Flexible Packaging Market Sees Growth in 2022

Flexible Packaging Market Growth Driven by Elevated E-Commerce Activity and Mounting Environmental Concerns

Through early 2022, packaging providers—and the flexible packaging market as a whole—have significantly benefited from rising consumption, fueled by strong wage growth, and the continued adoption of online shopping. While consumers have increasingly returned to in-person shopping with the rollout of vaccines and booster shots, online shopping has proven to be sticky, accounting for 12.9% of total retail sales in Q4 2021, compared to 11.0% in Q4 2019, according to the U.S. Census Bureau.1

In recent earnings calls, public packaging market players Westrock (NYSE:WRK), Packaging Corporation of America (NYSE:PKG), and Berry Global Group (NYSE:BERY) have reported robust Packaging merket demand and strong sales growth despite ongoing supply chain challenges. Capitalizing on exposure to high-growth Consumer categories, Berry Global Group’s Consumer Packaging International division delivered a 7% year-over-year (YOY) revenue increase in 2021 and a 15% improvement on a two-year basis despite reporting raw material price increases and freight and labor challenges, according to its fiscal Q1 2022 earnings call.2 Similarly, Westrock reported that its Consumer Packaging sales were up 7% YOY in fiscal Q1 2022 and its corrugated packaging sales, excluding white containerboard trade sales, were up 11.5% YOY with a strong backlog, according to its earnings call.3 The company cited solid demand, along with improved productivity and volume as drivers behind its strong performance. Packaging Corporation of America’s Packaging segment also benefited from improved productivity with record-setting shipments from corrugated product plants despite ongoing truck and driver availability issues and a lack of available boxcars to move containerboard from mills to other box plants, according to its Q4 2021 earnings call.4 The company recorded healthy sales and EBITDA margin growth in 2021, reporting a full-year EBITDA margin of 23.9% with $1.7 billion in EBITDA in 2021 (excluding special items) and $7.1 billion in sales, compared to a 20.8% margin in 2020 with $1.2 billion in EBITDA and $5.9 billion in sales.

M&A Activity Accelerates in Flexible Packaging as Buyers Flock to High Growth Categories

Merger and acquisition (M&A) activity proliferated in 2021, improving 19.6% YOY from an exuberant 2020 as the Flexible Packaging Market continued to show its resilience with companies continuing to record growth and generate strong cash flows throughout the pandemic. Privately owned businesses in the Packaging sector with strong profitability have received healthy buyer interest through early 2022, on the heels of a record year in middle market M&A. Private equity (PE) buyers flooded the space, accounting for 63.1% of announced or closed deals in 2021, as sponsors sought defensible assets in sectors with strong growth dynamics. Platform investments comprised 19.1% of total deal flow as PE firms increased sector penetration, demonstrating a particular appetite for companies serving Healthcare or Consumer markets. This is exemplified by private equity firm GTCR’s acquisition of PPC Flexible Packaging in October (undisclosed). PPC Flexible Packaging provides short- and medium-run flexible packaging solutions for Healthcare, Snack and Organic Food, Specialty Produce, Pet, Nutraceutical, Bakery, and Horticulture markets.

Both strategic and private equity sponsors are targeting packaging companies serving high-value end markets such as E-commerce, Consumer Packaged Goods, Food & Beverage, Medical, and Specialized Industrial Applications.

Add-on acquisitions accounted for 44.1% of the transaction volume as private equity firms acquired businesses to bolster portfolio companies’ offerings, enhance exposure to e-commerce channels, or add sustainable capabilities. For example, Ares Management Corporation (NYSE:ARES)-backed pressure-sensitive label provider Resource Label Group acquired StickerGiant.com, a leading e-commerce sticker and label manufacturer (September 2021, undisclosed). As a result of the transaction, Resource Label Group will benefit from StickerGiant’s footprint in the E-Commerce Labeling space. Strategic buyers, comprising the remaining 36.9% of acquisitions, displayed similar preferences, consolidating competitors to enhance scale, add capabilities or serviceable markets, or bolster exposure to the e-commerce and sustainability megatrends. Two recent notable transactions are outlined below, demonstrating acquirer appetite for Consumer packaging and labeling companies.

- Genstar Capital, LLC to acquire Brook + Whittle Limited (November 2021, Undisclosed) – Genstar Capital, a private equity firm primarily focused on Industrials, Financial Services, Healthcare, and Software industries, has entered a definitive agreement to acquire Brook + Whittle. Brook + Whittle is a leading provider of premium prime labels in the North American market. Headquartered in Guilford, Connecticut, the company serves a broad range of growth-oriented Consumer end markets, including Personal Care, Beverage, Food, Healthcare, and Household Products.

“We are passionate about leaving the world in a better place than we found it. Our mission to drive brands towards 100% sustainable packaging is enabled through product innovation and our technologically advanced platform. We deliver highly complex decorated labels that capture consumers’ attention on branded goods that are recognized around the world. We are digitalizing our business and expanding our ecommerce platform and look forward to benefiting from our new partnership with Genstar to continue delivering technology-driven innovations to our customers,” said Mark Pollard, Chief Executive Officer of Brook + Whittle, in a press release.5

- Advanced Converting Works, Inc. acquires Bag-Pack (November 2021, Undisclosed) – Itasca, Illinois-based Advanced Converting Works, a provider of specialty pouches for Food, Healthcare, Household, and Pet Markets acquired Bag Pack. Advanced Converting Works currently operates three Food, Feed, and Packaging Safety Systems of Companies (FSSC) 22000 certified manufacturing facilities in Itasca, Illinois (Phoenix Converting), Green Bay, Wisconsin (Valley Packaging Supply), and Franklin, Wisconsin (Precision Color Graphics). Headquartered in Hamilton, Ohio, Bag-Pack, produces specialty bags and pouches for Food, Security, and Retail markets. Through the acquisition, Advanced Converting Works will benefit from Bag-Pack’s market-leading position in the Security Bags and Customized Polyethylene (PET) Mailer Bags spaces, according to a press release.6

Leading Packaging Providers Pursue Environmentally Friendly Initiatives

Although elevated demand and online shopping habits have recently benefited packaging companies, sector players must be forward-thinking regarding consumer preferences to maximize exposure to growing trends. At the onset of the pandemic, hygiene and safety features were paramount for consumers, with sustainability taking less precedence. Consumers preferred sealed packaging with products that did not touch human hands over environmentally friendly products. However, sustainability has resurfaced as a primary concern among consumers and companies. Packaging providers must ensure that their products are environmentally friendly to capture demand as 73% of Consumer Products company executives indicated that sustainability issues were a major concern or top-of-mind at all stages of the supply chain process, according to an Oxford Economics survey.7 Large public packaging players have continued to invest significant resources into improving the sustainability of supply chains and developing initiatives that align with environmental, social, and governance (ESG) guidelines. For example, Berry Global Group recently announced its goal of 30% circular plastic use across its fast-moving Consumer Goods Packaging segment by 2030. WestRock has benefited from its ESG initiatives with its run rate for plastics replacement and sustainable solutions recording sequential improvement, nearing $300 million in Q1 2022. The company has also formed a partnership with Grupo Gondi in Mexico to provide CanCollar, a family of recyclable, paperboard-based multipack solutions, to ABI Mexico Group Modelo. Similarly, WestRock and Canadian multinational fast food restaurant chain Tim Hortons have partnered to launch a hot beverage cup that is compostable and recyclable and made from up to 20% post-consumer recycled (PCR) content, according to an article by Waste Management World.8

Packaging Market to Benefit from E-Commerce Megatrend & Sustainability Initiatives

Flexible packaging is expected to be increasingly adopted due to both its durability in the e-commerce shipping process and its ability to align with corporate and consumer sustainability preferences. The Flexible Packaging market is already the second-largest packaging segment in the U.S. following Corrugated Paper, comprising ~19% of the $177 billion U.S. Packaging market, according to the Flexible Packaging Association (FPA).9 Amid the pandemic, the Flexible Packaging subsector benefited from strong downstream demand, particularly through e-commerce channels, in Food & Beverage, Cosmetics, Personal Care, Household, and Pharmaceutical Products sectors. Flexible Packaging is poised for continued growth stemming from rising disposable income and the advent of omnichannel retailing.

Online Shopping Drives Flexible Packaging Demand

With more touchpoints throughout the shipment process, flexible packaging is an ideal format for e-commerce as the material can resist breakage, prevent spills, and hold products together. Compared to traditional retail, e-commerce products are handled at least three times more often, according to Plastics Today.10 Flexible packaging can also drive shipping cost efficiencies as the billable weight for a package is determined by whichever value is greater, actual or dimensional weight (the amount of space a package occupies in relation to its actual weight). Thus, more space-efficient formats can drive lower shipping prices. In the example below the flexible e-commerce mailer format saves $4 per unit due to minimal air space surrounding the good.

Packaging providers must also consider visual engagement capabilities in order to differentiate their products from competitors. In traditional retail, a consumer is able to interact with a product before they’ve made the purchase, making its appearance on the shelf critical. While this is impossible in e-commerce, visual engagement can be even more important as an enjoyable unboxing experience can drive brand loyalty.

Flexible Packaging as an Environmentally Friendly Choice

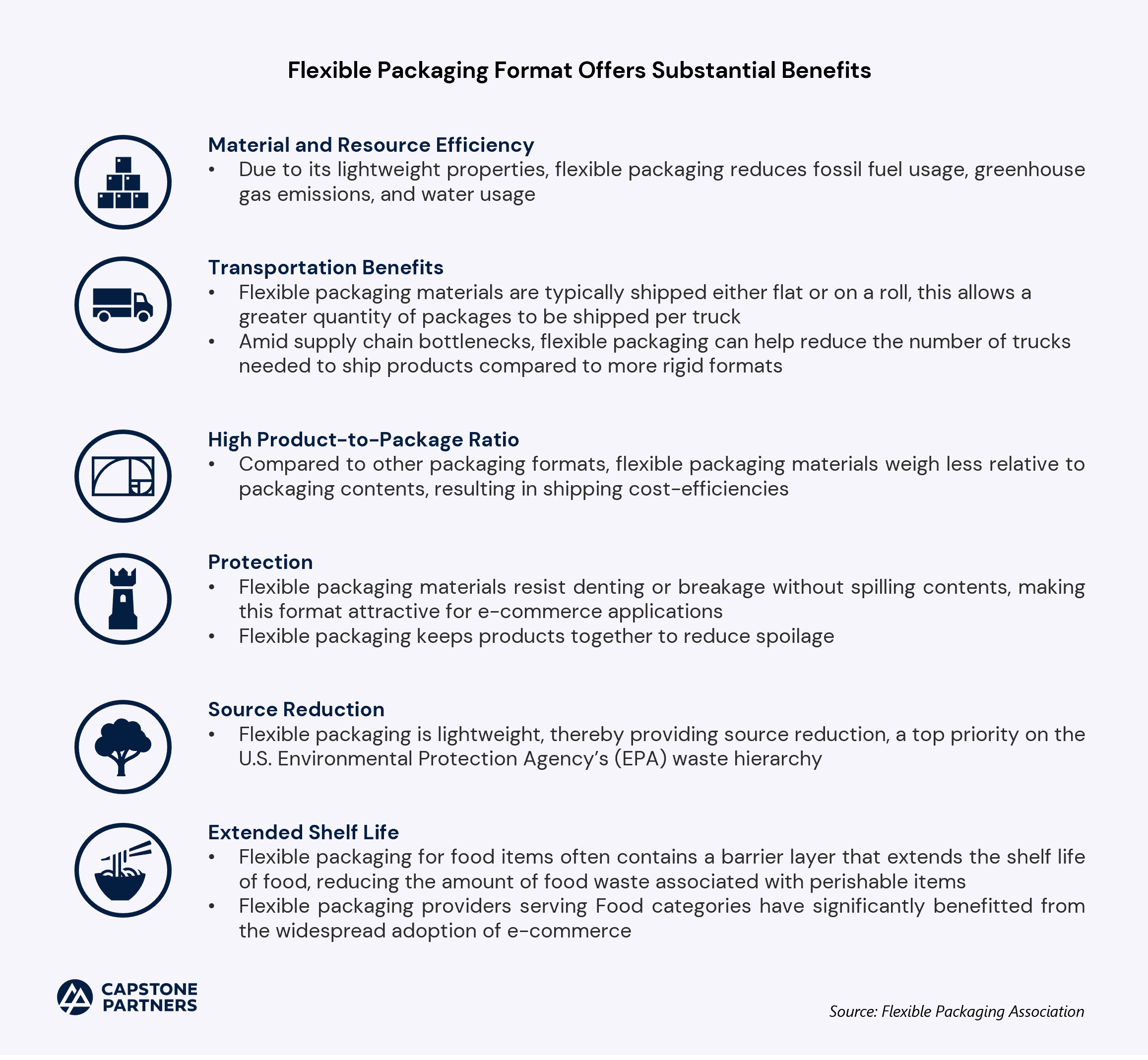

In addition to its e-commerce appeal, flexible packaging offers source reduction, requires less energy to manufacture and transport, reduces water usage in the manufacturing process, and has a higher product-to-package ratio than other packaging formats, according to the FPA.11

Due to its durable design, flexible packaging can protect products throughout the rigors of e-commerce shipping without an overbox (a corrugated box that protects another corrugated box within it), reducing the environmental footprint of shipments. As an example, in a standard shoe delivery, an overbox to protect the shoebox would result in 14.2% higher fossil fuel consumption and 65.6% higher greenhouse gas emissions compared to a flexible mailer, according to Plastics Today. Flexible packaging can also reduce material usage on returns by including resealable features. While flexible packaging formats offer a variety of environmental benefits, the format has a few limitations. Flexible packaging materials often include coextruded or laminate plastics which need to be separated to go into single polymer waste streams, making the product non-recyclable in many instances, according to Flexible Packaging Magazine.12

Packaging companies are developing mono-polymer flexible packaging laminates to ensure circularity while capitalizing on the many upsides of the flexible packaging format. “In order to support a circular packaging economy, brands need to think about how to keep their packaging ‘in the loop’ and out of the environment. This means a bigger focus on material science in the lab, implementing circular design principles when crafting new packaging, and leveraging lifecycle analysis to validate sustainable designs. Virtual testing tools really help CPG companies significantly reduce costs and get to optimal secondary, tertiary, and e-commerce packaging much faster,” said Philippe Loeb, Vice President of Home & Lifestyle CPG and Retail at Dassault Systèmes (ENXTPA:DSY), in an article by Packaging Strategies.13 While large packaging providers have the resources to invest in the development of new, innovative, packaging designs to meet circular economy goals, niche manufacturers with innovative product ideas can also capitalize on this opportunity, bringing new designs to market.

In addition to organic investments, packaging providers are also expected to continue pursuing acquisition targets that expand environmentally flexible packaging offerings to capitalize on the segment's growth. Notably, leading flexible packaging provider ProAmpac Intermediate acquired Prairie State Group in December. Terms of the transaction were not disclosed. Prairie State Group produces a variety of Safe Quality Food (SQF)-certified environmentally friendly flexible packaging and label solutions. Its product portfolio includes wrappers, pouches, compostable film, roll stock, and pressure-sensitive labels. Through the transaction, ProAmpac will benefit from Prairie State Group’s vertically integrated capabilities and diverse base of long-tenured customers, according to a press release.14 In addition, the acquisition extends ProAmpac’s reach in Food and Pet Food markets, expands its pouching capabilities, and reinforces its leading market position in sustainable, flexible packaging solutions.

To discuss Flexible Packaging Market M&A activity, provide an update on your business, or learn about Capstone's wide range of advisory services and Packaging sector expertise, please contact David Bench.

Endnotes

-

U.S. Census Bureau, “Quarterly Retail E-commerce Sales,” https://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf, accessed February 14, 2022.

-

Seeking Alpha, “Berry Global Group, Inc. (BERY) CEO Thomas Salmon on Q1 2022 Results – Earnings Call Transcript,” https://seekingalpha.com/article/4484171-berry-global-group-inc-bery-ceo-thomas-salmon-on-q1-2022-results-earnings-call-transcript, accessed February 17, 2022.

-

The Motley Fool, “WestRock (WRK) Q1 2022 Earnings Call Transcript,” https://www.fool.com/earnings/call-transcripts/2022/02/03/westrock-wrk-q1-2022-earnings-call-transcript/, accessed February 14, 2022.

-

AlphaSense, “Packaging Corporation of America Q4 2021 Earnings Call,” https://research.alpha-sense.com/?dt=1_8_75_12000&rt=&sort=DATE&order=DESC&search_id=tmp-bfcd7aea9555acbf5d8dac4f0574494be65e2a5a, accessed February 15, 2022.

-

Brook + Whittle, “Genstar Capital to Acquire Brook + Whittle from TurArc Partners,” https://brookandwhittle.com/genstar-capital-to-acquire-brook-whittle-from-truarc-partners/, accessed February 17, 2022.

-

Advanced Converting Works, “Advanced Converting Works announces acquisition of Bag Pack Inc.,” https://advancedconvertingworks.com/advanced-converting-works-announces-acquisition-of-bag-pack-inc/, accessed February 17, 2022.

-

SAP, “The Sustainable Supply Chain Paradox,” https://www.sap.com/cmp/dg/sustainable-cp/typ.html?source=social-global-forbes-blog-IEumbrella-2022-SustainabilityCPG&pdf-asset=3cda617c-dd7d-0010-bca6-c68f7e60039b&page=1&client_id=49f4d89b-8e9f-11ec-94e9-73414c030d08, accessed February 15, 2022.

-

Waste Management World, “Tim Hortons aims at a more sustainable future,” https://waste-management-world.com/artikel/tim-hortons-aims-at-a-more-sustainable-future/, accessed February 17, 2022.

-

Flexible Packaging Association, “Flexible Packaging Facts and Figures,” https://www.flexpack.org/facts-and-figures, accessed February 16, 2022.

-

Plastics Today, “Flexible Packaging Delivers in the Ecommerce Era,” https://www.plasticstoday.com/packaging/flexible-packaging-delivers-ecommerce-era, accessed February 16, 2022.

-

Flexible Packaging Association, “Sustainability Throughout the Entire Life Cycle,” https://www.flexpack.org/sustainable-packaging#:~:text=FLEXIBLE%20PACKAGING%20HAS%20NUMEROUS%20BENEFICIAL%20ENVIRONMENTAL%20ATTRIBUTES&text=Flexible%20packaging%20requires%20less%20energy,product%2Dto%2Dpackage%20ratio, accessed February 16, 2022.

-

Flexible Packaging Magazine, “Flexible Packaging Innovations Emerging,” https://www.flexpackmag.com/articles/91756-flexible-packaging-innovations-emerging, accessed February 16, 2022.

-

Packaging Strategies, “Executive Forecast: More of the Same in 2022,” https://www.packagingstrategies.com/articles/96602-executive-forecast-more-of-the-same-in-2022?oly_enc_id=1037D5657490A7V, accessed February 16, 2022.

-

ProAmpac, “ProAmpac Acquires Prairie State Group,” https://www.proampac.com/news/en-us/proampac-acquires-prairie-state-group/, accessed February 17, 2022.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.