Middle Market Business Owners Survey – 2023

Capstone Business Owners Research Survey Finds CEOs Execute Growth Strategies in Preparation for a Market Rebound

Capstone Partners has released its 2023 Middle Market Business Owners Survey Report, with insights from privately-owned companies across the U.S. This report combines Capstone’s in-depth middle market knowledge with proprietary data obtained from 435 participating owners of privately held, middle market companies. Capstone surveyed middle market business owners across industries in the U.S. between July 31, 2023, and August 31, 2023.

The full report, available for download below, evaluates the health and progress of the middle market in 2023, with sections including:

- State of Business & Decision Making,

- Growth, Financial, & Exit Planning, and

- Revenue Impacts, Forecasts, & Economic Outlook. The report also reveals data by industry, company size, and revenue generated, highlighting statistically significant variances.

Summary of Key Middle Market Business Owners Survey findings:

Inflationary Pressures Continue to Create Headwinds

The U.S. has entered a structurally higher interest rate environment to combat elevated inflation, which has challenged company growth for more than half (58.9%) of middle market business owners surveyed. Heightened inflation was identified as the primary concern in all industries surveyed, demonstrating the widespread impact of economic headwinds. The Federal Reserve’s ability to mitigate inflation through interest rate hikes will likely dictate owners’ growth outlook throughout 2024.

Amid current economic volatility, middle market business owners have increasingly focused on building strong leadership and advisor teams, with a significant portion of CEOs utilizing accountants, lawyers, and financial advisors to assist with critical business decisions. Building a broad network of specialized professionals can assist owners in navigating specific business decisions and ensure longevity of the company.

Capital Support to Play Critical Role in Operational Initiatives

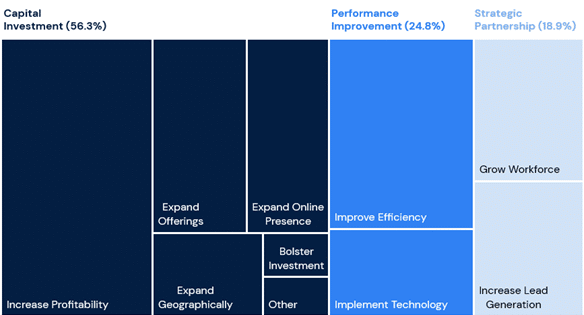

Reaching or enhancing profitability often serves as a significant milestone in a company’s growth trajectory. As such, increasing profitability is among the top operational initiatives for middle market business owners over the next 12 months, as noted by 26% of CEOs surveyed. Improving efficiency and expanding offerings will also be pertinent operational initiatives for 2024, as identified by 17% and 11.3% of owners, respectively. Among total business owners surveyed, the majority (56.3%) emphasized capital investment as the most useful resource in support of their primary operational initiative, followed by performance improvement support (24.8%) and strategic partnerships (18.9%). Specifically, owners require additional capital investment to reach profitability goals and expand offerings, online presence, and geographic reach. In addition, capital investment can ensure sufficient net working capital for businesses eyeing the next stage of growth.

Primary Operational Initiatives Over the Next 12 Months and Support Required

Questions: What will be your primary operational initiative over the next 12 months?/Support for primary initiative

Source: Capstone Partners’ Middle Market Business Owner Survey, Total Sample Size (N): 435

Owners Prioritize Growth Strategies, Require Growth Strategy Support Services

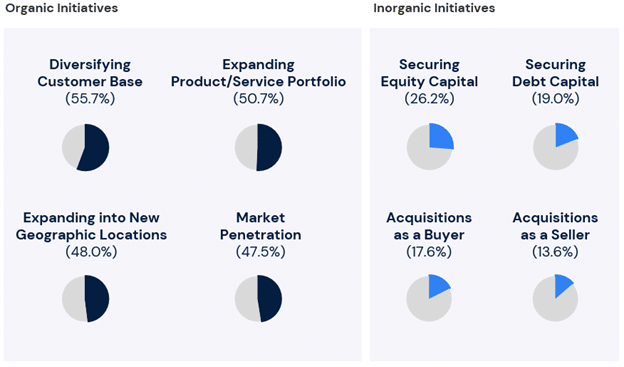

More than half (50.8%) of business owners surveyed plan to execute growth strategies over the next 12 months to capture additional market share and gain scale in preparation for a market rebound. Among CEOs planning growth strategies, most have prioritized organic initiatives including diversifying customer bases (55.7%), expanding offerings (50.7%), and penetrating new geographies (48%). While organic measures can support revenue growth, inorganic growth practices have remained a key strategic option to expedite expansion. Of note, 26.2% of owners plan to raise equity capital as the elevated cost of debt capital has persisted. Merger and acquisition (M&A) transactions have also remained prevalent, with 17.6% of CEOs surveyed planning a buy-side acquisition to capitalize on compressed M&A valuations. Only 13.6% of owners plan to engage in an acquisition as a seller as many sell-side prospects have opted to delay deal execution in hopes of a more favorable valuation environment.

CEOs’ Top Growth Strategies for 2024

Question: Which of the following growth strategies are most important to prioritize over the next 12 months?

Source: Capstone Partners’ Middle Market Business Owner Survey, Sample Size (N): 221

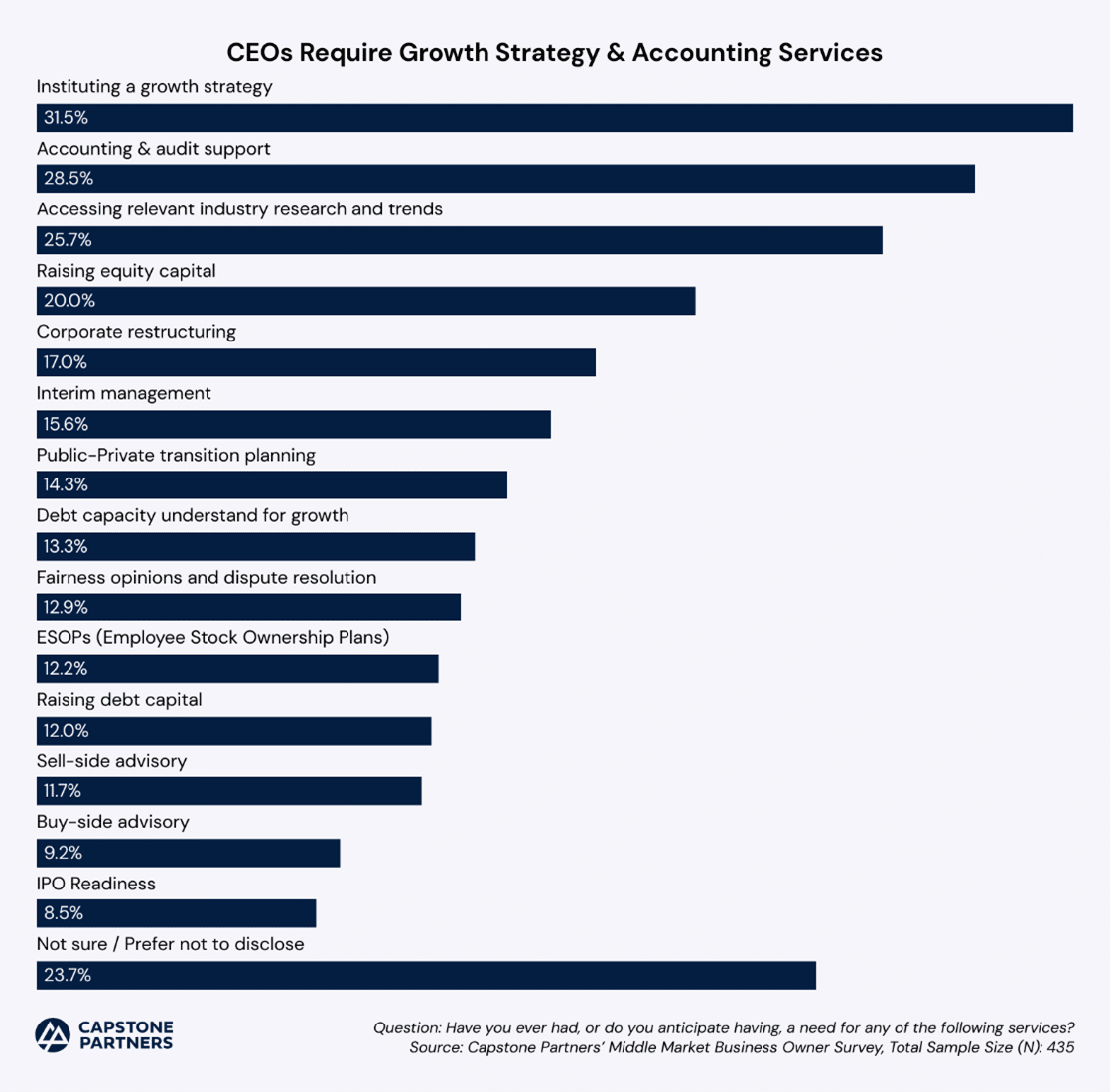

The current stage and initiatives of a business often dictates which financial services are in demand. As the majority of CEOs surveyed indicated growth strategies are a priority for 2024, the lion’s share (31.5%) of owners anticipate a need for growth strategy support services. Similarly, 28.5% of owners require accounting and audit support to shore-up cash flows and establish financial stability. In addition, more than one-fourth of CEOs demonstrated an interest in accessing relevant industry research to keep up with emerging industry trends, complete competitor analyses, and track capital markets activity in their space.

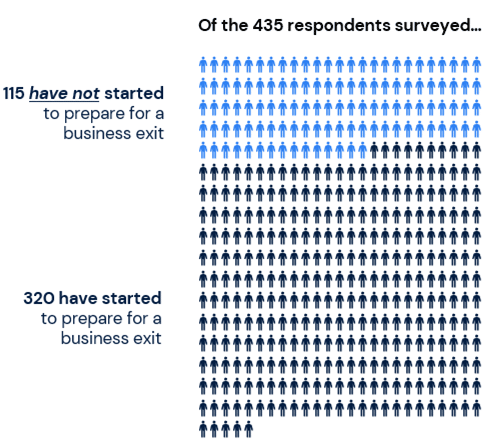

More Than One-Fourth of Owners Have Yet to Start Exit Planning

In 2023, 26.4% of CEOs surveyed indicated they have yet to start planning a business exit. In addition, of the 58 respondents planning to engage in an acquisition over the next year, only 29 stated they have an investment banker in place (50% of owners planning to engage in acquisitions). Investment banks offering M&A advisory services act as a partner to business owners throughout an acquisition process, leveraging industry knowledge and investor connections to achieve the client’s transactional goals. M&A advisors help in all stages of a transaction process, guiding due diligence, negotiating purchase price and terms, and utilizing expertise to drive deal execution. Starting the dialogue sooner rather than later is always best practice when seeking assistance from a M&A advisor as the preparation prior to an acquisition typically takes two to three years.

Question: What steps have you taken to prepare for a future exit?

Source: Capstone Partners’ Middle Market Business Owner Survey, Total Sample Size (N): 435

Strong Correlation Found Between Revenue Growth and Outlook

While many factors can influence a business owner’s industry outlook, there has been a strong correlation between revenue growth and industry optimism among the CEOs surveyed. Notably, the Industrial Technology and Energy & Power industries showcased the highest concentration of CEOs feeling very positive on the state of their respective industries over the next 12 months. These industries also comprised the highest percentage of owners experiencing year-over-year (YOY) revenue growth in 2023. Additionally, the mission-critical nature of manufacturers and service providers in these industries has likely supported heightened optimism.

The bulk of business owners surveyed have enjoyed modest YOY revenue growth in 2023, with 27% of owners reporting revenue increases between 10-25%. Similarly, 31.3% of CEOs project 2024 revenues to rise 10-25% YOY, indicating steady near-term sales growth among many middle market businesses. At an industry level, the Energy & Power, Industrial Technology, and Transportation, Supply Chain & Logistics industries had the highest concentration of owners reporting YOY revenue growth in 2023. Looking ahead, the majority of CEOs in each industry have forecasted YOY sales growth for 2024, with the exception of Real Estate.

Despite inflationary headwinds, middle market business owners have continued to maintain a positive economic outlook for the next 12 months, particularly at the local and global levels. Of note, CEOs headquartered in the Western region of the U.S. were the most bullish on local economic outlook, with 65% of owners feeling very or somewhat positive. This optimism is likely partially driven by the recent increases in commercial and public construction spending in the Western U.S. propelling local economies. CEOs have remained relatively cautious regarding overall U.S. economic outlook, with many of the middle market business owners surveyed demanding a change of administration and new economic policy to alleviate inflationary pressures and fortify balance sheets.

Download the Full Report Below

Use this form to gain access to our full 2023 report publication, with an in-depth analysis of survey responses broken down by industry and sign up to participate in our 2024 study:

Max Morrissey, Manager, was the lead Market Intelligence contributor to this report.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.