overseeing Europe and its brands while continuing his role at Stellantis Pro One, Jean-Philippe Imparato will lead Maserati, and Francesco Ciancia returns from Mercedes-Benz (XTRA:MBG) to manage global manufacturing. Ralph Gilles has become global head of design, and Gregoire Olivier will direct operations in China and the Asia-Pacific region. – Reuters

- Several senior leaders from Nio’s (NYSE:NIO) Smart Driving division, including its AI platform head, world model lead, and smart driving product chief, have recently departed, according to Chinese media reports. Nio stated the exits are part of a broader restructuring aimed at accelerating development of World Model 2.0, the AI architecture behind its autonomous driving system, underscoring the pressure to advance AI capabilities in China’s competitive EV market. – Electric-Vehicles.com

- Stellantis CFO Doug Oosterman has resigned after less than a year and will be succeeded by Joao Laranjo, the current North America CFO. Oosterman oversaw operations during a turbulent period, while new CEO Antonio Filosa focuses on steering the company through a turnaround. – Detroit Free Press

- OPmobility (ENXTPA:OPM) laid off 82 employees at its Spring Hill, Tennessee plant on November 21, reversing a recent $3 million expansion tied to EV programs as softening EV demand pressures operations. – The Tennessean

- Bosch (BSE:500530) has planned to cut 22,000 jobs in its Mobility division by 2030, including 13,000 new layoffs, as part of a restructuring aimed at saving $2.7 billion. The shift to EVs has reduced demand for traditional components, requiring fewer workers overall, while suppliers like Bosch face mounting pressure as automakers bring more work in-house and the uneven transition to EVs disrupts supply chains. – Wall Street Journal

Regulatory and Legal News

- President Donald Trump has announced a 25% tariff on all medium- and heavy-duty trucks imported into the U.S., effective November 1, in a bid to protect domestic manufacturers. Mexico, the largest exporter, has tripled shipments since 2019 to about 340,000 units, and the tariff could significantly impact automakers such as Stellantis, which builds Ram trucks and vans in Mexico and has lobbied against the measure. – Reuters

- Lucerne International has canceled plans for a $50 million aluminum forging plant in Detroit, citing tariffs on equipment and raw materials that made the project “too risky.” The decision, which cost the city 325 jobs, underscores how trade barriers intended to boost U.S. manufacturing can instead divert auto supply chain investment elsewhere. – Automotive News

- The U.S. has finalized a trade deal with the European Union (EU), retroactively reducing tariffs on autos and parts to 15% starting August 1, while exempting key raw materials such as nickel, rare earths, and magnesium. The tariff cut has eased cost pressures on European automakers and helps stabilize transatlantic trade flows. – Reuters

- The U.S. Commerce Department has been weighing an expansion of the Section 232 national security tariffs to include more auto parts, building on existing 25% duties on vehicles, components, and materials critical to EVs. Automakers and suppliers have warned that this uncertainty has been inflating costs, disrupting supply chains, and complicating EV production, as companies scramble to diversify sourcing, stockpile inventory, and consider reshoring—all of which may add risk and expense to an already strained industry. – Reuters

This page was updated November 3, 2025. Report contributors include Sheldon Stone, Kathleen Dobrovic, Erik Morandi, and Vikram Vennapusa.

Previous Issues

- The Auto Industry: Reason for Optimism or More of the Same? (September 2025)

- Tariff Uncertainty Continues to Cloud Automotive Market (August 2025)

- Facing Disruption, Suppliers Adopt New Playbook (January 2025)

- North American and European Automotive Industry Supplier Base M&A Activity Intensifies (June 2024)

- Automotive Suppliers – Moving from Internal Combustion Engines to Electric, Not an Easy Road (August 2024)

Endnotes

-

Boston Consulting Group, “Where Will Software Drive the Auto Industry Next?,” https://www.bcg.com/publications/2023/future-of-automotive-software, accessed October 5, 2025.

-

AlphaSense, Software Defined Vehicles – Market Landscape and Investment Outlook, https://research.alpha-sense.com?docid=GDS 67fd15b614788506befd08d3&utm_source= , accessed October 5, 2025 (not published online).

-

Reuters, “After Robotaxi Failure, GM Software Bet Turns to Driver Assistance,” https://www.reuters.com/business/autos-transportation/after-robotaxi-failure-gm-software-bet-turns-driver-assistance-2025-01-30/, accessed October 5, 2025.

-

Reuters, “Exclusive: Ford Kills Project to Develop Tesla-like Electronic Brain,” https://www.reuters.com/business/autos-transportation/ford-kills-project-develop-tesla-like-electronic-brain-2025-04-30/, accessed October 5, 2025.

-

AlphaSense, How Emerging Rules on Explainable AI, Data Residency, and Driver-Inattention Monitoring Could Reprice the Software-Defined Vehicle, https://research.alpha-sense.com?docid=GDS-67d92ed1c67d856f316d2ea5&utm_source=, accessed October 5, 2025 (not published online).

-

Global Market Insights, “Automotive Driver Monitoring System Market Size,” https://www.gminsights.com/industry-analysis/automotive-driver-monitoring-system-market, accessed October 5, 2025.

-

Bloomberg, “Automakers Are Investing in EVs Like They Mean It,” https://www.bloomberg.com/news/articles/2021-08-05/automakers-are-investing-billions-of-dollars-in-evs, accessed October 5, 2025.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.