CASE STUDY: Setting Newco Up for Success: A Strong Merger Integration Plan

Merger Integration Plan: A Key Tool to Maximize Value

Integrating two different organizations during a transaction and having the resulting entity be more than the sum of its parts is more complicated than just combining IT, HR, accounting, sales, and operational platforms.

The success of a transaction and the optimization of returns on an acquisition depend on many factors. Acquirers and their advisors have quantifiable financial goals top of mind during the deal process. At the same time, they can sometimes underestimate other factors that have an enormous impact – either positive or negative, depending on how they are managed – on the final outcome. This is why, in addition to technical considerations, a successful merger integration plan must always consider the skill sets and culture of the combining organizations.

Integrating two different organizations during a transaction and having the resulting entity be more than the sum of its parts is more complicated than just combining information technology (IT), human resources (HR), accounting, sales, and operational platforms. Most middle-market businesses are dynamic, people-driven organizations. Some even depend on the contributions of people who might be irreplaceable in the short term. They may have processes that are hardwired into their businesses, making it difficult to adopt new systems post-transaction. For these reasons, having a post-merger integration plan can be essential to maximize the value of a transaction. The complexity of every plan will vary depending on the size of the organizations, their structures and cultures, and the expectations for the transaction. Support for a successful process can be as basic as consulting in advance with the leadership teams to actually managing the process before and after the transaction closes.

Creating a Merger Integration Plan

The best integration plan involves key people from both companies, as well as any investors, working collaboratively. Together, they can identify and quantify synergies, define key milestones, set goals and accountabilities, and communicate progress to their respective organizations as well as capture feedback through regular surveys during and after the transaction. We also strongly recommend working with a professional merger integration consultant for post-merger change management even if members of the company or investment firm have extensive experience with merger and acquisition (M&A) transactions. This ties back into the cultural factor – even leaders that are enthusiastic about a merger are still human. A professional integration team can be a neutral voice to help overcome any personality issues or perceptions of bias, and to ensure the efficiency and integrity of the process remain intact.

Since preparation is key to value creation, the integration process should ideally start about the time the LOI (Letter of Intent) is signed. This does not mean, however, that an advisor can’t assist you later if the process is proving to be more challenging than expected – it’s never too early, but it’s also never too late. We’ve even helped clients that have gone through the process on their own only to realize that their post-transaction operations were suffering from the effects of unresolved integration issues.

A robust, comprehensive merger integration process can help ensure a smooth and productive operational transition. It can lay the groundwork for ongoing communications in the new entity, build credibility with leaders and employees, leverage synergies across the two organizations, and contribute directly to the value of the transaction.

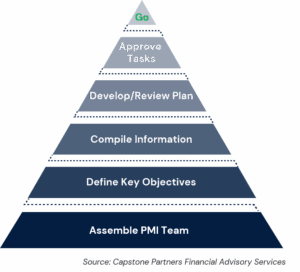

Roadmap to a Successful Integration

Real World Learnings – A Case Study

Situation

- The client, a private equity-owned distribution company, made three add-on acquisitions in short succession.

- A lack of integration and poor communication on the part of the leadership team led to ineffective integration of the acquired companies with the parent company.

- Consolidation of functions created gaps throughout the order-to-cash process.

- The company suffered from improper order taking, inventory management issues, customer frustrations, collections disruptions, and financial and management reporting problems.

Solution

- After assessing the situation, a PMO (Project Management Office) was created to map the order-to-cash process, determine where integration issues created problems, and to identify and implement the appropriate solutions.

- The PMO created procedures to harmonize order entry and fulfillment process and complete warehouse consolidations and developed KPI (Key Performance Indicators) and financial reporting tools to provide real-time information on the consolidated organization and make the financial reporting process more accurate and efficient.

Result

- The company was able to return to same day order fulfillment and accurately track inventory.

- They implemented processes to ensure accuracy of invoicing and collections, bringing DSO (Days Sales Outstanding) back to normalized levels.

For More Information

As we’ve said, it’s never too early to discuss the creation of a merger integration plan, but it’s also never too late. If you’re considering a future transaction and want to build a solid foundation, or if you’ve completed one but are struggling to get the results you had anticipated, there is help. Capstone’s Financial Advisory Services (FAS) management consulting professionals have helped numerous businesses evaluate performance improvement challenges (and opportunities) and create a roadmap to a successful outcome.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.