Supply Chain Trends – September 2023

Destocking Challenges and Valuation Impacts for OEM, Mission Critical Suppliers, and Value-Added Distributors

Consensus among financial experts throughout the U.S. seems to be that the Federal Reserve and U.S. economy have evaded another recession as the nation exits the COVID era. This optimism has been palpable when looking at business leaders’ decisions, and current inventory management strategies indicate as much. Even in the wake of the global dislocation of the supply chain, the term “inventory destocking,” has climbed in recent earnings calls, with transcript analysis from AlphaSense revealing a 116% increase in the phrase over the past 90 days.

Supply Chain Challenges Unwind and End-Users Destock Back to a Fragile Just-In-Time Inventory Strategy

Pre-COVID, Just-In-Time (JIT) supply chain management was more than just a strategy, it was the norm for best-in-class manufacturers and distributors across the globe, having been developed and championed by Toyota Production System (TPS). The JIT method has several benefits, including:

- reducing the volume of inventory kept on hand (safety stock, buffer stock, etc.);

- relying on a seamless supply chain with reliable, timely deliveries to fulfill orders as they are placed;

- minimized working capital investment;

- enhanced cashflow;

- reduced risk of overproduction/obsolescence;

- increased flexibility/agility to meet fluctuations in demand;

- enhanced quality control as lower volumes allow rapid identification of defects before they escape;

- and closer supplier relationships.

Most, if not all, scaled manufacturers and their channel partners adopted systems, policies, support staff, and vertical integration strategies. I experienced this first-hand early in my career as a Lean Six Sigma Black Belt at General Electric (NYSE:GE), with a handful of projects specifically targeting lead time, working capital, and inventory reduction.

At the same time, as with every business strategy, benefits come with risks. JIT is no exception, and the COVID era exacerbated inherent risks. Specifically, the lack of buffer stock left little to no room for stockout-induced delays, let alone for an entire unraveling of the global supply chain as was witnessed during the COVID pandemic. Markets reward flexibility and resilience, but when JIT policies are executed poorly or too aggressively, lead times suffer, and customers search out, what often become, permanent alternative solutions. Amid the pandemic, businesses with inventory, or the ability to produce inventory to meet demand, experienced margin expansion alongside volume growth, sometimes 100% or more year-over-year (YOY), as market share shifted away from incumbent market leaders utilizing JIT strategies and towards nimble competitors with a beachhead.

So why are some business leaders reverting to old tricks after JIT inventory management left companies exposed? While it may be unlikely that JIT practices will be tested again by another global pandemic, unidentified risks to supply chains are likely. Recent examples include the conflict in Ukraine, deglobalization efforts by nation-states, climate change-induced power outages in Texas, challenging labor shortages, strikes, and the shift to remote work have all had lingering impacts on supply availability. Every business environment presents its own challenges that leaders must navigate to thrive. Recent earnings calls suggest a soft landing is likely and point to a brighter economic picture in 2024. There must be confidence in the freshly shortened lead times of critical supply chain partners, although there is safety in distributors’ inventory levels sitting at historically high levels as of Q2 2023. As Flowserve (NYSE:FLS) CEO, Robert Scott Rowe stated in the company’s August Q2 earnings call, “It all depends on our lead times.…when our lead times are short, [distributors] can keep less on their shelves, when our lead times are long, they’ve got to stock up and have the inventory for their customers. And so, there’s a bit of a balance there. Lead times globally are coming down, which is going to allow distributors to de-stock a bit.”1 Having worked through COVID’s crippling of the global supply chain, many businesses have diversified, and thus strengthened, their supplier base. Increased optionality with qualified sources for materials has heightened flexibility and resilience.

A very likely motivator for reducing inventory includes an improved one-time injection to operating cash flow. With debt markets enduring higher interest rates for at least the foreseeable future, CFOs are turning to alternative sources of capital. I saw GE dust off this playbook in 2017, when research from JPMorgan Chase & Co. (NYSE:JPM) analyst Stephen Tusa helped erase $200 billion of market value over a two-year period. Cash flow conversion became an increasingly important valuation metric to the street, not adjusted earnings, as skepticism of accounting problems, opaqueness of large complex organizations, and their senior leadership went under the street’s microscope.

While it is arguable if businesses are under the same external pressures to lower working capital, debt markets may be the biggest reason we see so much focus on the metric in earnings transcripts. Debt is not as cheap as it once was, and debt recapitalizations have become more challenging. Some companies are looking at loan maturities in the near-term, where interest rates are going to spike from the current levels. Reducing the refinancing needs of the business has become notably more accretive to equity as the free money environment ends. If the de-stockers of the world can balance the lessons learned during COVID, specifically de-risking their supply chains, they can shift back to traditional JIT strategies, pull out some near-term capital to reduce debt burdens, and maintain their competitive lead times/service levels.

How Destocking Impacts Different Parts of the Value Chain

Commodity suppliers felt the whipsaw of pricing increases and declines first. Input costs soared as supply constraints were mismatched with demand. Steel peaked last year and has since fallen as capacity and demand reached a new equilibrium. For example, energy, agriculture, chips, and building materials saw increased volatility during the COVID-induced disruptions to supply. In markets where the competitive landscape has remained unchanged, most businesses will continue to grow with GDP (gross domestic product), on average.

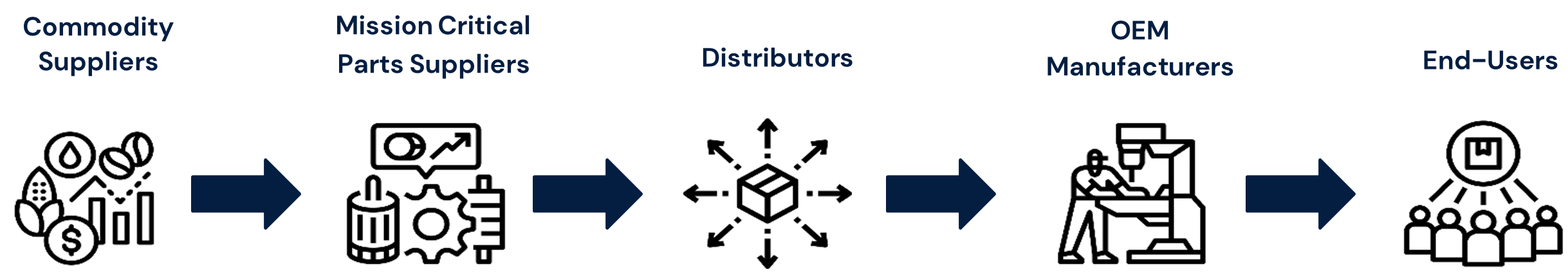

Understanding the Value Chain

Source: Capstone Partners

Original equipment manufacturers' (OEMs), Mission Critical Suppliers, and Engineered Products Manufacturing, such as Ingersoll Rand (NYSE:IR) and Parker-Hannifin (NYSE:PH), saw some of the most positive uplifts, due to their operating effectiveness during COVID, with an improvement to their financial metrics between 2017-2023 outpacing Capstone’s Industrial Engineered Products Index. Prices expanded drastically during COVID, and not just from inflationary pressures to pass on costs. Many saw the opportunity to push through price increases that reflect the value to their end-users, particularly after a period of downward pricing pressure leading into COVID. This led to enhanced margin profiles for a variety of manufacturers that had held off on price increases early in the pandemic to show good faith to their customers. JIT strategies require both suppliers and end-users to work hand-in-hand, and that can come in the form of discounts traded for volume guarantees for the duration of a contract. Pricing agreements that came up for renewal or merely needed repricing based on input costs often led to enhanced margin profiles for suppliers.

After inflation ran rampant, and end-users saw margin expansion at the supplier level, customers may not be looking for just a one-time injection of cash flow. This may be an opportunity to see who blinks first when it comes to pricing. Suppliers have seen a drop-off in volume and have pointed directly to destocking at the OEM and/or distributor level. The Donaldson Company (NYSE:DCI) specifically pointed to destocking behavior across their OEM channel and suggested it is not specific to one end market. However, suppliers like Donaldson and Flowserve, expect destocking to last for another quarter or two. “Our estimation is that the destocking at the OE side would go in the first Q and likely the second quarter, because there's a lot of balance sheet management across the OE sector in our second quarter as we end the calendar year and then pick up in the second half of the year,” said Donaldson CEO, Tod Carpenter, in the company’s earnings call for Q4, ending July 2023.2 Flowserve’s bookings sit at a record $591 million in their aftermarket line of business, up 12% YOY. Additionally, while Flowserve has experienced an absence of big projects in the second quarter, Rowe described a disciplined approach to taking on projects. “…. with the backlog that we have and the margin expectations, we're being very selective on … what we bid on and … what margins that we are prepared to win … Typically, these big projects are highly engineered work … We've got a better formula to make sure that we get the returns that we want.” So, there is confidence in holding onto the margin expansion they have experienced over the last few years, particularly with a strong backlog or pipeline of opportunities.

How can suppliers be sure? Backlog and book-to-bill ratios might give some insight, and the industry index suggest continued bookings align with discussions in recent public company earnings calls. Large projects and investments at the end-user level built up a sturdy backlog. However, backlog is not the same as seeing volumes flowing through the P&L (profit & loss), and hockey stick forecasts are typically discounted by investors.

Even if they are willing, can customers pay for the inflated prices on large project investments if the interest rate environment stays elevated, or even continues higher? Looking at gross profit margins on an aggregate basis for the Capstone’s Industrial Engineered Products Index, it appears the profitability of companies may have been volatile through COVID’s unruly supply chain, but ultimately came to equilibrium at or near pre-COVID levels. Prices have certainly increased, but so too have the input costs.

Impact of Supply Chain Trends Like Destocking on Value-Added Distributors

It is not just the suppliers that have been impacted by this trend. Value-added distributors have described the same theme. Players like MRC Global (NYSE:MRC), while optimistic about 2024, have pointed to destocking in 2023 as a short-term headwind, primarily in their Gas Utility sector. These end-users are traditionally conservative and concerns about inventory product availability led to over-ordering, according to Robert Saltiel, MRC’s CEO in the company’s Q2 earnings call.3 At the same time, MRC’s inventory peaked in Q2 2023, and as backlog converts, their own inventory reduction efforts should yield incremental cash flow. That will then shift the destocking issue further up the supply chain.

OEM’s, such as ITT’s (NYSE:ITT) Measurement Technology business, experienced divergent performance based on geographies, where they suggest Europe is going to have a longer destocking trend. This shouldn’t be entirely surprising as we have seen exacerbated cost-push inflation in Europe (5.3% YOY in July, according to the European Central Bank4) compared to the U.S. where demand-pull inflation was the primary culprit (3.2% YOY in August, according to the U.S. Bureau of Labor Statistics5. Continued headwinds in Europe are beyond COVID and the different responses from the Fed and ECB (European Central Bank), but rather a result of the supply chain constraints on energy and agriculture caused by Russia’s invasion of Ukraine.

Valuations and Adjustments in Destocking Environment

OEMs, mission critical suppliers, and value-add distributors are likely to see destocking headwinds in their revenue for the rest of the year, and possibly longer depending on their end-markets. Most expect the destocking trend to normalize in the first half of 2024.

What does that mean for sellers over the next six-12 months? OEMs need to hold onto gross profit levels achieved during the recent inflationary period while volumes sit temporarily depressed until the slack is pulled out of the supply chain. If they can do that when volumes return, valuation multiples should stay as healthy as debt allows. Distributors and service providers, particularly those selling into MRO (maintenance, repair, operations), should expect highly competitive processes with great valuations for the next twelve months. Examples include recent flow control transactions trading at healthy EBITDA multiples This might suggest sponsors need to put capital to work with a near-term prioritization of downside protection above and beyond valuing outlier growth potential. When Capstone sees a highly competitive processes, with a surge in bidders, it is often for those with highly recurring sales, typical of the MRO space.

Businesses looking to sell at peak valuation, can choose to be patient until destocking is traded for the next issue. Even still, a blip in the rearview can impact a more stabilized trend over time, with nearly every private equity investor on the planet looking for those “stable recurring revenue” streams. The question many face in the current destocking environment is: which EBITDA will be the basis for valuation? As such, it is important to fully understand how destocking affects a business and isolate the noise.

Some strategies in the market include pushing buyers towards end of year or even end of next year's EBITDA in lieu of a traditional trailing twelve-month period for bid valuations. Others adjust historical performance by normalizing destocking customer demand in line with historical demand. Both could be quite favorable to the seller. Highly competitive auction processes can push buyers to sharpen their pencils, but significant buyer diligence should be expected. For example, if adjusting revenue based on a select number of customers destocking, a buyer will want to have meetings with those customers before the transaction is closed. Even if the equity investor agrees to such methodologies, getting today's skittish debt investors in line will prove more challenging.

Analysis we’ve performed for clients includes, but is not limited to, SKU or customer level price, margin and volume trend analysis, adjustments for expenses related to securing the supply chain (over-stocking), and other non-recurring costs to get to a baseline EBITDA, either with third-party qualified accounting service providers or our internal Financial Advisory Services group. These normalized financials are the foundation of support for forecasting the business' future performance and valuation.

Our merger and acquisition (M&A) clients experiencing these types of dynamics require detailed analysis and guidance on how to effectively convey the ongoing value of their business to would-be investors. Ultimately, adjustments to historical financial performance require explanations that can be underwritten with heavily underwritten analytics.

At Capstone, we expect the transaction backlog built at all the investment banks to convert to processes over the next six to twelve months as interest rates stabilize. Many investors have not seen as many opportunities to put capital to work in the rising interest rate period of the last twelve months. As our clients enter the M&A market, destocking will be one of the many topics to be analyzed understood. The due diligence process always includes how the business performed so investors can underwrite about how it is expected to perform in the future. While working capital on the balance sheet may not tell the whole story, it is often overlooked until the very end of a process when surprises are not a seller’s friend.

Six months from now, when destocking challenges are expected to unwind by many industry leaders, we are optimistic M&A markets will open up as debt markets stabilize, allowing sellers and buyers to value their businesses with more certainty. We see a higher probability of a 2021 scenario where the M&A industry will be stretched thin to work through a largely deferred deal log from 2023. Bankers, lawyers, and advisory firms could become a bottleneck to bringing as many deals to the table as the market desires. Sell-side engagements can take months to prepare, but those ready to get to market in early 2024 should benefit the most.

Conclusion

The Toyota Production System, Lean Six Sigma, and other process improvement strategies must evolve to incorporate the lessons of the recent past. While business cannot anticipate the next pandemic, international conflict, or its equivalent, business leaders should incorporate the lessons of yesterday to build resilient and agile supply chains for the future. Rushing straight back to the old ways of hyper fragile JIT creates unnecessary risk for competitive lead times to raise some short-term capital. Those with a strong balance sheet should keep focus on service levels and market share when adjusting inventory levels.

About the Author

Wolfgang Zahner is a Director in Capstone’s Industrials Investment Banking Group, specializing in Engineered Products with a focus on Flow Control and Value-Added Distribution. He brings a diverse background of leadership and industry experience in manufacturing, supply chain, finance, and military operations to his team. At Capstone, his M&A experiences include a variety of industries including Flow Control, Manufacturing, Renewable Energy, and Industrial Operations.

Endnotes

-

Flowserve," Q2 2023 Flowserve Corporation Earnings Conference Call," https://ir.flowserve.com/events-and-presentations, accessed September 13, 2023.

-

Donaldson Company, "Donaldson’s Q4 FY23 Earnings Conference Call Webcast," https://ir.donaldson.com/events-and-presentations/event-details/2023/Donaldsons-Q4-FY23-Earnings-Conference-Call-Webcast/default.aspx, accessed September 19, 2022.

-

MCR Global, "Q2 2023 MRCS Global Inc. Earnings Conference Call," https://investor.mrcglobal.com/events/event-details/q2-2023-mrc-global-inc-earnings-conference-call, accessed September 18, 2023.

-

European Central Bank, "HICP - Annual percentage changes, breakdown by purpose of consumption: July 2023," https://www.ecb.europa.eu/stats/ecb_statistics/escb/html/table.en.html?id=JDF_ICP_COICOP_ANR&period=2023-07, accessed September 18, 2023.

-

U.S. Bureau of Labor Statistics, "Consumer Price Index-July 2023" cpi_08102023.pdf (bls.gov), accessed September 18, 2023.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.