How to Prepare Your Business for a Recession

This article explores how to prepare your business for a recession, including the key warning signs of a shift in the business cycle, the steps owners can take to protect their company against a downturn, and the opportunities for growth post-recession.

Identifying Business Cycle Trends

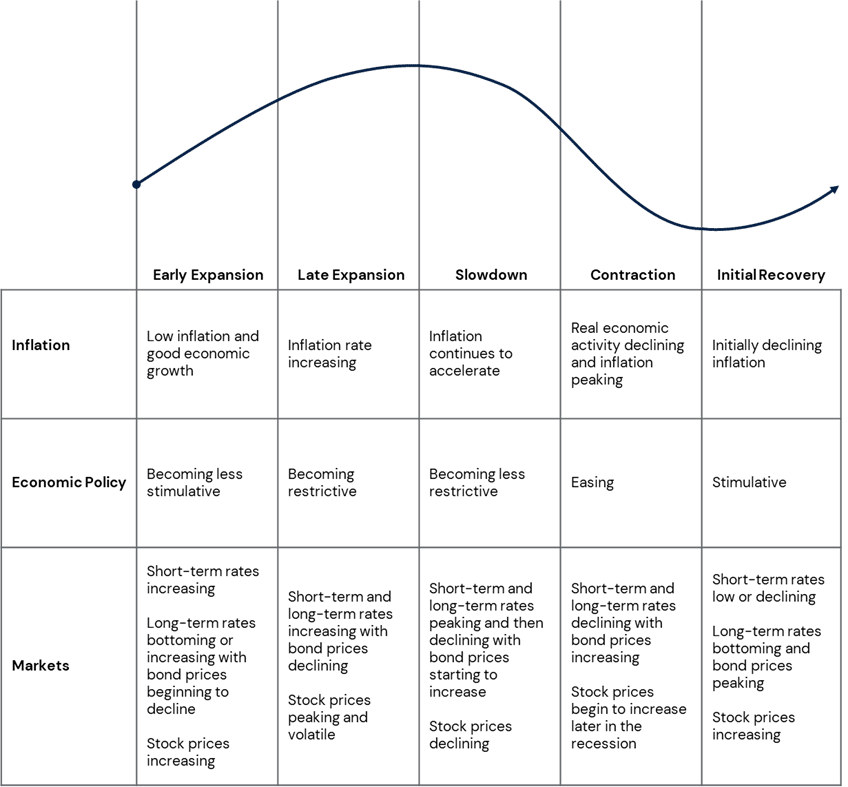

The business cycle follows an inevitable pattern of an economic peak followed by a period of contraction, or a decline in economic activity. While no two recessions are the same and historic precedent may not always directly apply to the current economic environment, there are several general characteristics of each stage in the business cycle that provide a healthy gauge for where the economy stands. Identifying these trends can allow business owners to fortify their operations and prepare ahead of an impending downturn. The recessions of 2008-2009 and the COVID-induced downturn in 2020 have served as recent examples of economic hardships that business owners have combated. An added challenge in the middle market is that privately-owned companies often do not have the scale or financial resources of their large-cap peers—making it more important for businesses to prepare for a market downturn. This article explores the key warning signs of a shift in the business cycle, the steps owners can take to protect their company against a downturn, and the opportunities for growth post-recession.

Business Cycle Indicators

Source: CFA Institute and Capstone Partners

Source: CFA Institute and Capstone Partners

How to Prepare Your Business for a Recession – 3 Stages

The process business owners can take to create a resilient company profile and be well-positioned for adverse economic events can be broken down into three stages: 1) Preparation, 2) Execution, and 3) Recovery. While the preparation and execution stages are key to successfully navigating a recession, business owners should also have a plan for the inevitable upswing in the business cycle, which will present opportunities for growth and expansion. Companies in the middle market often face challenges at the inflection point, especially if they are carrying a significant debt load. Normally, by the time the upswing begins, companies with significant debt have been working hard to manage cash flows and stay compliant with lender requirements. This often puts a strain on their balance sheet, which diminishes their creditworthiness.

As business activity increases, middle market companies with significant debt may find it challenging to access the capital needed to finance the early stages of an expansion, which are typically working capital intensive. This situation could leave a company vulnerable to competitive pressures.

Within each stage of creating business resilience, a company will have specific steps and measures that apply to their operations. The framework outlined below can serve as a useful guide in preparing for a downturn.

Stage #1: Preparation

The preparation stage is the first step in addressing a business’ level of resilience. The greater the level of detail at the preparation stage, the more success a business will likely have in the execution and recovery phase. Ultimately, managing liquidity will be critical for business owners facing a recession. One of the most important steps in this stage includes:

- Identifying Vulnerabilities – Understanding the areas of weakness within a business and identifying ways to strengthen gaps can be extremely valuable for defending operations against macroeconomic or business-specific threats. One method that can be a useful measure is scenario analysis, where business owners model out a worst, base, and best case scenario for different variables. This allows a business owner to gauge how recessionary threats could affect operating performance. The scenario analysis should lead to management actions such as cost reductions, initiatives to improve liquidity, and actions to minimize the company’s dependence on debt capital, which are integral to the execution stage described in the next section. Management should also closely follow profitability measures by product and customer. A 24-month forecast is often a valuable tool to implement to gauge the near-term outlook for company operations and liquidity.

For example, a company could identify the effect that the loss of a big contract would have on forecasted revenue or how a 2% increase in inflation could affect net income. In addition, a 13-week cash flow model can provide visibility to a businesses’ vulnerabilities and short-term needs. The model forecasts a business’ cash inflow and outflow over 13 weeks, updated weekly, often by the company’s chief financial officer, an accounting professional, or outside advisors. In addition to imposing discipline on company management, the 13-week cash flow also provides transparency to creditors and can be vital in negotiations with vendors, landlords, and other stakeholders.

Stage #2: Execution

The execution stage builds upon the foundation created in the preparation phase. Once a business has identified its shortcomings, it can use this actionable insight to enact operational changes. There are several important steps to the execution phase, including:

- Cost Reductions – The timing, nature, and extent of cost reductions are typically informed by the scenario analysis, combined with the business owner’s understanding of their cost structure. Normally, at a minimum, all discretionary costs are curtailed and capital expenditures are rationed. Management should make the distinction between maintenance capital expenditures and growth capital expenditures. Maintenance capital expenditures are necessary to maintain the current level of business. Growth capital expenditures should be dependent upon the liquidity position of the company, the payback period, and the overall internal rate of return of the expenditures. In more severe circumstances, headcount reductions are implemented to ensure adequate cash flow through the downturn.

- Balance Sheet Strength – Business owners should strive for healthy levels of outstanding debt to avoid an overleveraged position. Metrics such as the current ratio (current assets/current liabilities), interest coverage ratio (EBIT/interest expense), leverage ratio (debt/EBITDA), and debt to equity ratio (debt/book value of equity) can provide valuable insights on short-term liquidity, flexibility, and financial strength. Liquidity can be improved by tightening up and strictly enforcing payment terms with customers and evaluating vendors for opportunities to extend payment terms. Additionally, companies with non-core business assets should consider selling those assets to create liquidity and/or repay debt. Sale leaseback transactions are also a potential source of liquidity.

- Financing Flexibility – Restrictive debt covenants can often reduce the financial flexibility of a business. Business owners should aim for a healthy target capital structure that is in line with their peers. To the extent that capital is available, business owners should consider repaying as much debt as possible, which will reduce the company’s debt load and the cash cost of servicing that debt.

- High-Margin Product Mix – The highest priority and focus should be placed on the most profitable segments of a business to provide insulation during adverse economic or capital market expectations. An in-depth profitability analysis of the business is often crucial to efficiently allocating resources (capital expenditures).

- Working Capital Management – The cash conversion cycle is a key measure of how efficiently a business can covert cash inputs into cash flows. Business owners can analyze their own cash conversion metrics to provide further insights into areas such as inventory management.

- Sustainable Earnings – Business owners should strive for recurring and sustainable earnings—which are key characteristics buyers scrutinize when pursuing the acquisition of a target company. Earnings from non-recurring sources are often considered lower quality and make revenue projections more difficult.

Stage #3: Recovery

The final stage, recovery, can be thought of as the culmination of the successful navigation of the downturn or recession. At this stage, business owners have created a resilient business profile that is ready to pursue its next chapter of growth or liquidity.

- Prepare for Growth – Post-downturn, businesses that have fortified their balance sheets with ample liquidity and access to capital can benefit from going on the offensive. This may include penetrating new verticals, bolstering sales teams, or acquiring new capabilities. Adverse economic environments may also present attractive pricing for acquisition targets.

What Comes Next? Resilient Businesses Can Emerge as Valuable Targets for Buyers

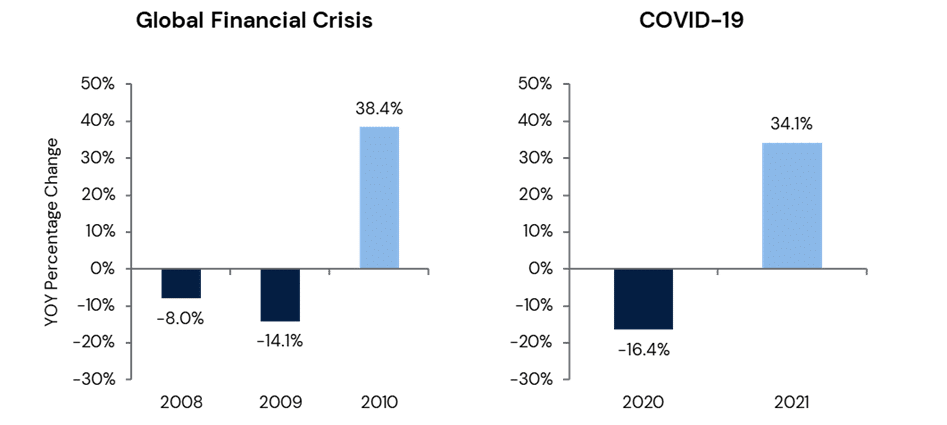

Economic downturns and recessions have often translated to substantial declines in merger and acquisition (M&A) transaction volume. During 2008 and 2009, middle market dealmaking fell 8% and 14.1% year-over-year (YOY) respectively. The pandemic brought similar results with deal volume falling 16.4% YOY in 2020. However, each period of economic downturn has been met with a fervent pace of dealmaking, evidenced by the massive upswing in transaction volume in 2010 and 2021. Business owners that have successfully employed the preparation and execution stages of the business resilience process can emerge as attractive suitors for businesses or as valuable target companies for buyers.

Source: Capital IQ and Capstone Partners

Capstone Partners Can Help Prepare Your Business for a Recession

Capstone Partners’ Financial Advisory Services (FAS) group offers a robust suite of services to business owners seeking greater resilience and defensibility, providing expert corporate financial consulting services for companies, investors, and creditors. They specialize in creating customized, enterprise-wide solutions to improve organizational performance and generate shareholder value across all stages of the business cycle. Composed of senior-level executives with decades of experience managing the unexpected, the team will work with stakeholders to deploy rapidly and deliver immediate results—no matter the circumstances. Please contact us to learn more about Capstone’s FAS group capabilities and the firm’s broader solutions.

Related Transactions

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.