Defining the Middle Market

How is the Middle Market Defined and What are its Unique Challenges?

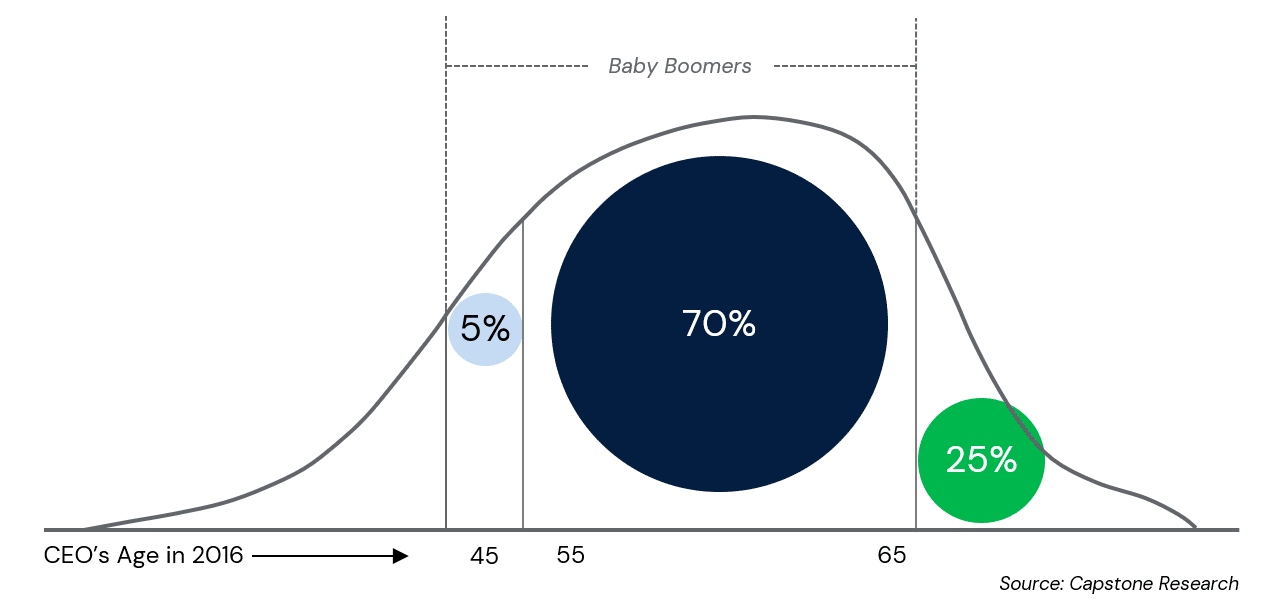

The “middle market” includes businesses that are valued between $10 million and $1 billion, comprising approximately 200,000 companies in the U.S. and accounting for around one-third of total private sector gross domestic product (GDP).1 Notably, roughly 70% of privately-owned businesses are held by baby boomers nearing retirement in the next two decades. This has contributed to an active pipeline of exits in the middle market as business owners decide how and when to transition their assets to the next generation, take chips off the table, or monetize their ownership of middle market companies.

Baby Boomer Transition Wave, 2016-2025

Knowledge of the key drivers and traits that facilitate a successful sale of a middle market business at an optimal value are crucial, and often, not readily available to middle market business owners. Privately held companies are not legally required to disclose their finances to the public, dissimilar to large publicly held companies that are held accountable to their shareholders by government regulators. As a result, valuation and the ultimate determination of a “fair” price for a middle market company is difficult because there often are few exact publicly available comparisons. This is where the value of an investment bank comes into play. Due to their frequent interaction with private companies, discussions with buyers, and transaction experience, they can help not only determine a fair market value, but they can drive competition and maximize the value of a quality company by bringing the right strategic or financial buyer to the table.

Defining the Middle Market Terms You Need to Know

When advisors look at companies, several key tools are used to identify a middle market business and ascertain its fair market value. Additionally, since the market is further nuanced by industry and sector characteristics, several different tools are sometimes necessary.

1. Enterprise Value

A companies’ estimated market value is calculated by its Enterprise value (EV), which is a measurement that combines all of the entities’ ownership interest and asset claims with debt and equity and then subtracts cash and cash equivalents. Using this calculation tool, the market is then more granularly defined by the Lower Middle Market ($10 – $250 million EV), Middle Middle Market ($250-$500 million EV), and Upper Middle Market ($500 million – $1 billion EV).2

2. Revenue

Revenue is also an important metric, especially for younger companies, start-ups, and technology firms that may not have achieved sustained profitability. Often, these firms will rely heavily on revenue multiples as a measure of value. Middle market revenues tend to mirror accepted enterprise value ranges of $10 million to $1 billion.

3. Employee Count

Additionally, employee count can be a useful tool for gauging the likelihood of a company being in the middle market, though it’s not an absolute measurement. Typically, middle market company’s employee count tends to converge in the range of 100-2,000, with tech and start-ups again being an anomaly.

Capstone Partners has successfully advised over 200 transactions in 2020, totaling $12.5 billion in value. Our firm provides tailored Wall Street caliber advisory services, leveraging our sector experts to guide business owners in the next step for their company. Capstone offers services and expertise that are typically found at bulge bracket banks who work with large publicly-held clients. We provide solutions to companies that are complementary to their scale and size, with a fully integrated suite of services including Mergers & Acquisitions, Financial Advisory, Debt Capital Advisory, Equity Capital Financing, ESOP Advisory, and Special Situations & Restructuring.

If you have questions on what it means to be a part of the middle market or are curious about the valuation of your company, connect with an expert in your sector here.

Endnotes

-

Investopedia, “Gross Domestic Product (GDP),” https://www.investopedia.com/terms/g/gdp.asp, accessed January 17, 2024.

-

Investopedia, “How to Use Enterprise Value to Compare Companies,” https://www.investopedia.com/articles/fundamental/04/031004.asp, accessed January 17, 2024.

Note: This piece was originally published in June 2021 and was most recently updated in February 2024.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.