Financial Technology M&A Update – April 2024

B2B and B2C End Markets Drive Financial Technology M&A Activity

The Financial Technology (FinTech) sector has continued to grapple with regulatory and macroeconomic headwinds, evidenced by muted merger and acquisition (M&A) and financing activity in 2023. However, acquisition and capital raising activity year-to-date (YTD) has held steady compared to the prior year period. This has primarily been supported by elevated acquirer and investor appetite in the Business-to-Business (B2B) and Business-to-Consumer (B2C) end markets. B2B FinTech companies offer enterprise software solutions, while B2C participants provide technology to other businesses in which the end-users are individual consumers. Capital deployment in the sector has increasingly gone to businesses serving these two end markets as the Direct-to-Consumer (DTC) market has become saturated.

Given the sheer size of the B2B FinTech markets globally, more investment dollars and M&A will naturally continue to flow into these end markets. We are also in the early innings of adoption for many of the B2B end markets, so there is tremendous amount of growth ahead.

Financial Technology Participants Increasingly Shift to B2B and B2C Models

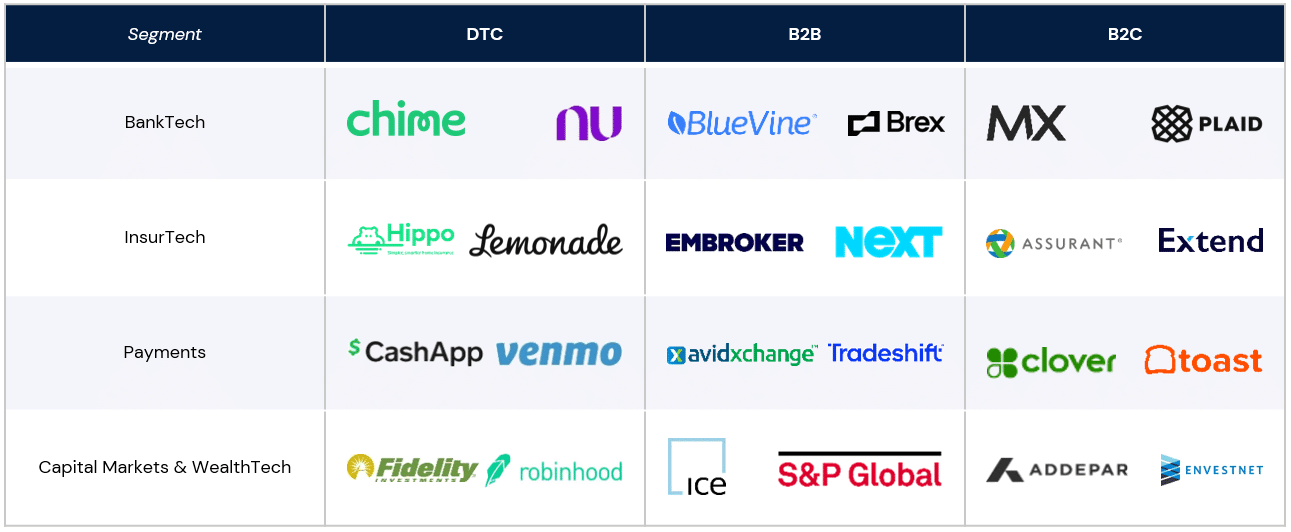

To pique capital investment, new entrants and established companies have increasingly shifted business models to serve more favorable end markets. Of note, 46% of U.S. FinTech businesses operate with a B2C model, followed by B2B (31%) and DTC (23%), according to PitchBook’s December 2023 survey.1 Capstone Partners has maintained an optimistic outlook for the sector’s capital markets as the majority of B2B and B2C participants are either privately-held or have received minority investments. This has created a favorable backdrop for exit activity in Capstone’s key FinTech verticals: Bank Technology (BankTech), Insurance Technology (InsurTech), Payments, and Capital Markets & Wealth Technology (WealthTech). Examples of representative FinTech companies by end market are outlined below.

Representative FinTech Companies by End Market

Source: PitchBook and Capstone Partners

Global Financial Technology M&A Volume Remains Healthy

Deal flow in the global FinTech M&A market has remained strong relative to historical levels. There have been 159 sector transactions announced or completed YTD, representing a mere 5.4% decline year-over-year (YOY). While transaction volume will likely not meet 2021’s record levels, acquisition activity to-date is on pace to meet or exceed full year 2023. Sector participants with recurring revenue, balance sheet-light business models, and low customer acquisition costs have continued to incite strong buyer interest from strategic and private equity-backed acquirers. Strategic buyers have comprised the majority (66%) of sector deals YTD, led by private strategics (44%) vertically integrating competitors to bolster technology stacks. While private equity firms largely stayed on the sidelines in many areas of the M&A market in 2023, sponsor activity in the FinTech sector remained relatively unchanged. Financial buyers accounted for 29.9% of FinTech deals in 2023 and have comprised 34% of engagements YTD. Ample dry powder, limited partner (LP) pressure to generate returns, and anticipated interest rate cuts will likely serve as catalysts for private equity transactions in the FinTech sector throughout 2024.

Financial Technology M&A Multiples Remain Strong, Valuations in North America Eclipses International Market

Financial Technology M&A transactions have continued to elicit strong pricing. In YTD 2024, global average sector purchase multiples have amounted to 5.3x EV/Revenue and 12.7x EV/EBITDA. Although this marks a slight dip YOY, average sector valuations to-date have outperformed full year 2023 and 2022 on a revenue multiple basis. The middle market (less than $500 million in enterprise value) has continued to yield considerable levels of sector deal flow, comprising 75% of global disclosed transactions to-date. Middle market sector participants have also enjoyed favorable pricing, with average purchase multiples of 5.0x EV/Revenue and 15.4x EV/EBITDA in YTD 2024.

Upon further analysis of the FinTech M&A valuation environment, North America-based targets have eclipsed international targets on a revenue multiple basis. North America-based FinTech targets have drawn an average revenue purchase multiple of 7.6x from 2021 through YTD compared to 4.5x for international targets during the same period. This delta has largely been driven by a strong U.S. dollar in the foreign exchange (FX) markets. Purchase multiples for U.S. FinTech businesses serving key end markets are anticipated to remain healthy throughout 2024, especially if the Federal Reserve’s interest rate cuts materialize.

B2B and B2C Financial Technology Targets Draw Strong Buyer Interest and Valuations

Sector participants’ shift to more favorable end markets has undoubtedly been reflected in the Financial Technology M&A market. The DTC vertical has witnessed significant declines in M&A appetite, especially from private equity firms as the customer acquisition costs are typically higher and require extensive marketing/branding budgets. In addition, building a strong DTC customer base typically entails raising significant funds over an extended period of time which often deters financial buyers from the vertical. DTC FinTech transactions declined 23% YOY in 2023 and have continued to fall in YTD 2024, dropping 46.8% compared to the prior year period. Deal volume in the B2B vertical has experienced a modest 1.5% YOY decline to-date, supported by an acquisitive pool of private equity groups and sponsor-backed businesses. The B2B space has also continued to comprise the majority (51.1%) of global FinTech M&A YTD. Deal activity in the B2C vertical surged in 2023 and has continued to climb through YTD. In 2023, FinTech transactions involving B2C targets rose 206.5% YOY to 236 deals announced or completed. To-date, there have been 39 B2C engagements which marks an increase of 129.4% YOY.

Acquirers in the sector have demonstrated a willingness to pay premiums for businesses in high-growth segments serving key end markets. Notably, the average purchase multiple for B2B targets from 2021 through YTD has amounted to 5.9x EV/Revenue compared to 5.5x EV/Revenue for B2C targets and 4.9x EV/Revenue for DTC targets. Several notable M&A transactions in the B2B and B2C end markets are outlined below.

- Advent to Acquire Nuvei (April 2024, $6.3 Billion) – In April 2024, private equity firm Advent announced its acquisition of Nuvei (TSX:NVEI) for an enterprise value of $6.3 billion. Nuvei shareholders will receive $34.00 per share, representing a 56% premium over the company’s closing stock price of $21.76 on March 15, 2024, according to a press release.2 Nuvei’s software platform enables businesses to accept next-generation payments and offer a variety of payout options. Advent has pursued the take-private acquisition to capitalize on Nuevei’s robust payment processing capabilities and global customer base. Of note, Nuvei has processed more than $200 billion in payments as of 2023, according to the press release. The transaction is expected to bolster Nuvei’s market share in the eCommerce, B2B, and Embedded Payments verticals.

- CapVest Partners-Backed Datasite Global to Acquire Ansarada Group (February 2024, $140.1 Million) – CapVest Partners-backed Datasite Global announced its acquisition of Ansarada Group (ASX:AND) in February 2024 for an enterprise value of $140.1 million, equivalent to 4.1x EV/Revenue. Sydney, Australia-based Ansarada provides data room software solutions for investment banks, private equity firms, and businesses engaging in capital markets transactions. Datasite, Ansarada’s direct U.S. competitor, has pursued the acquisition to bolster its international reach and market share in the Capital Markets segment. In addition, Ansarada has processed more than $1 trillion in transaction value which will be added to Datasite’s platform, according to a press release.3

- Thomson Reuters Finance Acquires Pagero Group (January 2024, $820.8 Million) – In January 2024, Thomson Reuters Finance, a subsidiary of Thomson Reuters (TSX:TRI), acquired Pagero Group (OM:PAGERO) for an enterprise value of $820.8 million or 8.6x EV/Revenue. Pagero delivers a software platform for B2B payments and financial controllers, specifically accounts payable (AP)/accounts receivable (AR) automation. The transaction illustrates strategic buyers’ appetite for acquiring B2B FinTech companies with significant recurring revenues. Pagero has demonstrated a high-quality financial profile, with recurring revenue comprising 87% of its total 2023 revenue mix, according to a press release.4 Additionally, more than 80 countries have announced or introduced legal requirements for e-invoicing and AP/AR automation, according to the press release. These regulatory amendments have created a strong backdrop for M&A activity in B2B Payments and CFO Stack segments.

- Dover Fueling Solutions Acquires Bulloch Technologies (January 2024, $112.1 Million) – Dover Fueling Solutions, a subsidiary of Dover (NYSE:DOV), acquired Bulloch Technologies in January 2024 for an enterprise value of $112.1 million. Bulloch provides point-of-sale (POS) technology and related solutions to gas stations and convenience stores. The company processes more than $35 billion in sales and 520 million transactions annually at 7,000 sites throughout Canada, according to a press release.5 The acquisition exemplifies B2C providers’ ability to draw attention from strategic buyers operating outside the FinTech sector. “This transaction has all the hallmarks of a successful bolt-on acquisition, which are integral to Dover's growth strategy. It adds an attractive digital and recurring revenue stream to Dover Fueling Solutions in a growing market where customers are increasingly digitizing their operations and payment security and compliance standards are continually increasing,” said David Crouse, President of Dover Fueling Solutions, in the press release.

Financing Activity Remains Muted, Investors Increasingly Deploy Capital Across End Markets

Financing activity in the global FinTech sector has remained muted through YTD, with total capital raised declining 9.6% YOY to $14.5 billion. The number of financing deals has also dropped YOY, falling 14.6% to 1,417 transactions in YTD 2024. Many venture capital firms in the space have become risk-averse due to turbulent capital markets conditions. This has spurred investors to participate in additional financing rounds for current holdings rather than deploy capital to new startups. The DTC vertical has historically drawn the lion’s share of growth capital in the sector as venture capital firms typically expect to deploy more capital than private equity and account for a longer time-to-market. However, venture capitalists have increasingly invested in the B2B and B2C verticals to capture more stable recurring revenue streams and capitalize on larger addressable markets. Total capital raised in the DTC vertical has fallen 11.8% YOY through YTD. To-date, the B2B and B2C verticals have enjoyed YOY total funding increases of 3.7% and 8.1%, respectively. Depicted below are notable funding rounds in the B2B and B2C verticals, demonstrating investors’ shift in capital deployment.

- Navro Secures $32.9 Million in Series A Funding (February 2024) – In February 2024, Navro secured $32.9 million in Series A financing for a $65.2 million post-money valuation. Bain Capital Ventures led the round. Eight of the nine Series A investors, including Bain Capital Ventures, also contributed to the company’s seed funding, illustrating venture capital firms’ preference for participating in multiple follow-on investments. Navro develops a cloud-based payment platform for small and midsize enterprises (SMEs) to efficiently collect, record, and track digital payments. The company plans to utilize the funding for product development and international expansion.

- Nasdaq Private Market Raises $62.4 Million in Series B Funding (February 2024) – Nasdaq Private Market completed a $62.4 million Series B funding round in February 2024, bringing its total capital raised to $83.8 million. Nasdaq (Nasdaq:NDAQ) led the round with seven other investors. Since its spinout in 2021, Nasdaq Private Market has operated independently from its former parent company Nasdaq. The company provides an online secondary market trading venue for private capital investments, equipped with data analytic capabilities. Nasdaq Private Market primarily serves private companies, broker-dealers, and institutional investors. The funding will help support Nasdaq Private Market’s growth strategy to bolster its company-sponsored liquidity programs and block trades.

To discuss end market performance and drivers, provide an update on your business, or learn about Capstone's wide range of advisory services and Financial Technology M&A knowledge, please contact us.

Max Morrissey, Vice President, was the lead Market Intelligence contributor to this article.

Endnotes

-

PitchBook, “Financial Fusion: FinTech’s M&A Landscape Unveiled,” https://files.pitchbook.com/website/files/pdf/Q1_2024_PitchBook_Analyst_Note_Financial_Fusion_Fintechs_MA_Landscape_Unveiled.pdf, accessed March 18, 2024.

-

PR Newswire, “Nuvei Enters into Agreement to be Taken Private by Advent,” https://www.prnewswire.com/news-releases/nuvei-enters-into-agreement-to-be-taken-private-by-advent-international, accessed April 5, 2024.

-

Business News Australia, “Dealmaker Data Solutions Group Ansarada to be Acquired by Rival Datasite,” https://www.businessnewsaustralia.com/articles/dealmaker-data-solutions-group-ansarada-to-be-acquired-by-rival-datasite-for--263m.html, accessed March 19, 2024.

-

Thomson Reuters, “Thomson Reuters Corporation Acquires Majority Interest in Pagero,” https://www.thomsonreuters.com/en/press-releases/2024/january/thomson-reuters-corporation-acquires-majority-interest-in-pagero-a-world-leader-in-e-invoicing.html, accessed March 20, 2024.

-

Dover, “Dover Acquires Bulloch Technologies,” https://investors.dovercorporation.com/news-releases/news-release-details/dover-acquires-bulloch-technologies-inc-leading-provider-point, accessed March 20, 2024.

Related Transactions

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.